Date: 15th November 2024.

Treasuries cheapen slightly, Wall Street slips after Powell’s remarks.

Trading Leveraged Products is risky

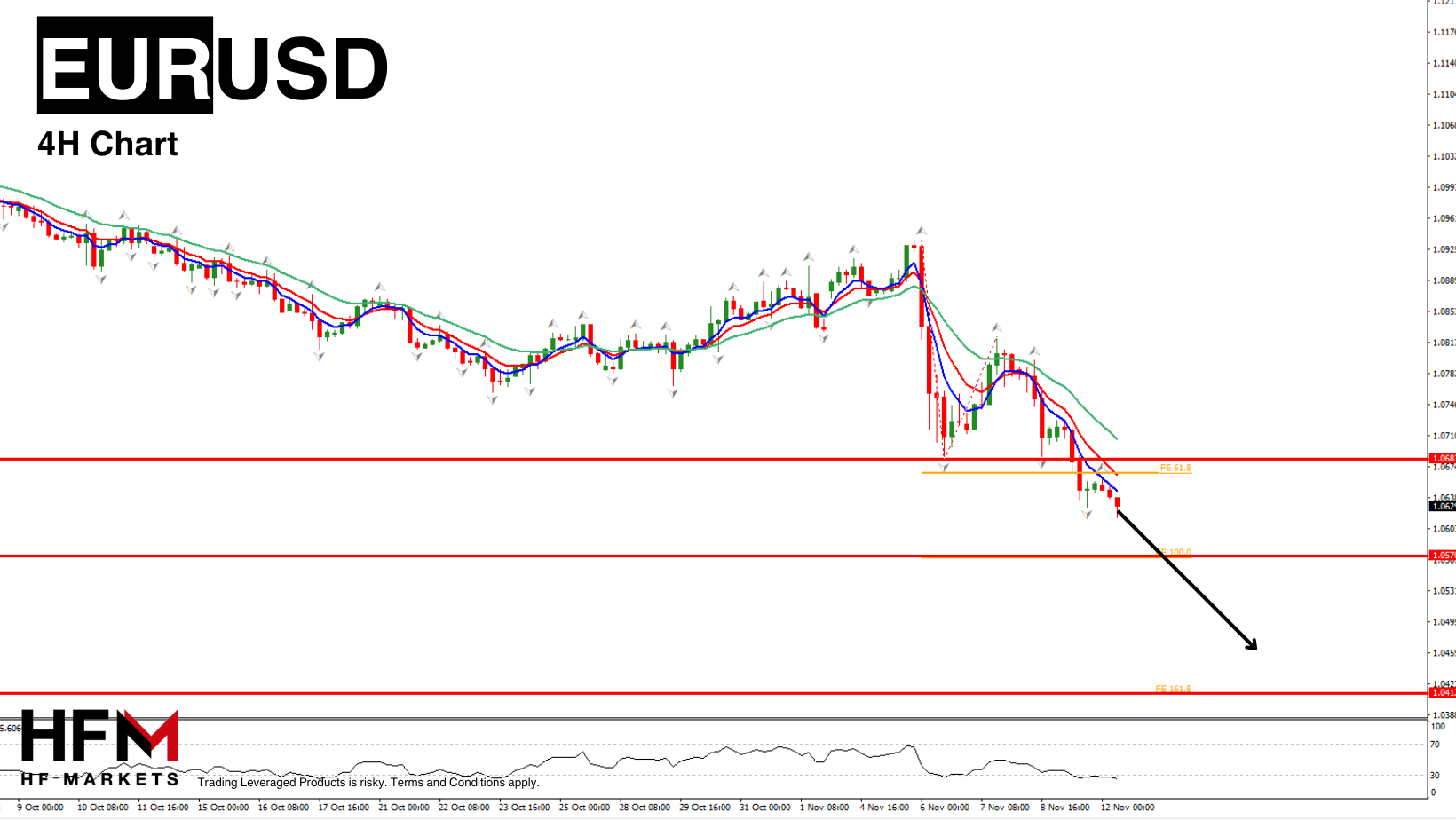

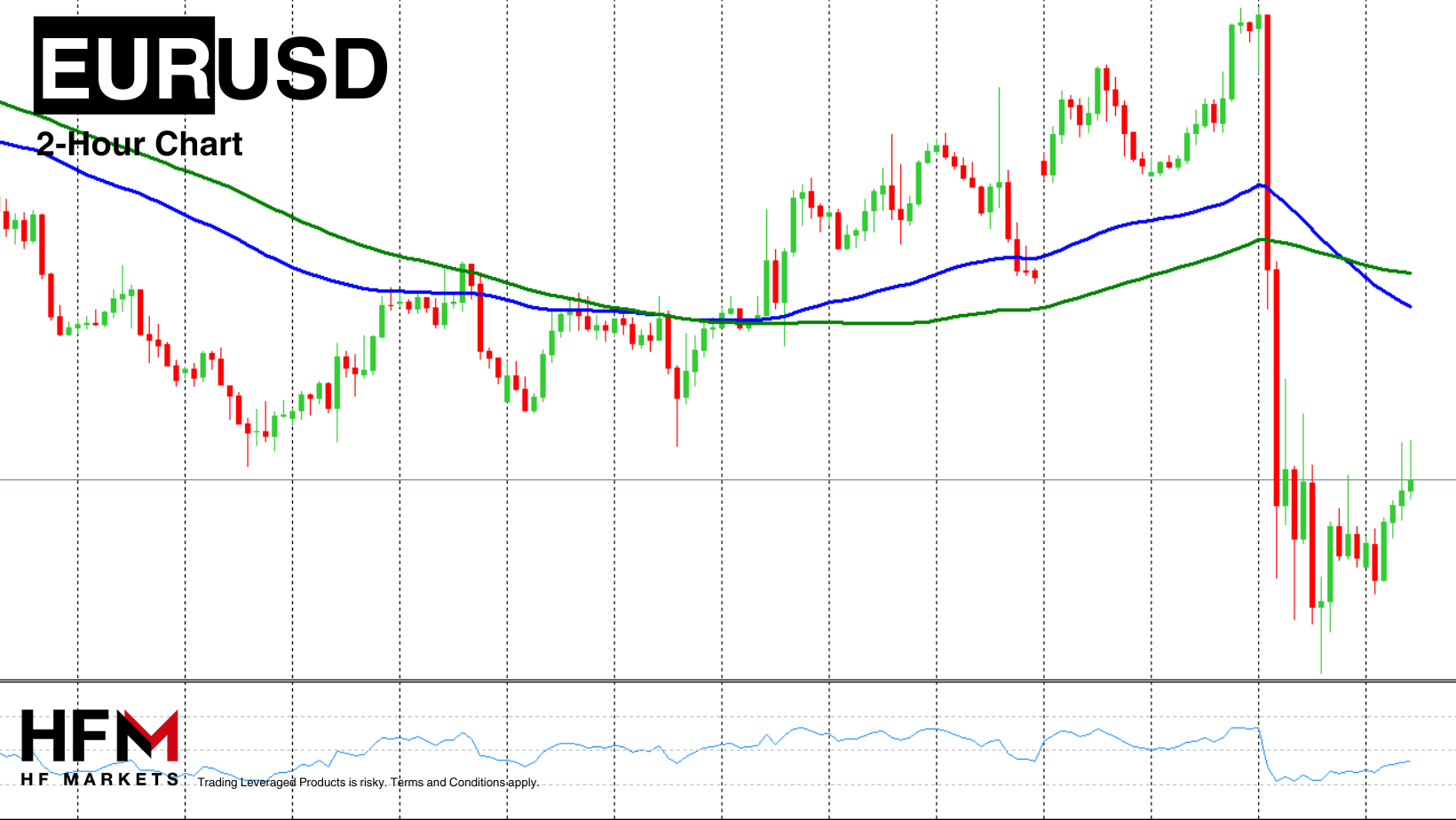

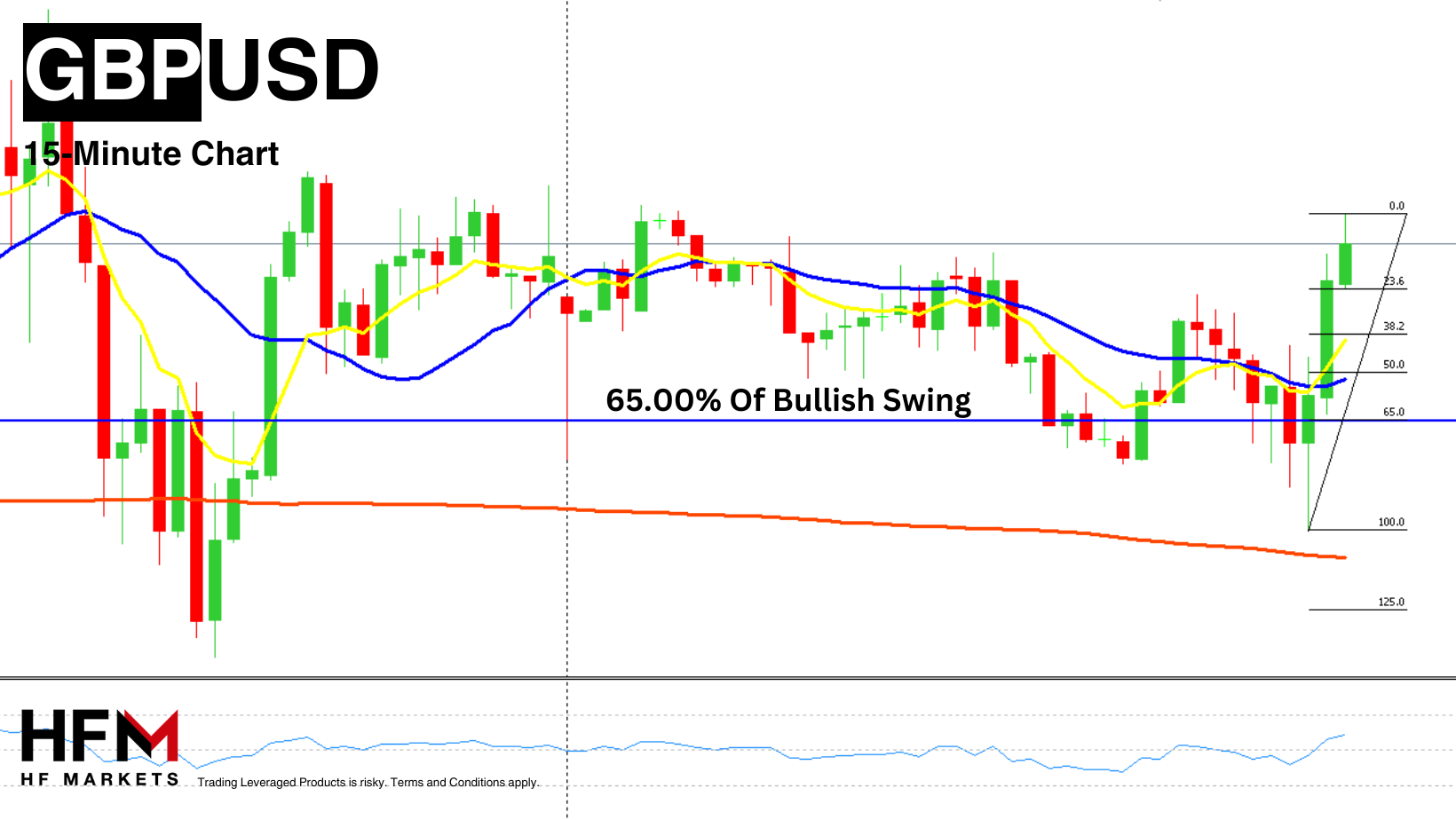

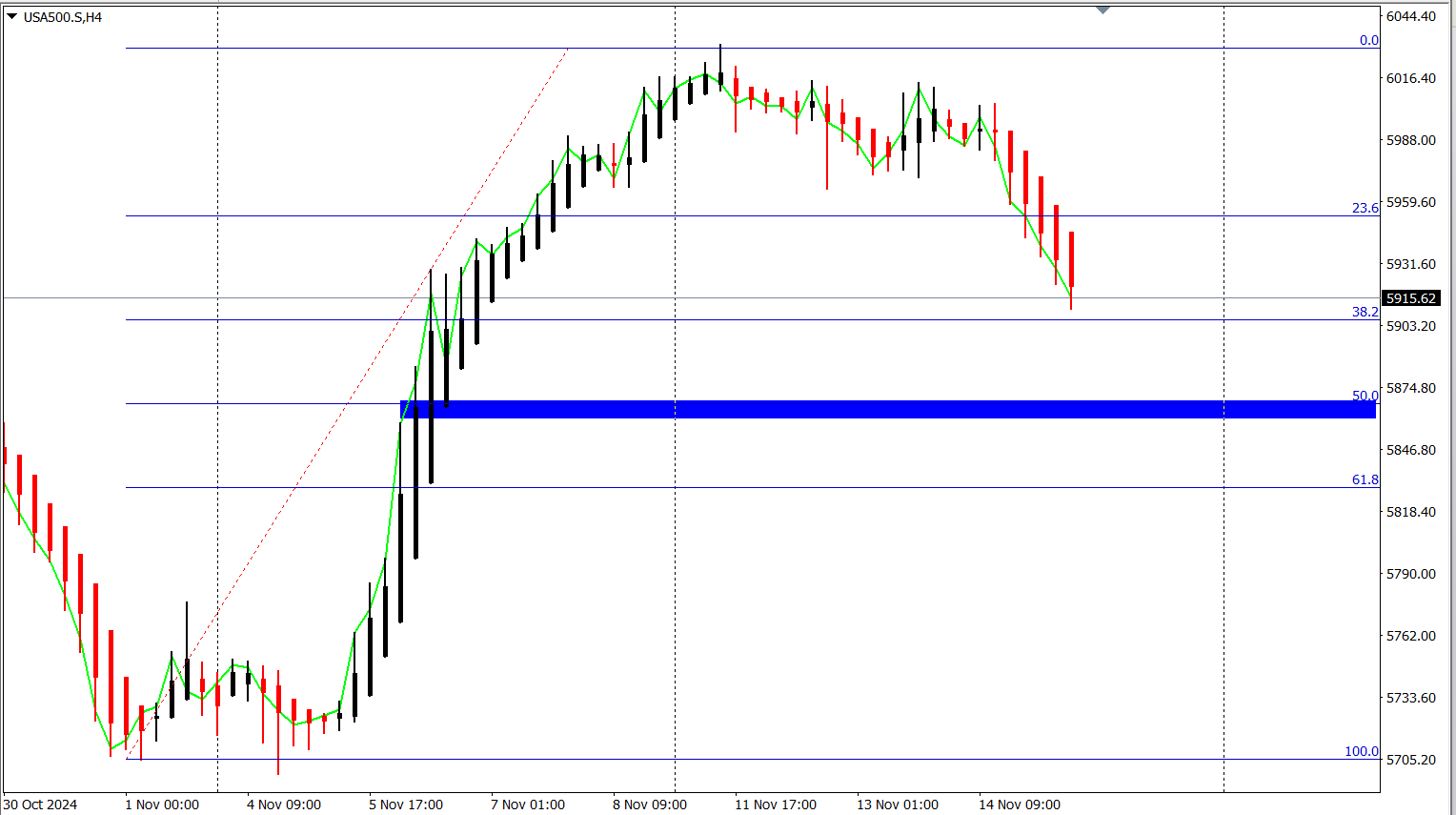

In the US session, the comments from Fed Chair Powell suggesting the FOMC might be pausing rate cuts weighed on Treasuries and Wall Street, keeping the US Dollar firm. Powell said the data are not showing the need for the FOMC to hurry with rate cuts. His remarks followed on the heels of the stronger than expected PPI and jobless claims data.

Asia & European Sessions:

*US: Producer prices exceeded expectations, and jobless claims hit their lowest since May. Policymakers called for caution on rate cuts amid strong economic performance, lingering inflation, and market uncertainty.

*Equity Futures Decline in US and Europe: Futures for Euro Stoxx 50 fell 0.7%, and S&P500 contracts extended losses after the benchmark declined 0.6%.

*Asian markets, in contrast, saw gains, with MSCI’s regional index rising on signs of economic resilience in China.

*China’s retail sales grew at their fastest pace in eight months, although the CSI 300 Index fell.

*Emerging markets equities were set for their worst week since June 2022, while emerging markets currencies neared year-to-date losses.

*US automakers like Tesla and Rivian dropped on reports that Trump might remove the $7,500 EV tax credit.Walt Disney shares surged after reporting better-than-expected profits.

*Bitcoin slid back to $87k territory, after Fed Chair Jerome Powell said there was no need to hurry interest-rate cuts. That left the token about $6,500 below a record high set on Wednesday. Markets seem to be cooling down at the end of the week.

*On the geopolitical front, Russian President Vladimir Putin expressed interest in resolving the conflict with Ukraine. This announcement came alongside President Trump’s endorsement of peaceful solutions, raising market hopes for a ceasefire and potential economic recovery in Eastern Europe. Analysts noted that an end to the conflict could spur economic activity and increase demand for cryptocurrency services.

*MicroStrategy made a significant $2 billion acquisition, adding nearly 25,000 BTC to its reserves. Institutional investments like these are seen as potentially stabilizing Bitcoin’s volatility and enhancing liquidity.

Financial Markets Performance:

*The US Dollar was set to gain over 1.4% for the week despite a slight drop on Friday. Gains were driven by Federal Reserve Chair Jerome Powell’s comments about a gradual approach to rate cuts.

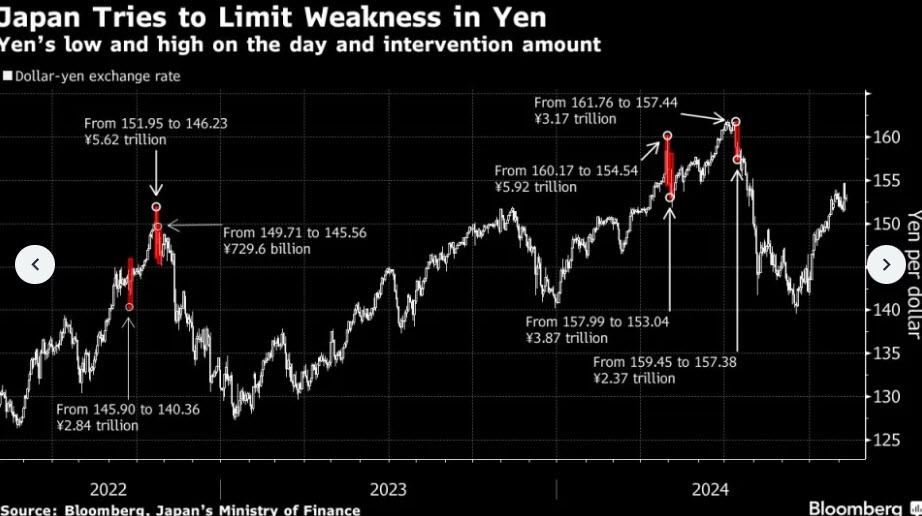

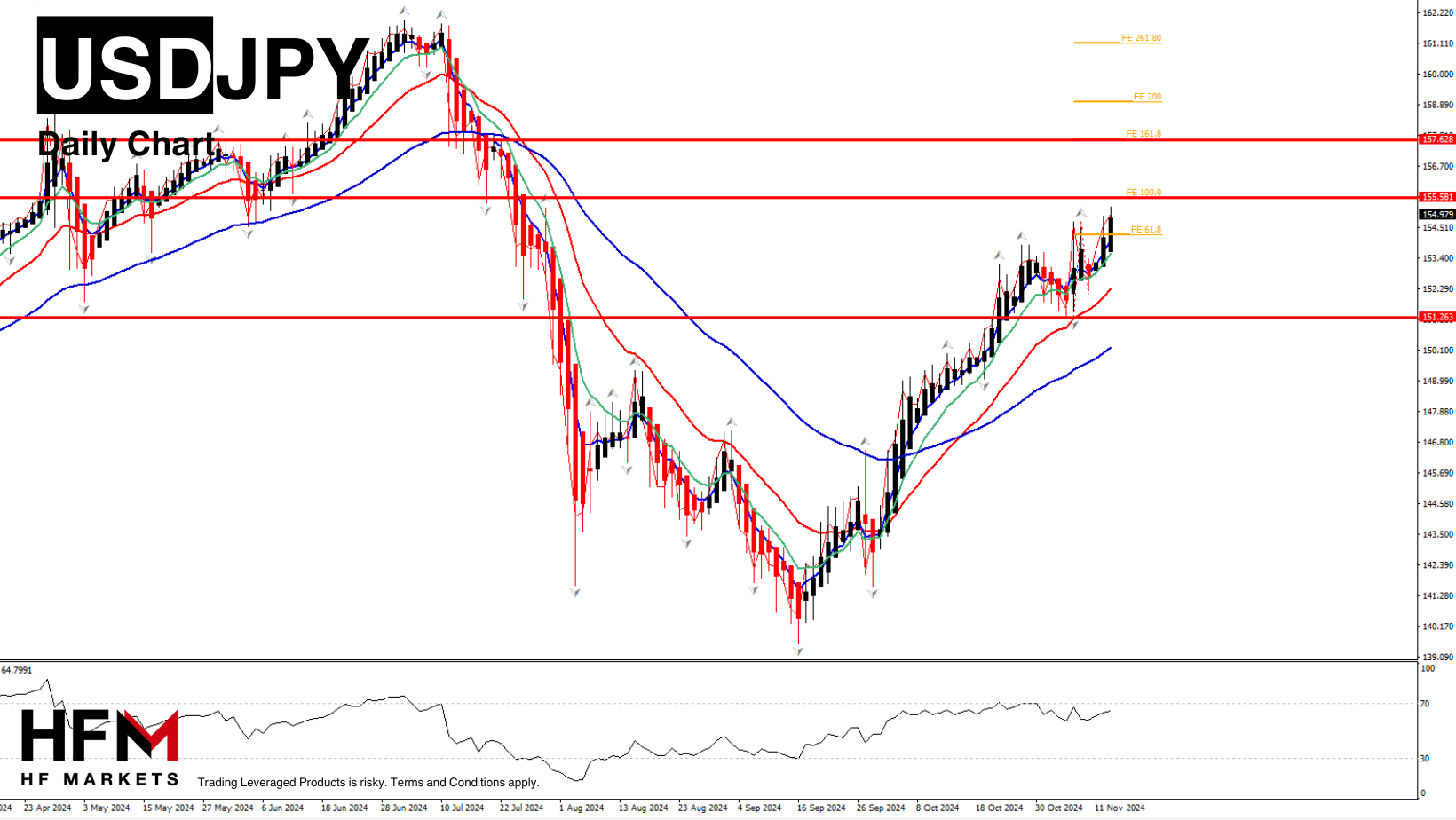

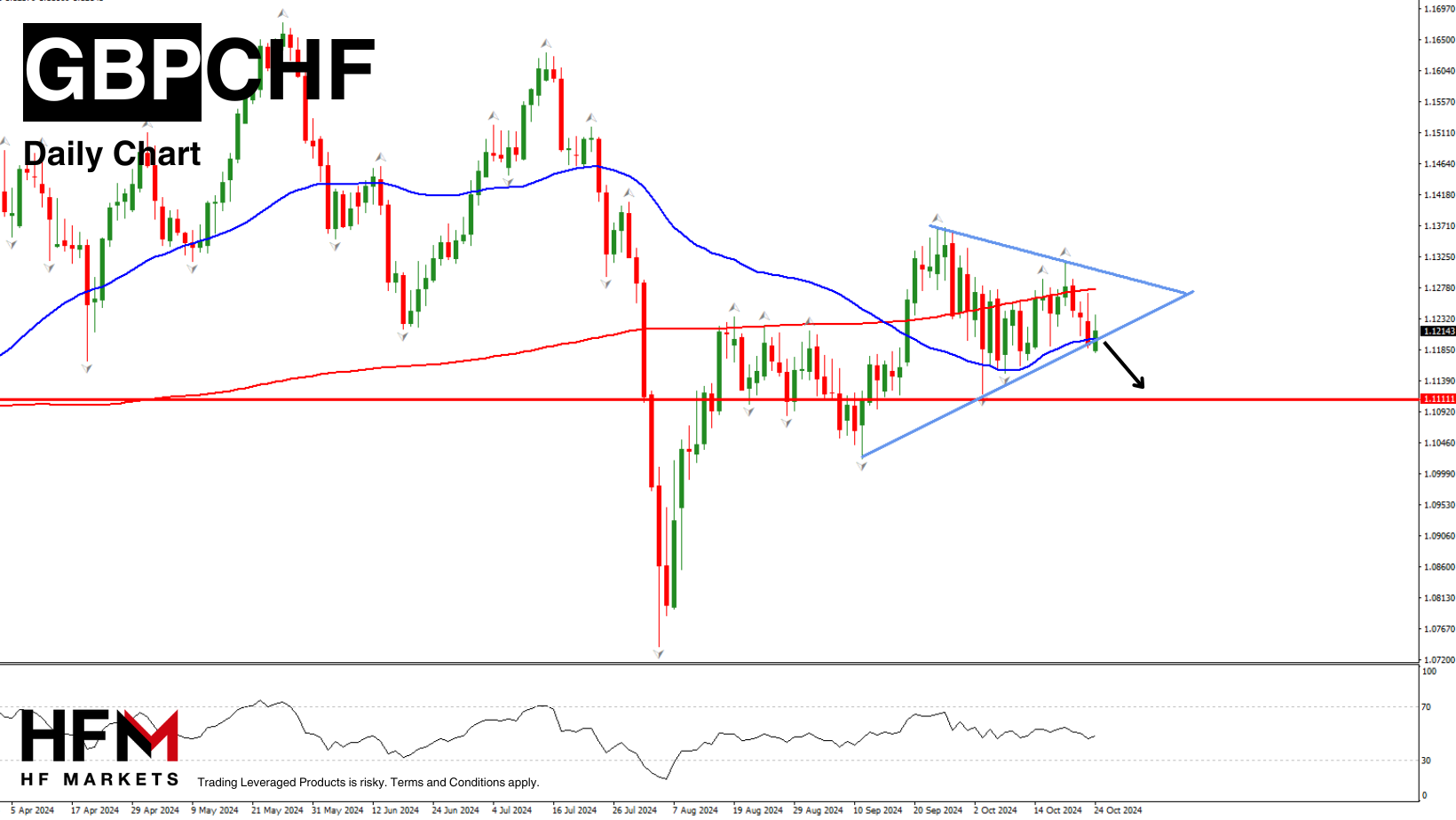

*The Yen recovered following Japan’s Finance Minister’s statement on monitoring the forex market. It is currently at 155.75.

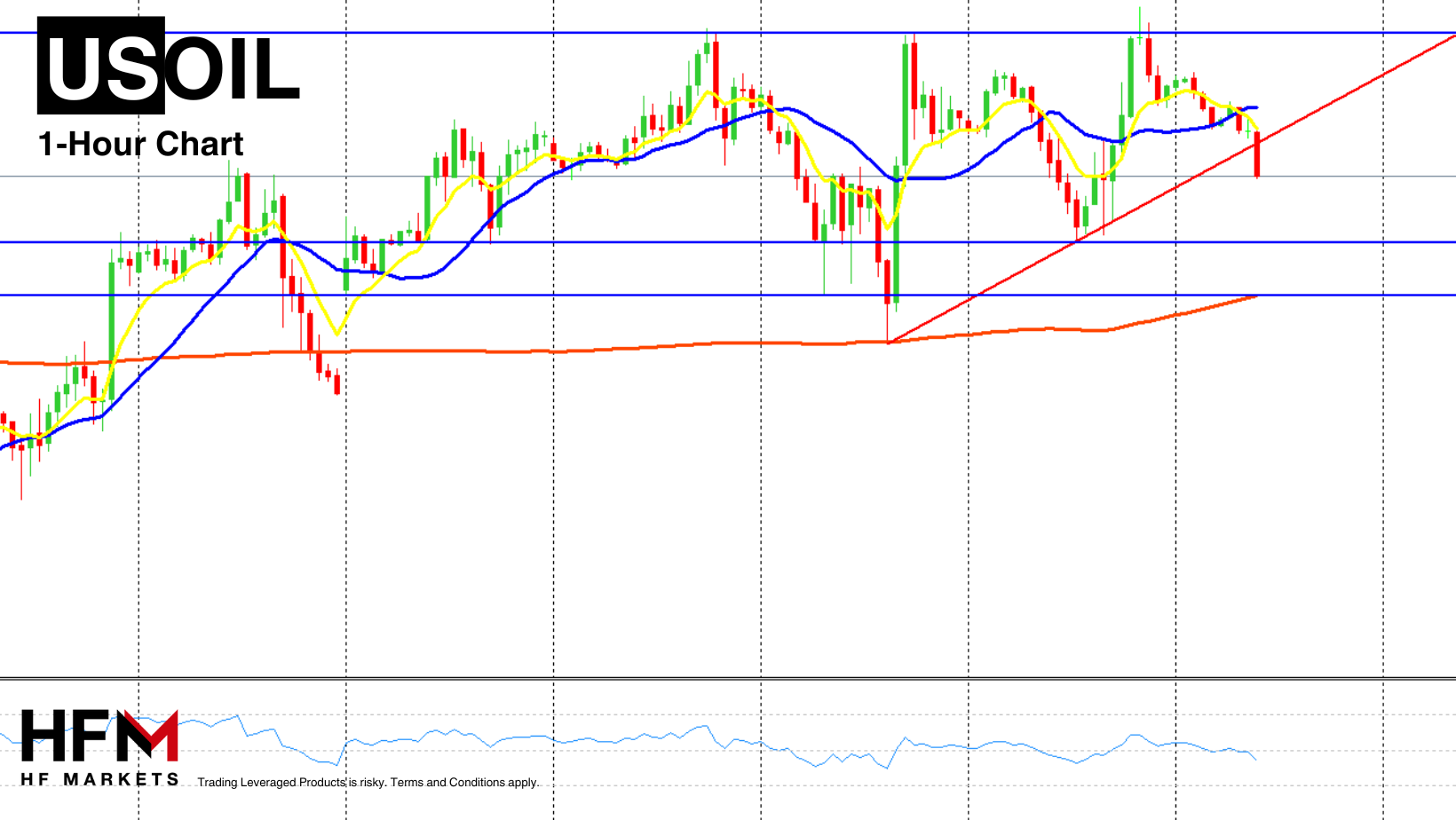

*Oil headed for a weekly loss, impacted by a stronger Dollar and oversupply concerns for next year.

*Gold remained near a 2-month low. Bullion is currently at $2567, as the USDIndex remains on an uptrend and flirts with the 107 level. The precious metal is still around 25% higher than a year ago. Silver is once again underperforming and copper, and steel prices are also falling as markets weigh the impact of weak Chinese growth.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote