Date: 11th November 2024.

Bitcoin Skyrockets to $81k; Asian Stocks Down; Markets weigh the risk of “Trump-tariffs”.

Asia & European Sessions:

*Bitcoin surged past $81,000 for the first time (94% higher for 2024), fueled by President-elect Donald Trump’s decisive victory, winning all seven US battleground states, including Arizona. The digital-asset industry, which invested over $100 million in pro-crypto candidates, celebrated the outcome.

*Trump pledged to make the US a hub for digital assets, including plans for a strategic Bitcoin stockpile and appointing crypto-friendly regulators.

*Dogecoin skyrocketed to highest price since 2021 (promoted by Trump supporter Elon Musk).

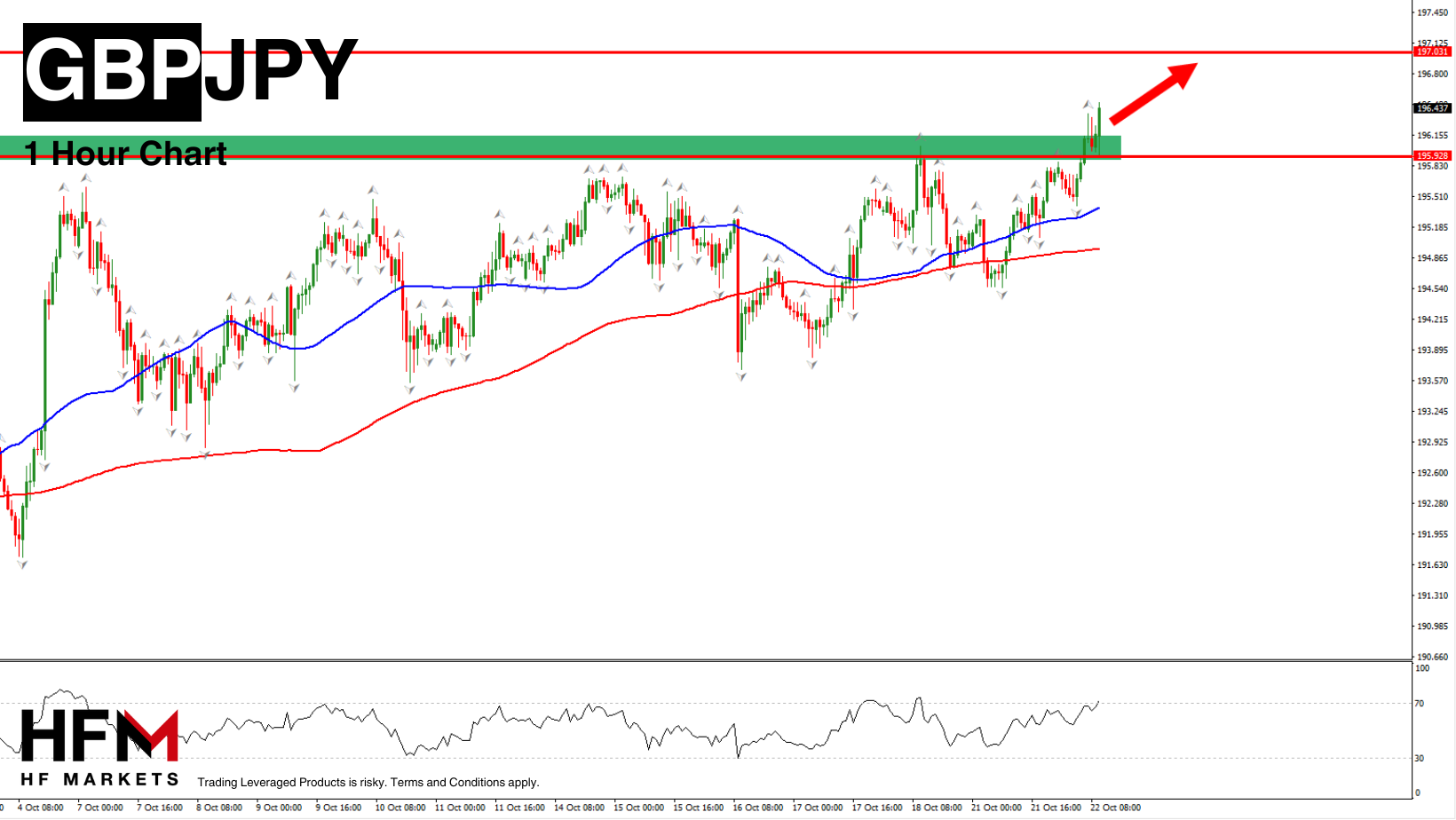

*Japanese indexes rallied as discussions at the last BoJ meeting focused on a cautious approach to additional rate cuts.

*Asian shares fell following concerns that China’s debt swap program may not be adequate, alongside data indicating ongoing deflationary pressures in the world’s second-largest economy. Investor sentiment is also dampened by declining foreign direct investment especially after Donald Trump’s presidential victory injected fresh uncertainty over tariffs.

*China’s inflation reports were weak, reflecting further deflation in wholesale prices. China’s trade surplus is poised to reach a new record this year. If the gap between exports and imports keeps expanding at its current rate, it could approach $1 trillion, based on Bloomberg’s calculations. These are ominous signs for the economy that continues to struggle.

Financial Markets Performance:

*European stock markets are mostly higher, with DAX and FTSE100 posting gains of 1.0% and 0.6% respectively.

*Bond markets are closed in the US and Canada today and while equity markets are open, trading conditions are likely to be quieter than usual.

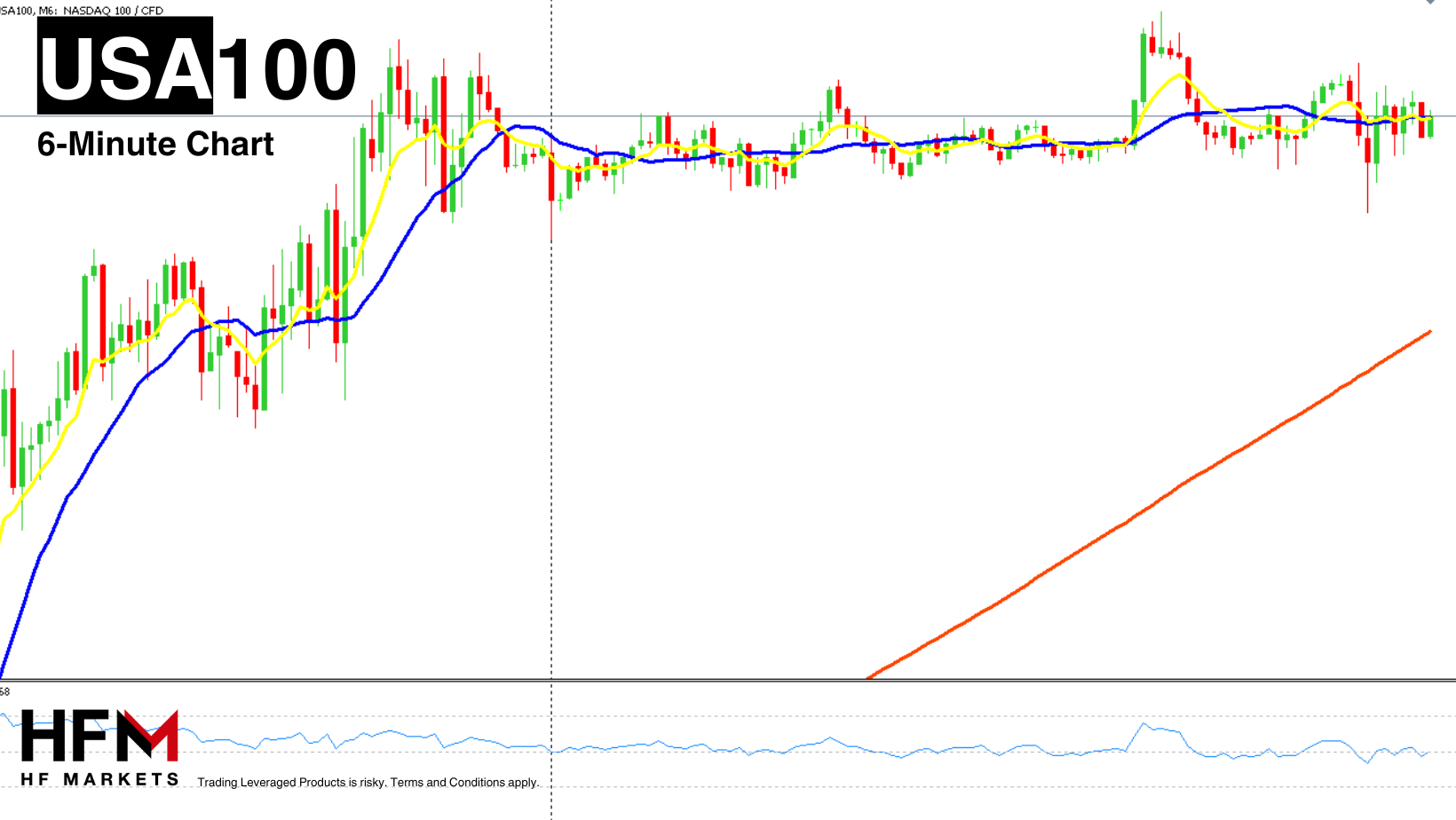

*US equity futures are currently higher, led by a 0.4% rise in the NASDAQ.

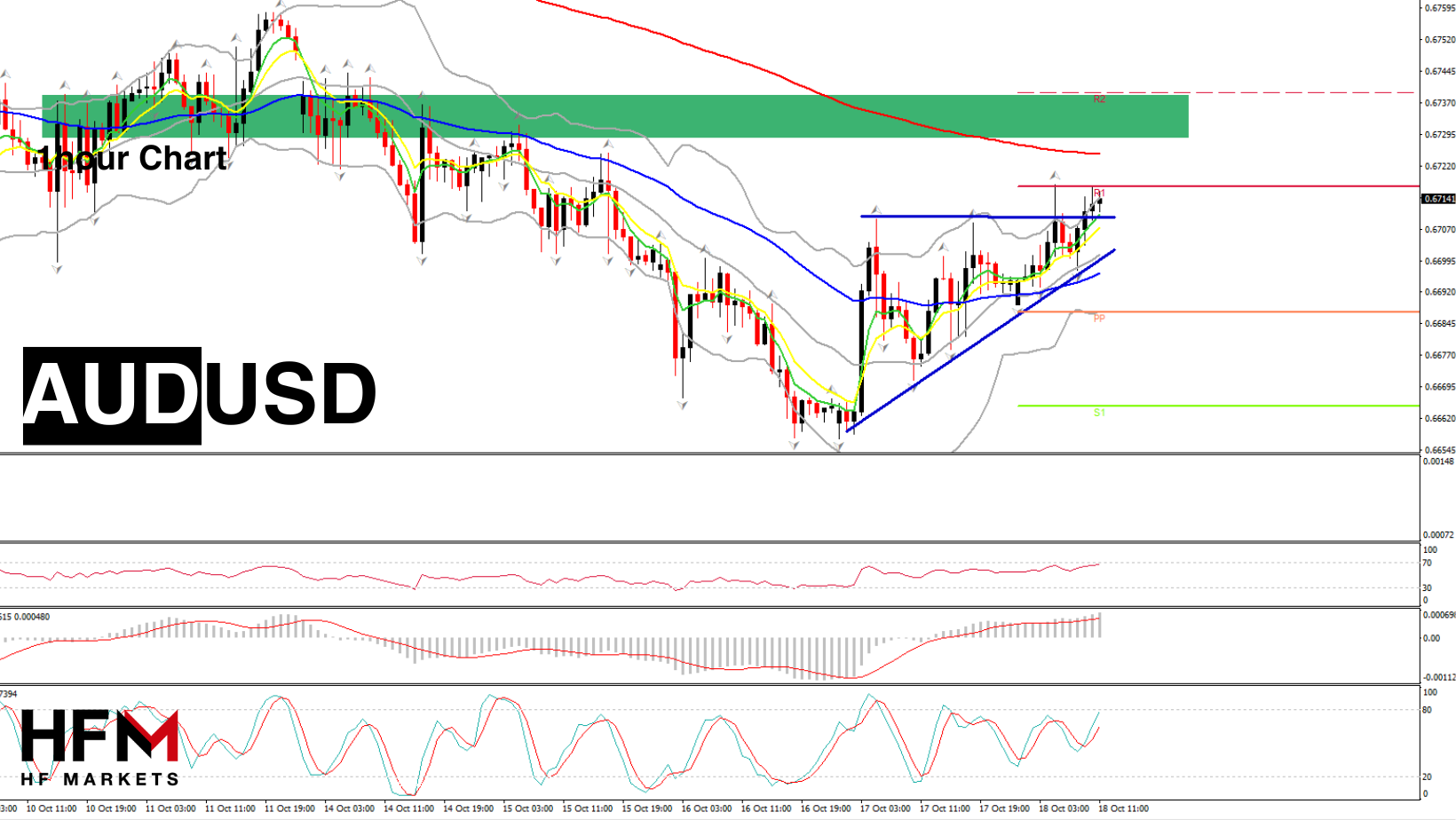

*The USDIndex climbed back above 105.

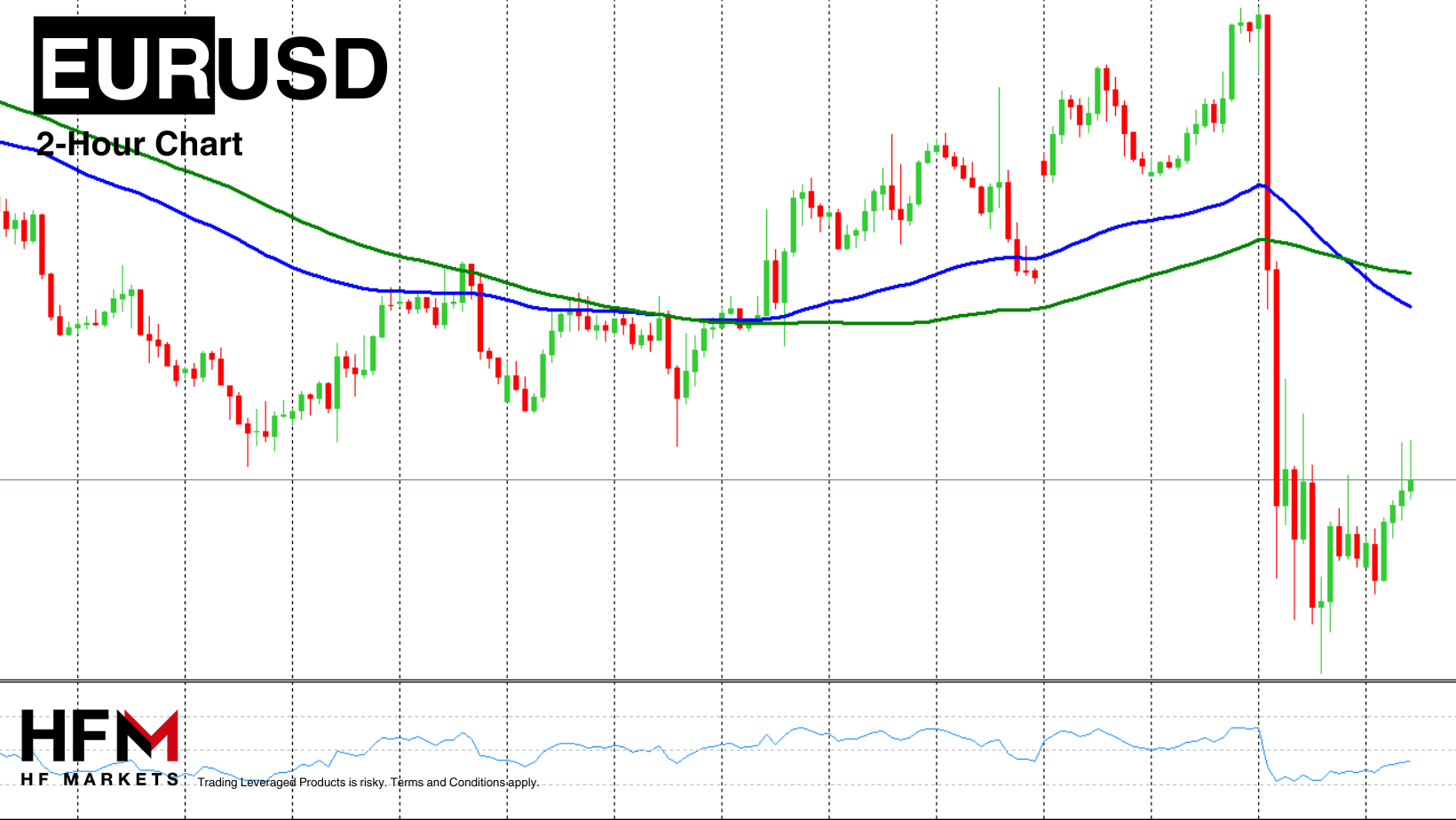

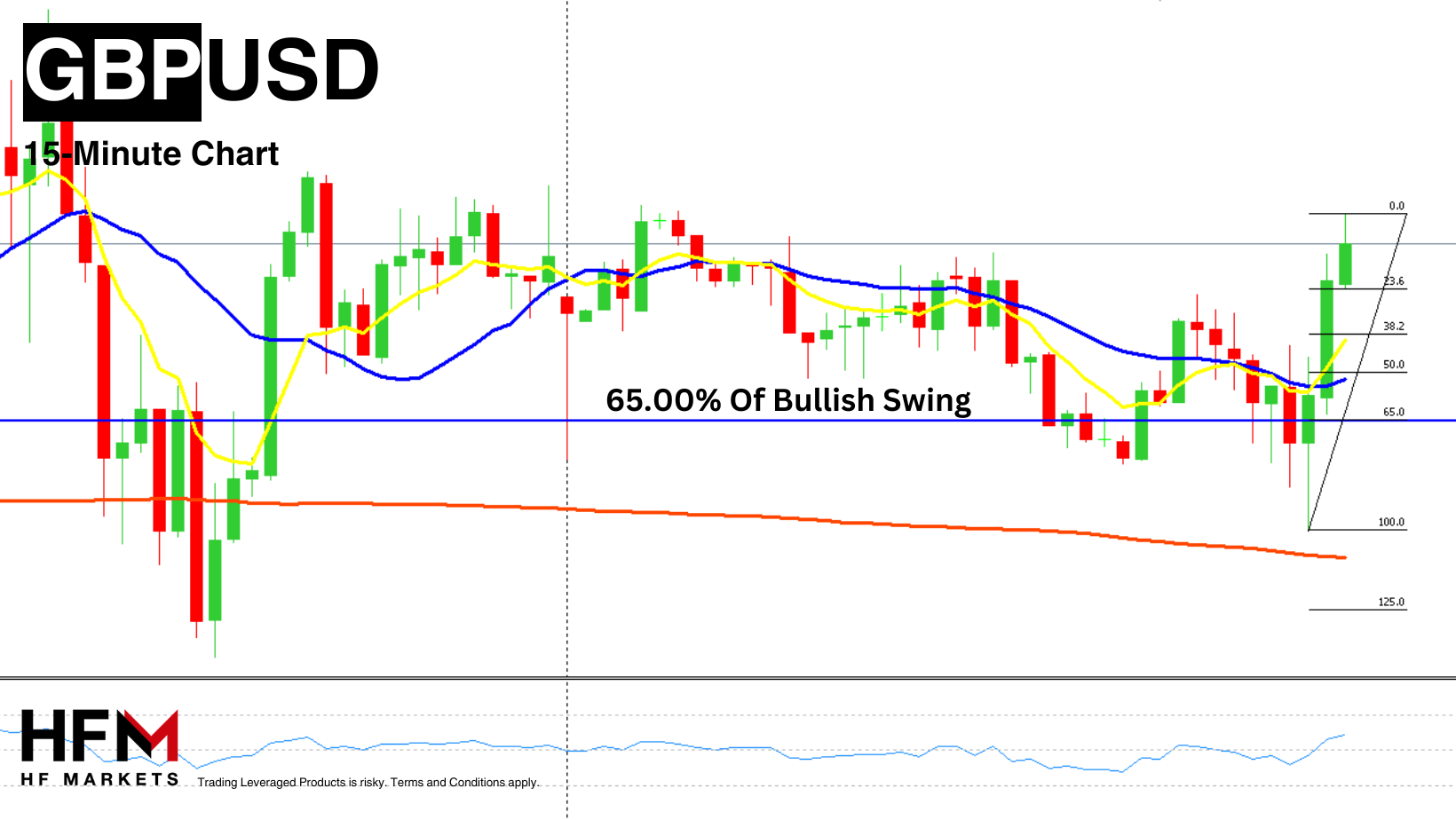

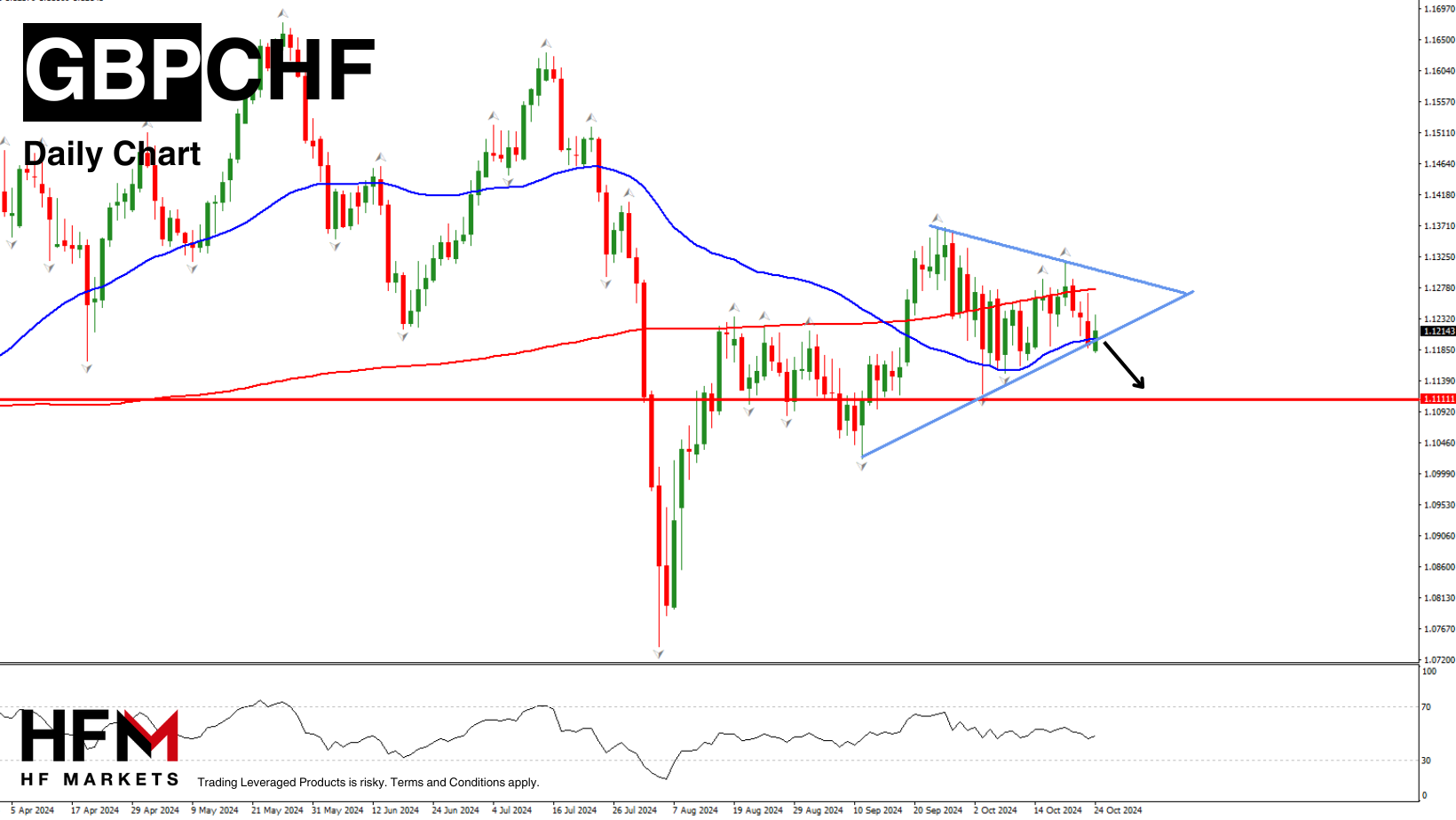

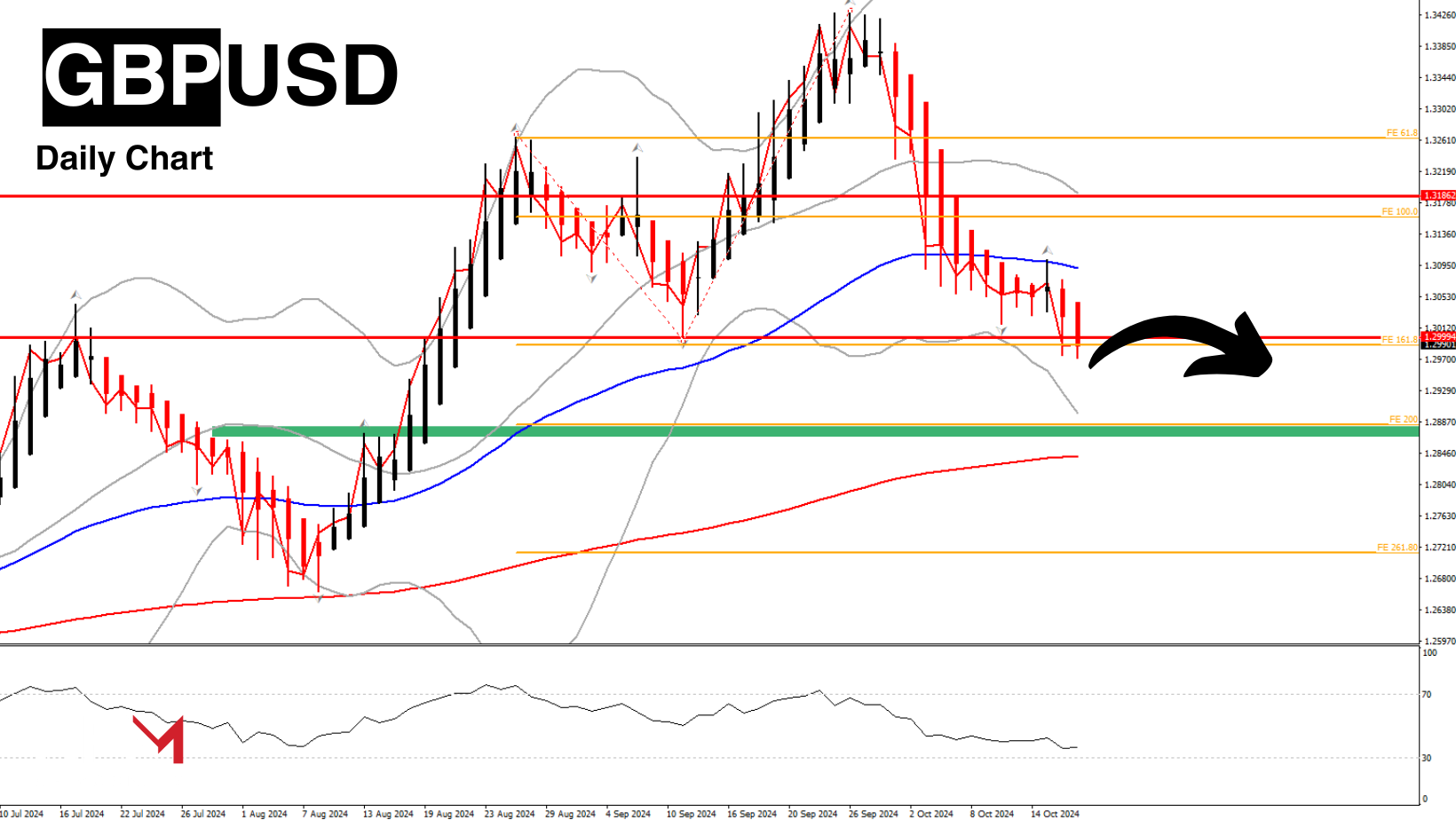

*EURUSD drifts to 1.069 and GBPUSD retests once again a break below 1.2900.

The USDJPY rebounds and extends again to 153.60 for the first time since July.

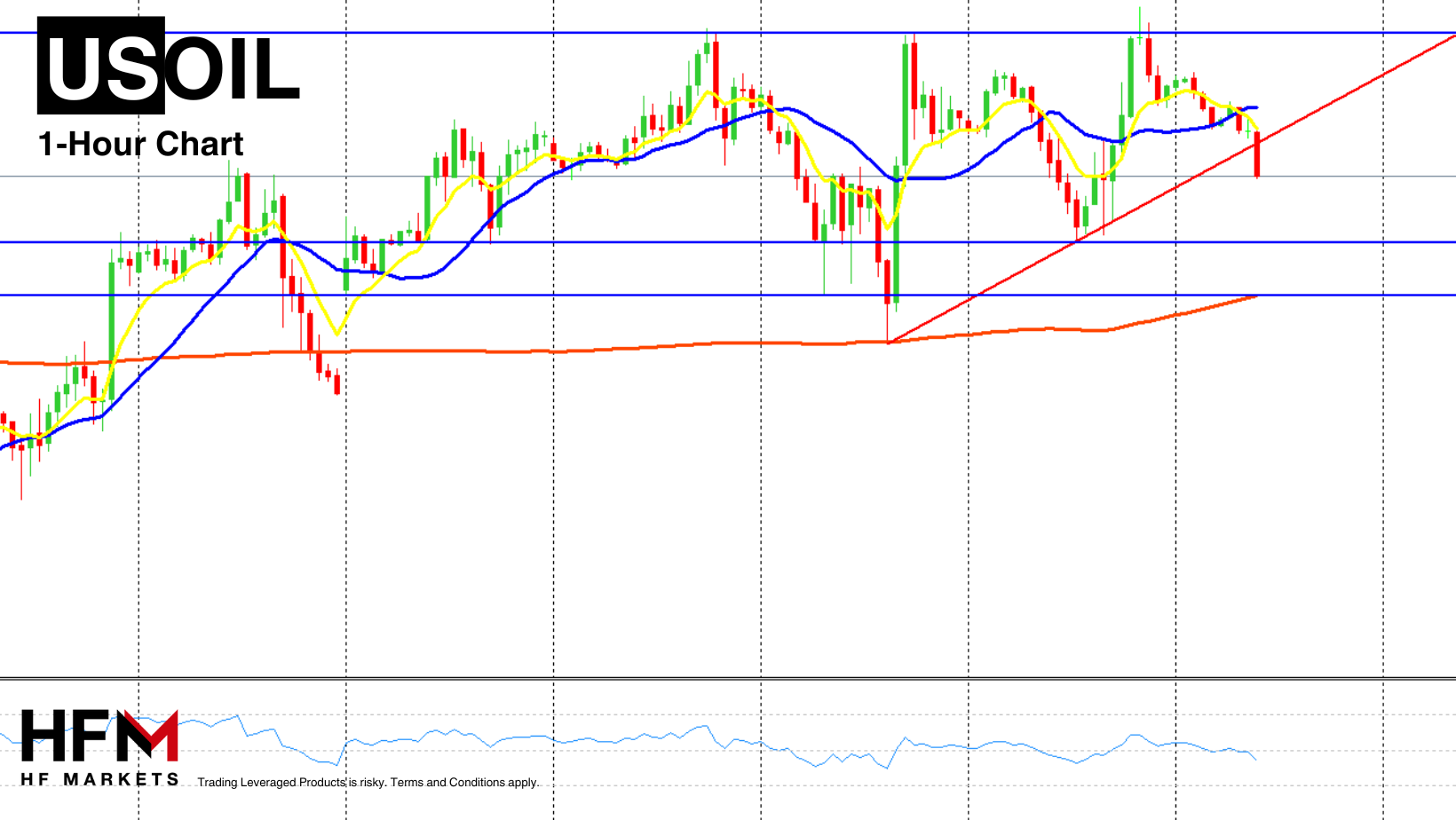

*Oil prices steadied at $70 lows following their largest drop in nearly 2 weeks, pressured by a weak outlook in China. Crude traders are considering global demand prospects for 2025, potential impacts from Donald Trump’s presidential win, and geopolitical tensions between Israel and Iran. A global surplus is expected next year, and influential outlooks, including OPEC’s report on Tuesday, are anticipated.

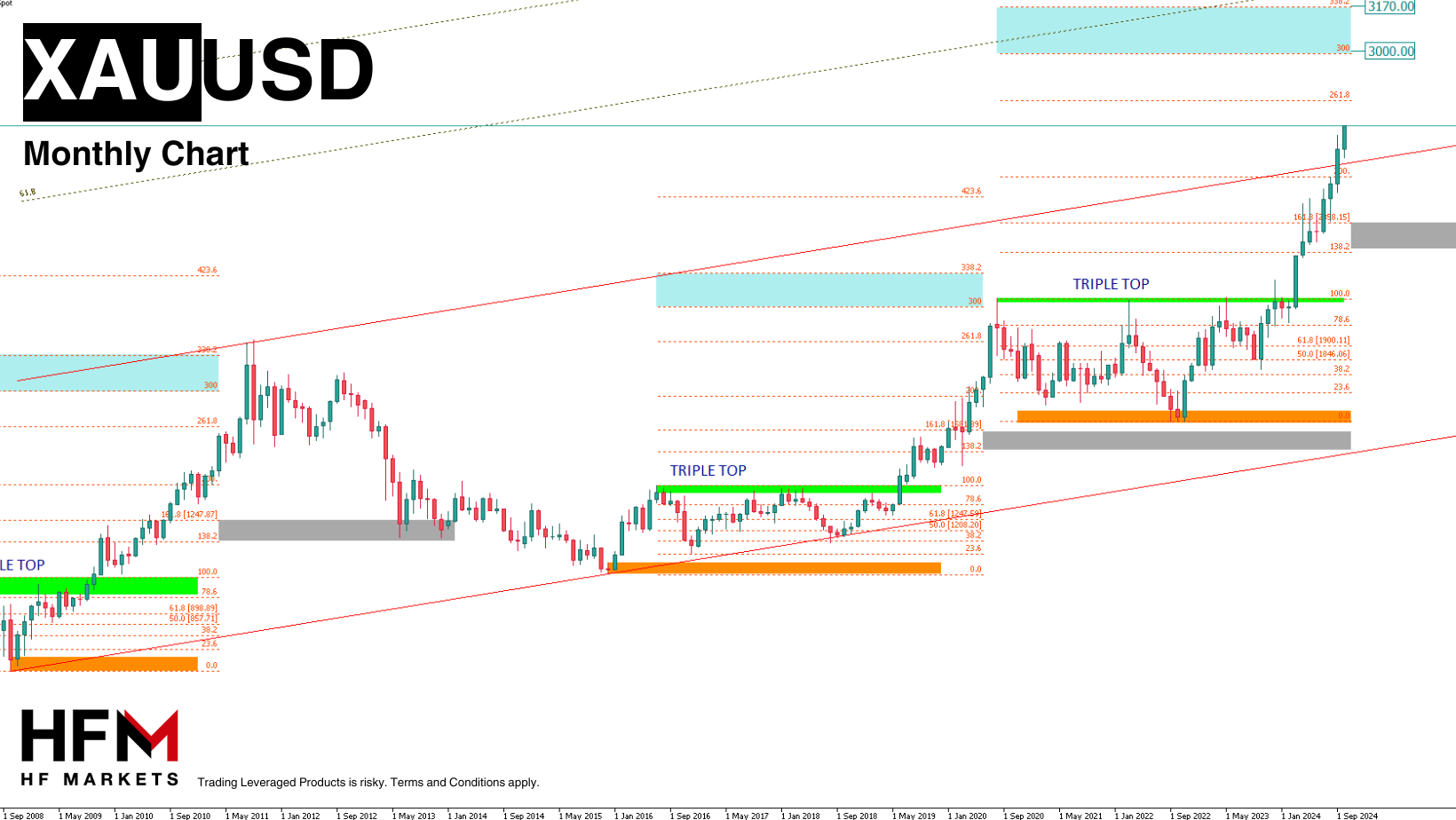

*Gold remains under pressure, as the US election outcome boosted the US Dollar and prompted a reversal of haven flows. The precious metal is currently trading at $2669 per ounce, slightly above the lows seen in the aftermath of the election and before the Fed cut rates.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote