Date: 25th November 2024.

New Secretary Cheers Markets; Trump Trade Eased.

Asia & European Sessions:

*Equities and Treasuries rise, as markets view Donald Trump’s choice of Scott Bessent for Treasury Secretary as a stabilizing decision for the US economy and markets.

*Bessent: Head of macro hedge fund Key Square Group, supports Trump’s tax and tariff policies but gradually. He is expected to focus on economic and market stability rather than political gains. His nomination alleviates concerns over protectionist policies that could escalate inflation, trade tensions, and market volatility.

*Asian stocks rose, driven by gains in Japan, South Korea, and Australia. Chinese equities fail to follow regional trends, presenting investors’ continued disappointment by the lack of strong fiscal measures to boost the economy. The PBOC keeps policy loan rates unchanged after the September cut.

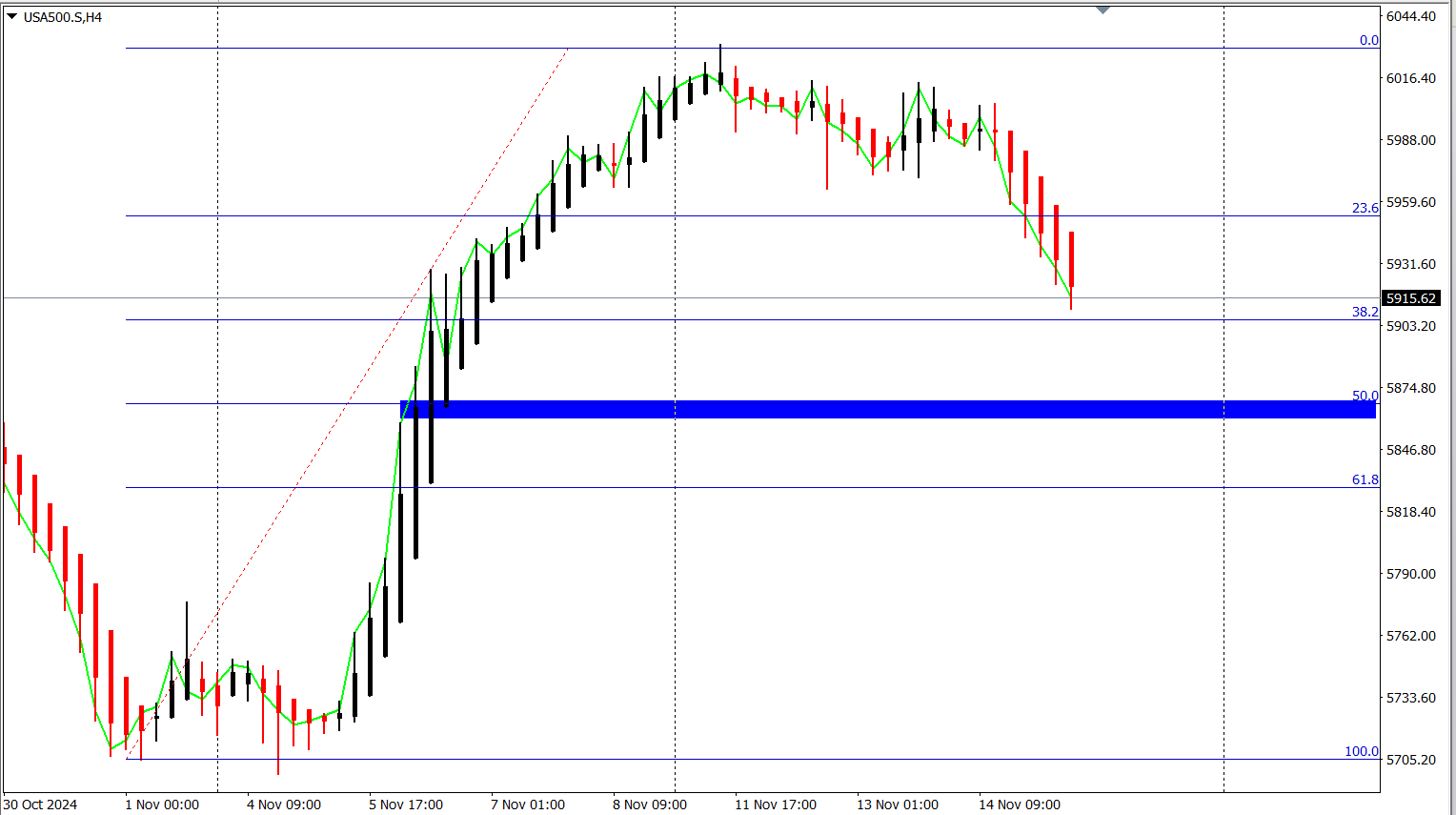

*US futures also see slight increases. 10-year Treasury yields fall by 5 basis points to 4.35%. Nvidia dropped 3.2%, affected by its high valuation and influence on broader market trends. Intuit fell 5.7% after a disappointing earnings forecast. Meta Platforms declined 0.7% following the Supreme Court’s decision to allow a class action lawsuit over the Cambridge Analytica scandal.

Key events this week:

*Japan’s CPI, as the BOJ signals a possible policy change at December’s meeting.

*RBNZ expected to cut its key rate on Wednesday.

*CPI & GDP from Europe will be released.

Traders will focus on the Fed’s November meeting minutes, along with consumer confidence and personal consumption expenditure data, to assess potential rate cuts next year.

Financial Markets Performance:

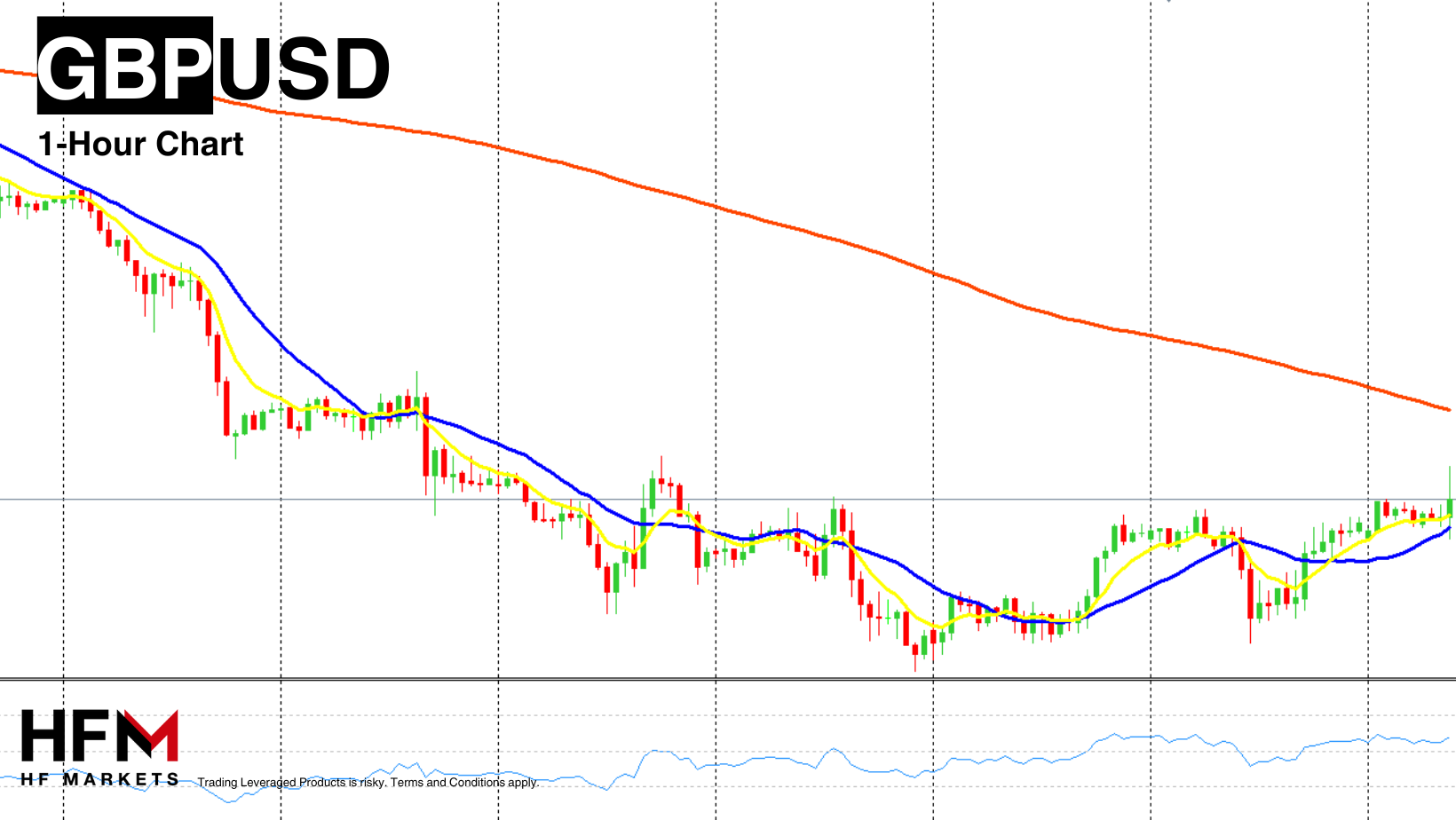

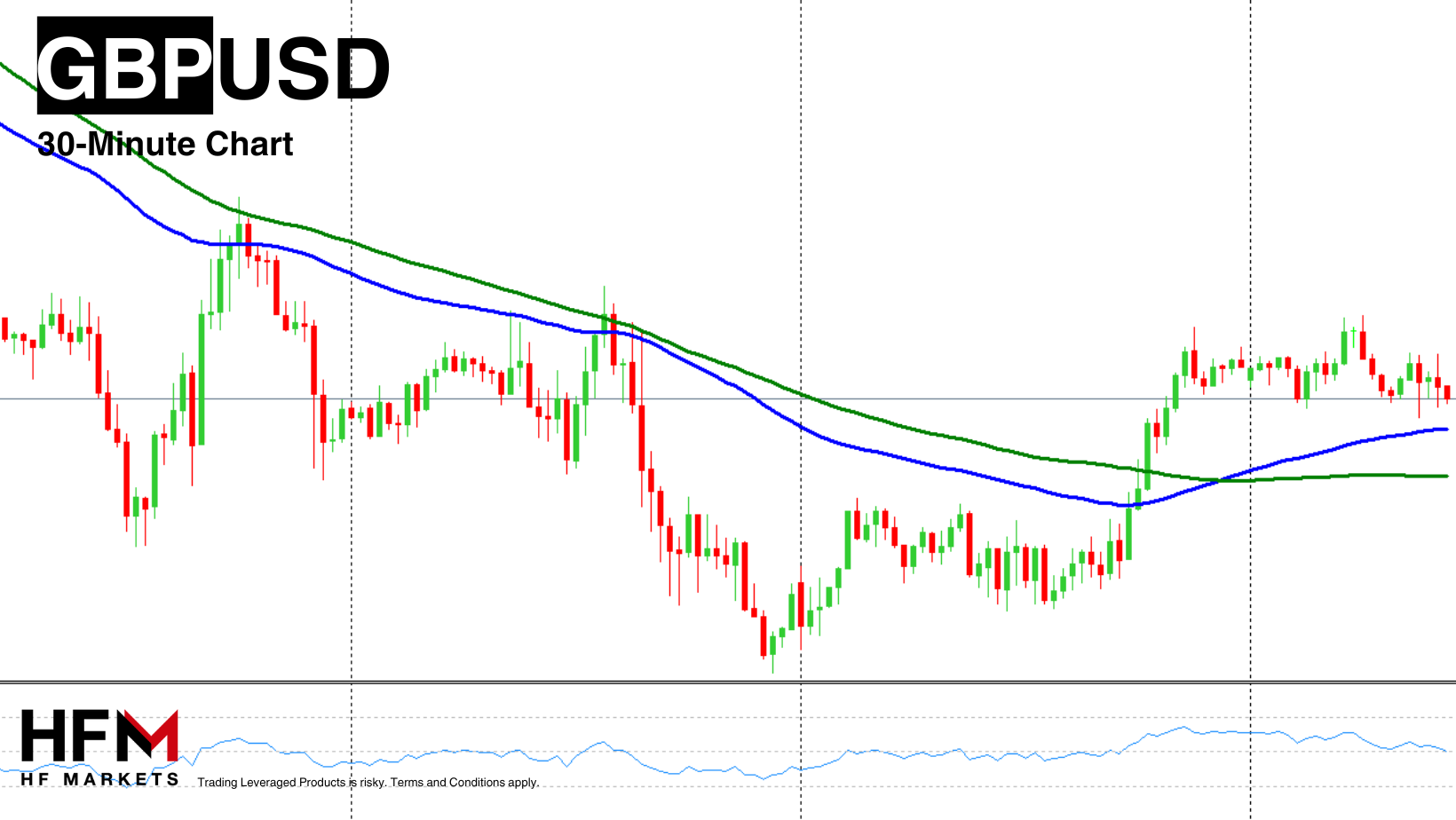

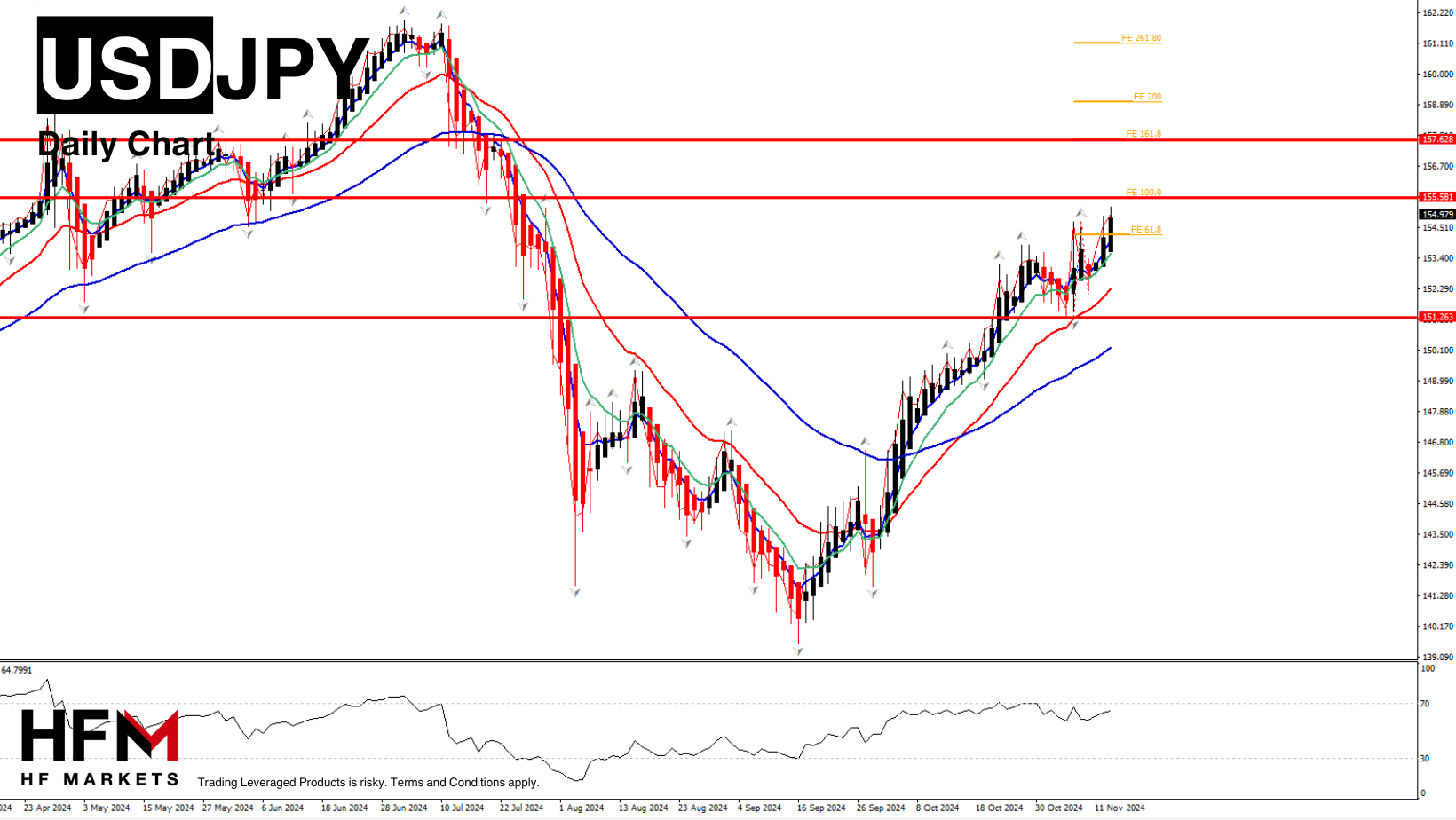

*The US Dollar declines as US Treasuries climb.

*Bitcoin recovers from a weekend drop, hovering around 98,000, having more than doubled in value this year. Analysts suggest consolidation around the 100,000 level before any potential breakthrough.

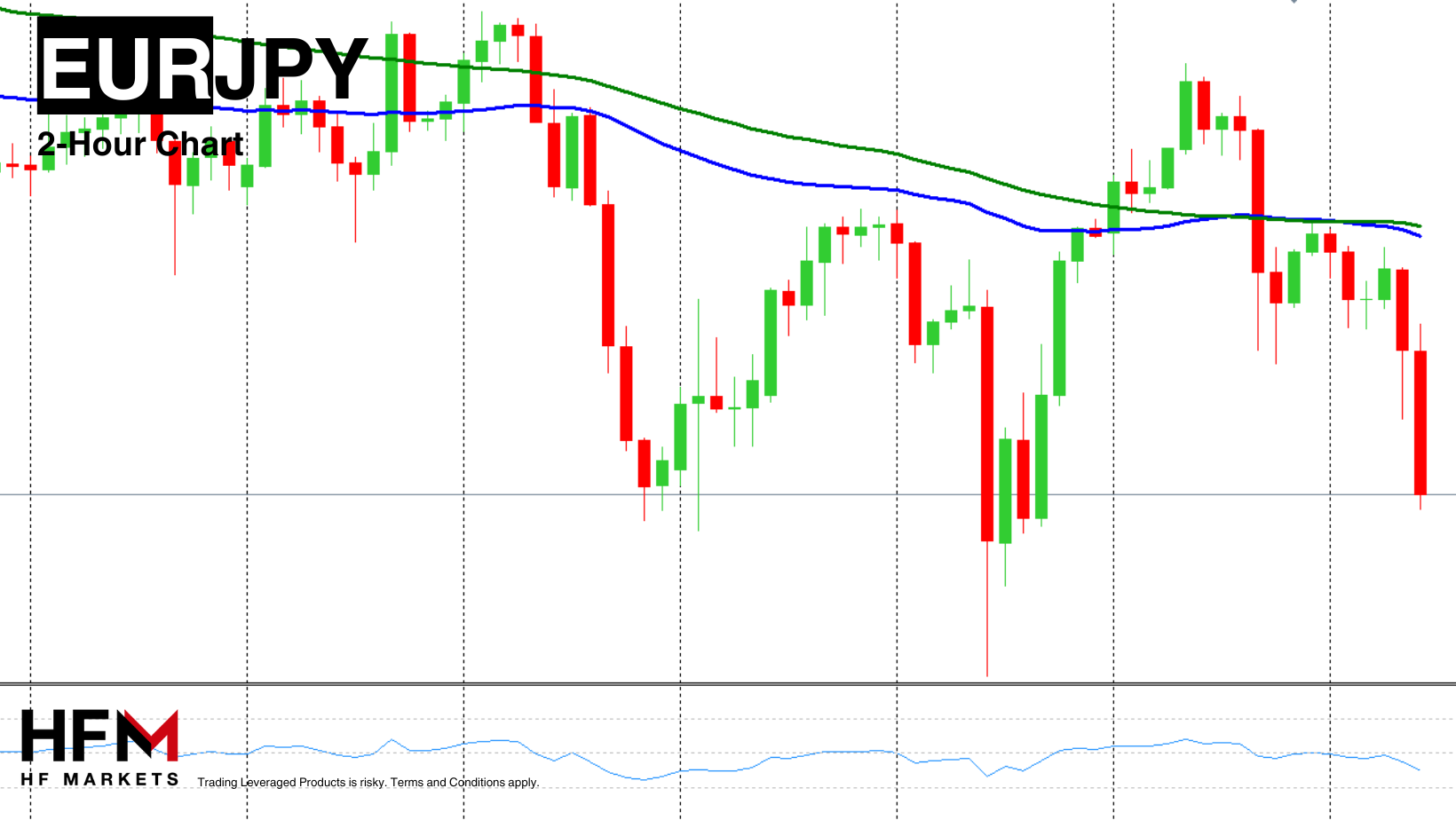

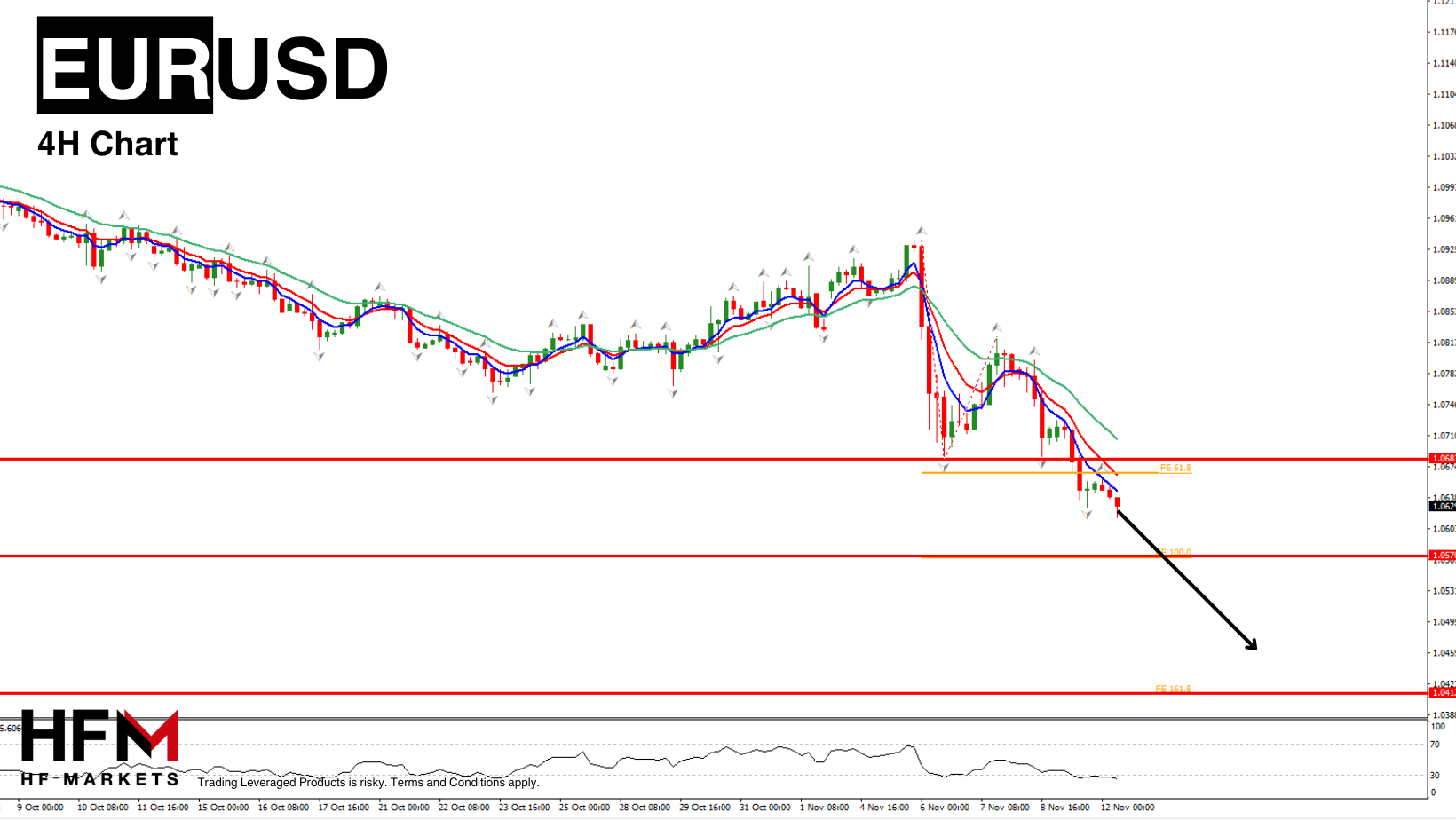

*EURUSD recovers slightly to 1.0463 from 1.0320 lows.

*Oil prices drop after the largest weekly increase in nearly two months, with ongoing geopolitical risks in Ukraine and the Middle East. UKOIL fell below $75 a barrel, while USOIL is at $70.35.

*Iran announced plans to boost its nuclear fuel-making capacity after being censured by the UN, increasing the potential for sanctions under Trump’s administration.

*Israel’s ambassador to the US indicated a potential cease-fire deal with Hezbollah, which could ease concerns about Middle Eastern oil production, a region supplying about a third of the world’s oil.

*Russia’s war in Ukraine escalated with longer-range missile use, raising concerns about potential disruptions to crude flows.

*Citigroup and JPMorgan predict that OPEC may delay a planned increase in production for the third time during their meeting this weekend.

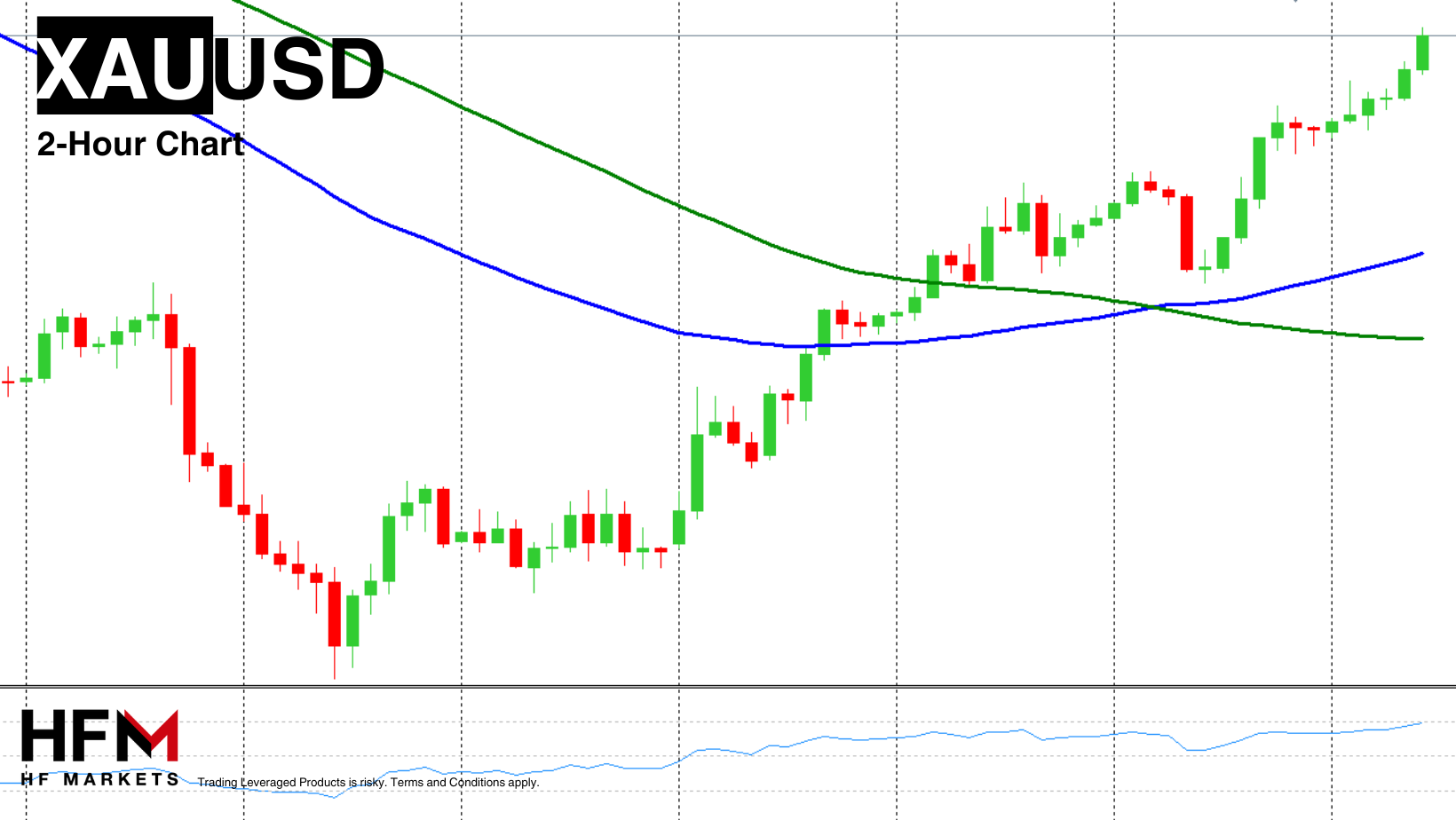

*Gold falls to $2667.45 after its largest rise in 20 months last week.Swaps traders see a less-than-even chance the central bank will cut rates next month. Higher borrowing costs tend to weigh on gold, as it doesn’t pay interest.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote