Date: 13th November 2024.

Stocks Cautious Amid Upcoming US CPI & Yen Pressures.

Trading Leveraged Products is risky

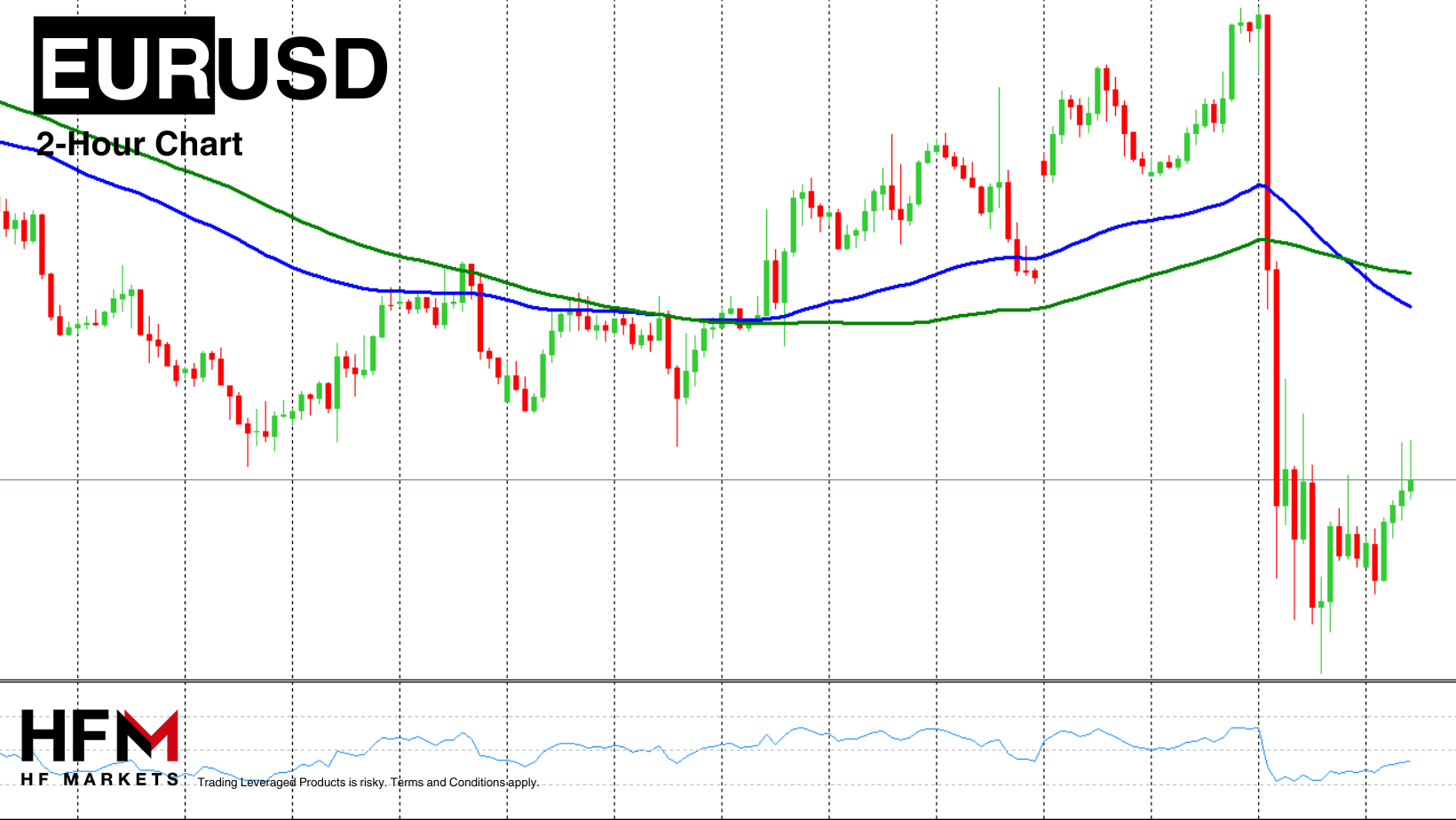

“Trump trade” has boosted the US Dollar and US stocks, but Trump’s policies may have less favorable effects on global assets. Trump’s plan to raise tariffs is expected to negatively impact economies worldwide, especially exporters like China.

Asia & European Sessions:

*Stock markets are turning cautious as markets prepare for Trump’s presidency. Growing concern that tariffs will disrupt global trade and fuel inflation has been denting sentiment.

*Indexes declined and Japan and Hong Kong, European markets are posting modest gains and US futures are in the red, as yields rise.

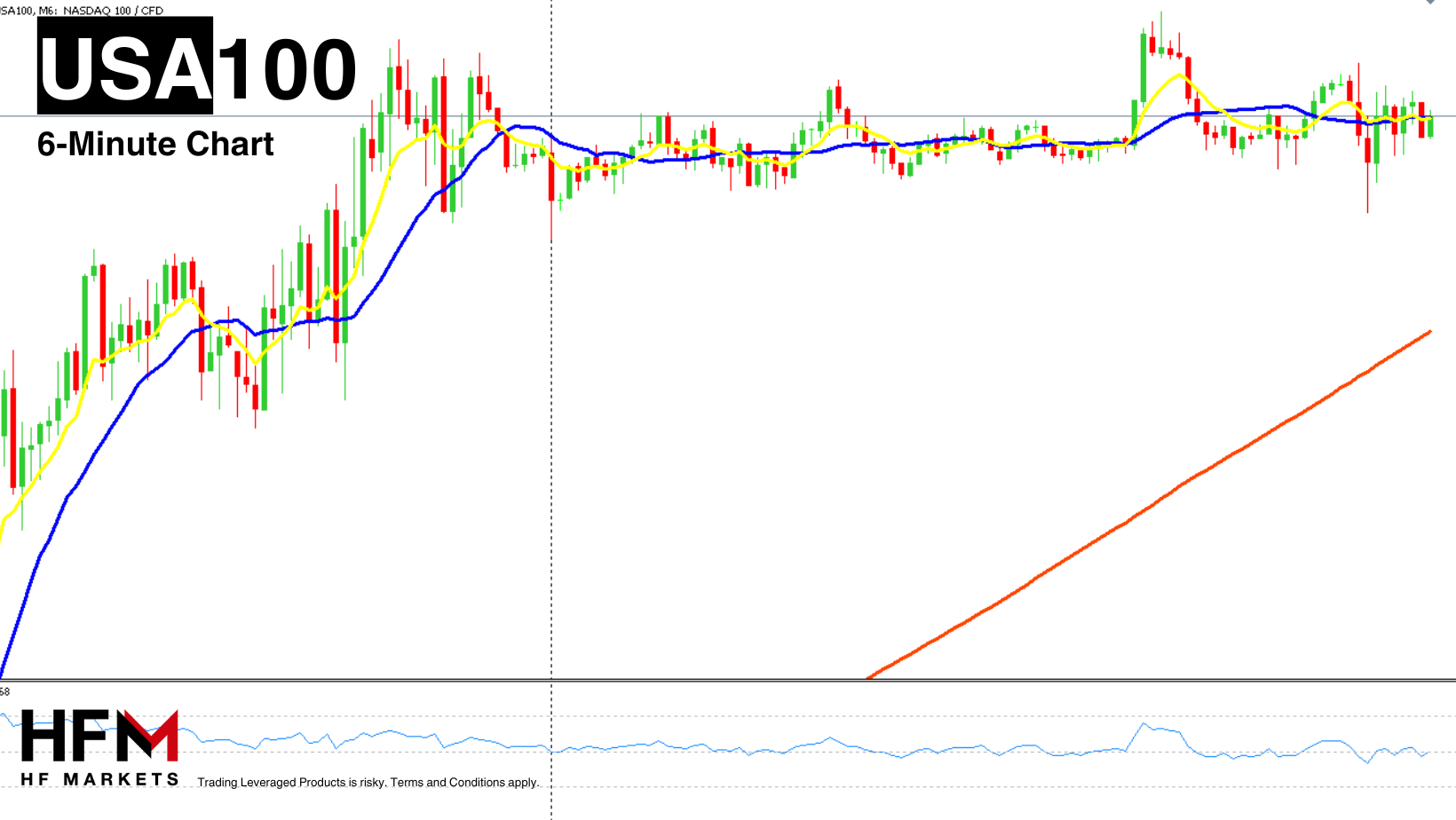

*Wall Street stumbled as the Trump trade ran out of steam after 5 straight days of gains on the S&P500 and Dow, along with 4 days of gains on the NASDAQ to more record highs.

Financial Markets Performance:

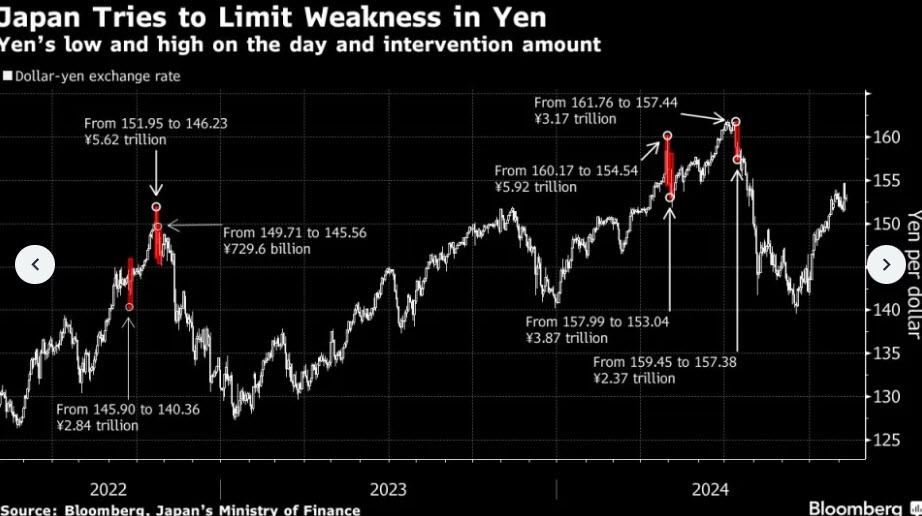

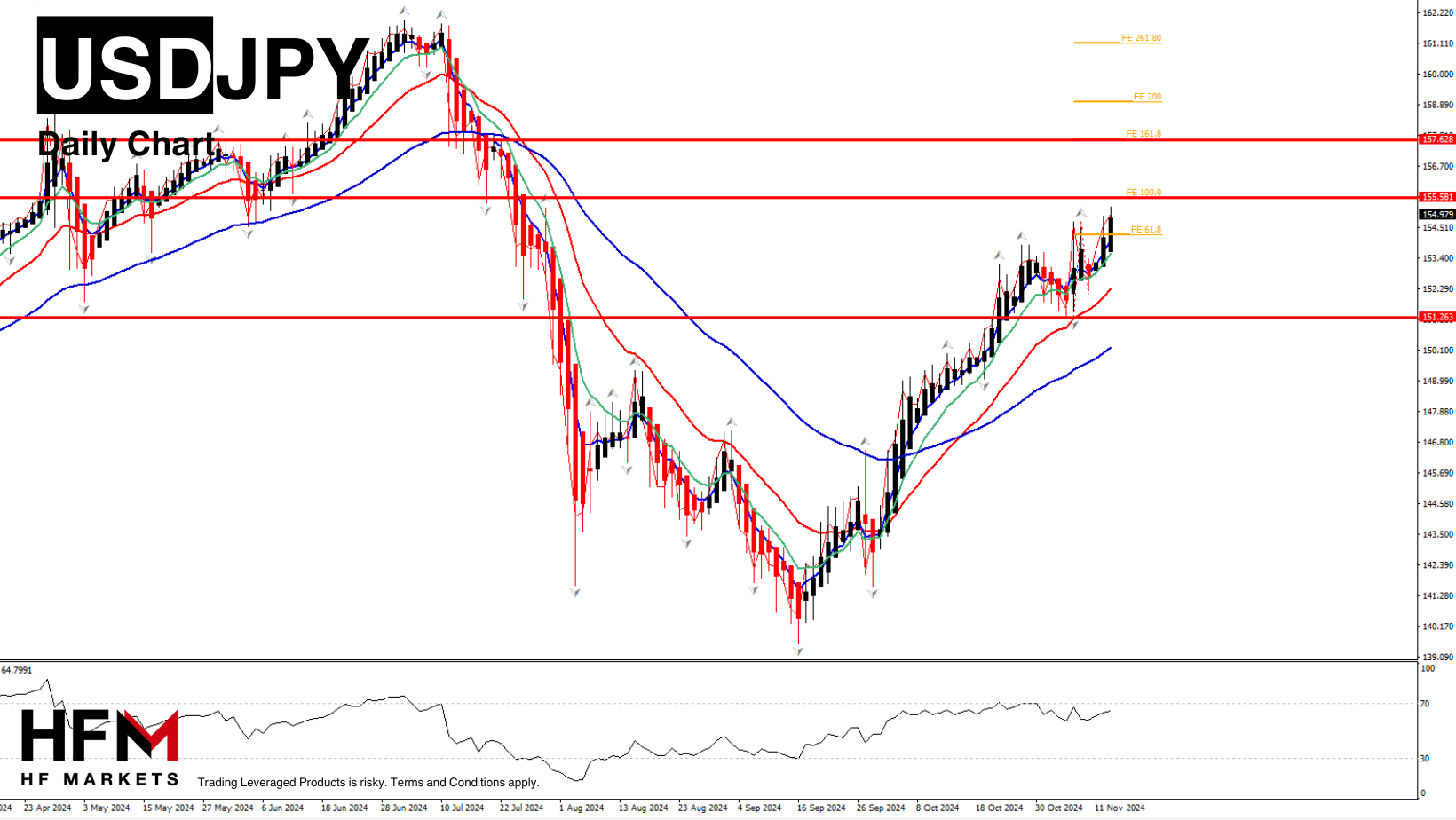

*The Yen weakened beyond 155 against the US Dollar for the first time since July, raising concerns that Japan might intervene in the currency market to curb its depreciation. A Bloomberg poll of 53 economists last month suggested intervention could be triggered at 150, with a median forecast of 160.

*A spike in Treasury yields is pressuring the Yen, with the two-year yield hitting its highest mark since July, driven by Trump’s economic agenda boosting US rates and the reduced cost of hedging due to the Federal Reserve’s rate cuts.

*The upcoming US data on CPI, PPI, and Retail sales could accelerate the Yen’s decline if the Ministry of Finance doesn’t step in with verbal warnings. Prolonged yen weakness may push the Bank of Japan to consider earlier rate hikes.

*Concerns over sticky high inflation ahead of the CPI report and concerns over potentially inflationary aspects of Trump’s fiscal policies exacerbated selling.

Financial Markets Performance:

*The USDIndex is settling above 106.

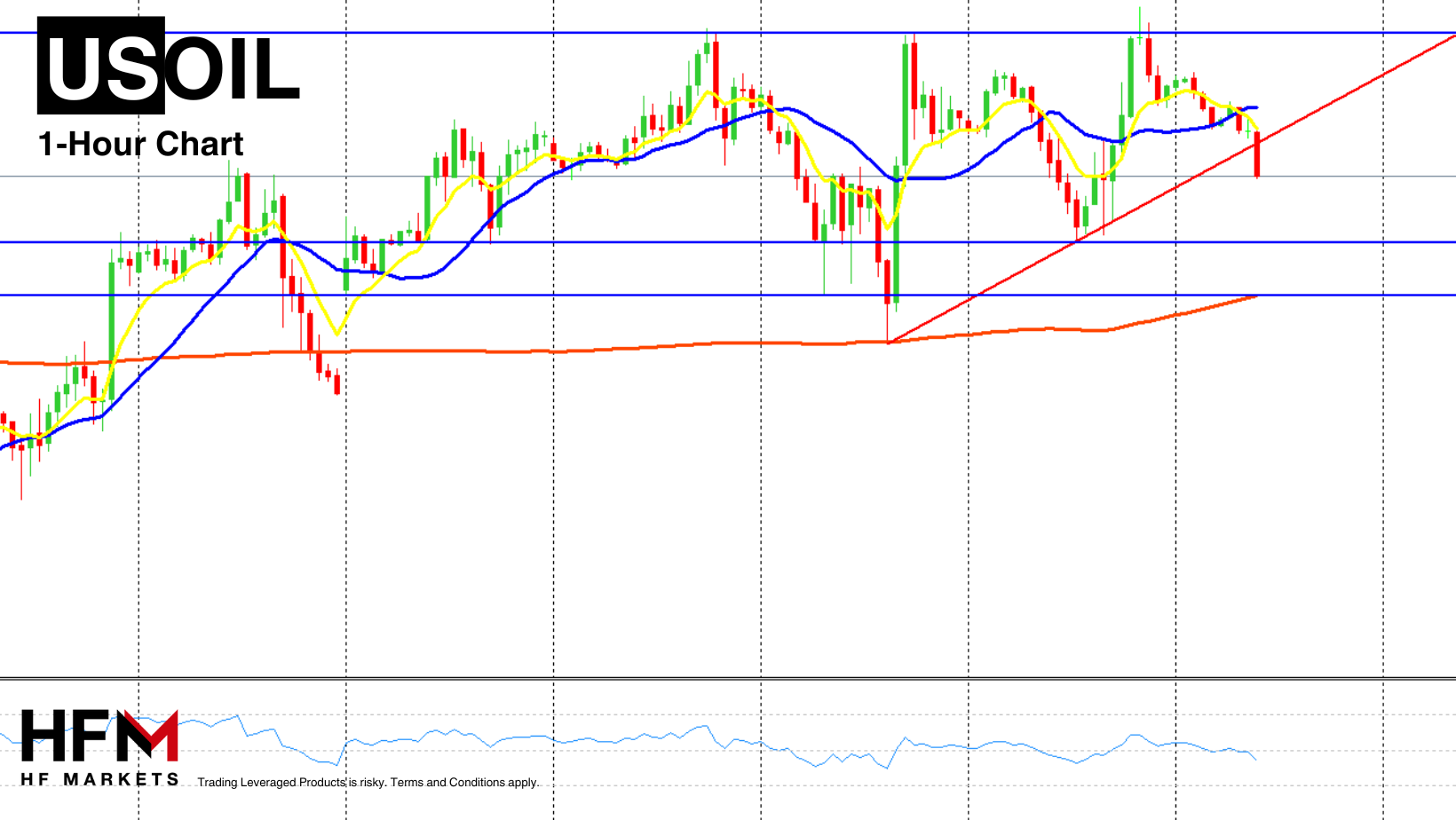

*Oil declined -0.09% to $67.98 per barrel with Trump’s “drill baby drill” reverberating.

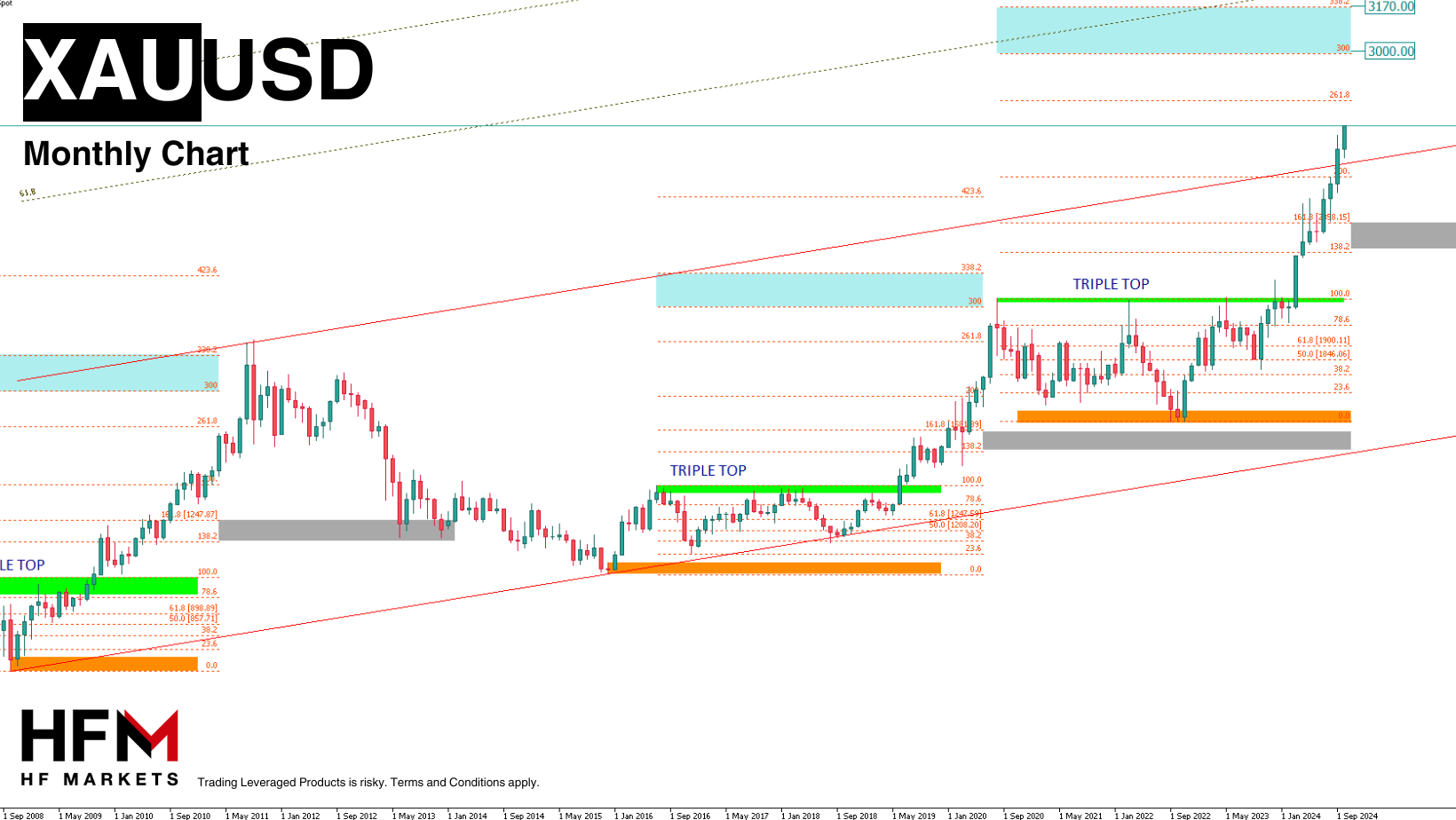

*Gold lost -0.82% to $2597.26 per ounce as interest rates surged. The rising Dollar also impacted commodities.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote