Date: 19th March 2025.

Stock Markets Mixed as Investors Await US Federal Reserve Interest Rate Decision

Trading Leveraged products is Risky

Asian stock markets showed mixed performance on Wednesday as investors awaited the US Federal Reserve’s interest rate decision. Global markets remain on edge, with traders looking for guidance from Fed Chair Jerome Powell on future monetary policy.

US stock futures edged higher, while oil prices declined for a second consecutive session.

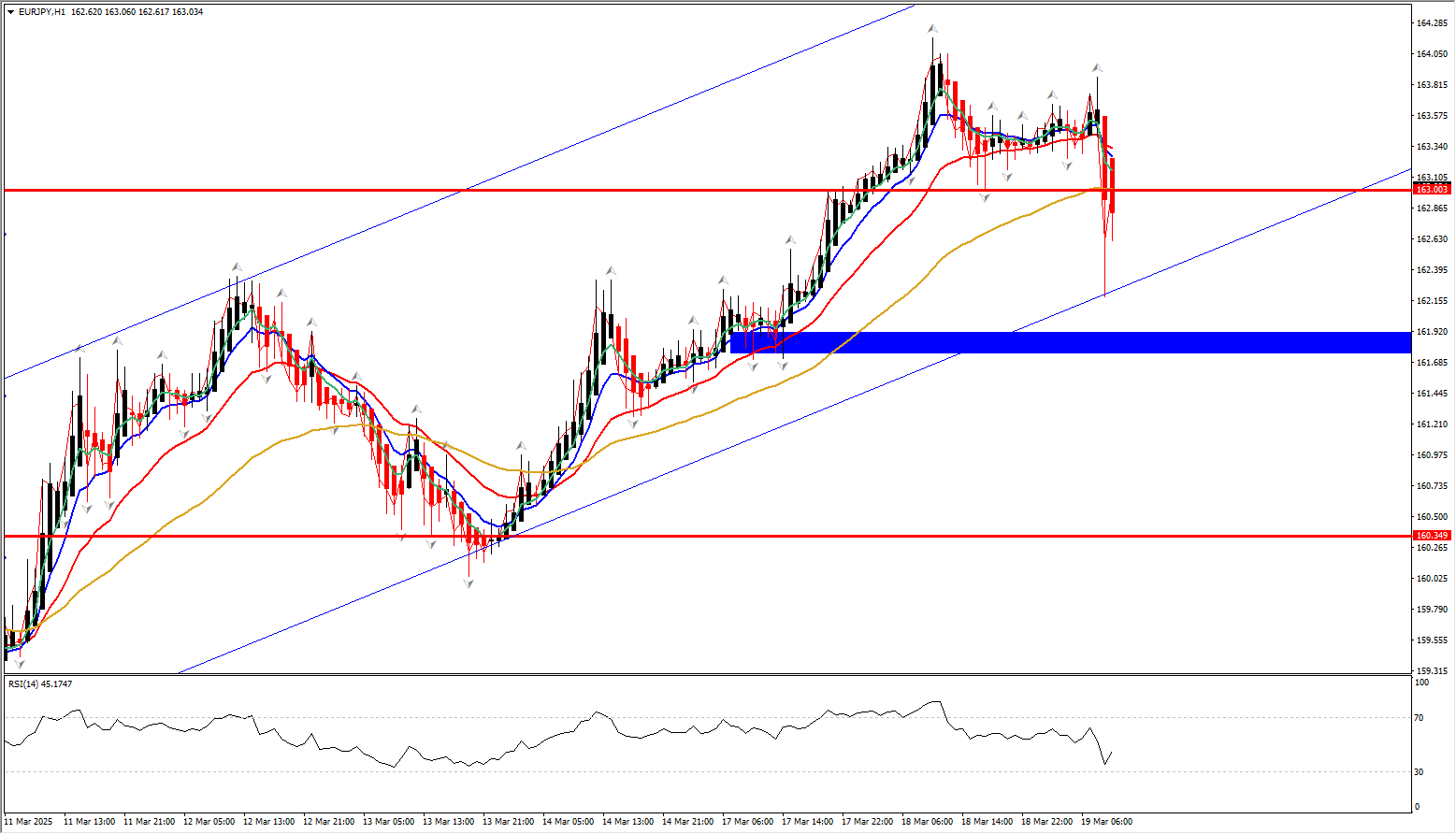

Yen Weakens as Bank of Japan Holds Rates Steady

The Bank of Japan (BOJ) kept its policy rate unchanged at 0.5%, signalling concerns over global trade tensions while acknowledging domestic conditions that support further hikes. The central bank added trade policies to its risk outlook, reflecting heightened uncertainty as President Trump's tariff threats loom.

Despite strong wage growth and inflation at 4%, BOJ Governor Kazuo Ueda appears cautious, suggesting the next rate hike may follow a six-month pace—possibly in June or July. Meanwhile, Japan’s latest trade data showed a surplus in February, with exports rising over 11%. The Bank of Japan kept its benchmark interest rate unchanged at 0.5%, in line with expectations. Similarly, the Federal Reserve is widely anticipated to maintain its current rate stance.

The Japanese Yen continued its decline against the US dollar after the Bank of Japan (BOJ) opted to keep its policy interest rate unchanged, citing ongoing global trade concerns and domestic economic trends, including rising wages and inflation. Meanwhile, the Fed is expected to cut rates starting in September, keeping the rate gap with Japan-wide.

The Yen slipped as much as 0.4% to 150 per dollar, extending losses from last week’s five-month high. The decision was widely expected, as all economists surveyed by Bloomberg had anticipated that the BOJ would maintain its current policy stance.

In its latest statement, the BOJ highlighted trade policies and global economic conditions as key risks to its outlook. This marks a shift from previous statements, reflecting heightened uncertainty in global markets. Over the past year, Japan’s central bank has raised interest rates three times since ending its negative interest rate policy, the last of its kind worldwide.

Key Focus: US Federal Reserve’s Rate Decision

All eyes are on the Federal Reserve’s policy announcement and Powell’s press conference, where investors hope to gain insight into future rate moves. The dot plot forecast is expected to align with December’s projections, suggesting two 25-basis-point rate cuts per year through mid-2027. Analysts anticipate rate reductions in June and December 2025, though Powell is likely to emphasize a measured approach toward the 2% inflation target.

US stock markets saw losses across major indices:

*S&P 500 fell 1.1% to 5,614.66.

*The Dow Jones Industrial Average declined 0.6% to 41,581.31.

*Nasdaq Composite slid 1.7% to 17,504.12.

Tech Stocks Under Pressure

Tesla dropped 5.3%, weighed down by slowing electric vehicle (EV) sales and rising competition. China’s BYD unveiled an ultra-fast charging system, intensifying pressure on Tesla’s market dominance.

Meanwhile, Alphabet (Google's parent company) lost 2.2% after announcing a $32 billion acquisition of cybersecurity firm Wiz, its largest-ever deal, aimed at strengthening cloud computing and AI capabilities.

The broader technology sector continued to struggle amid concerns over overvaluation and trade tensions.

*Nvidia dropped 3.3%, even as it hosted its "AI Woodstock" event.

*Super Micro Computer tumbled 9.6%.

*Palantir Technologies lost 4%.

Investors remain cautious about former President Donald Trump’s trade policies, which could impact US economic growth. Tariff uncertainty adds pressure on the Federal Reserve, as lower interest rates encourage borrowing but could also fuel inflation concerns.

Oil Prices Decline as Market Awaits Fed Decision

Oil prices slipped for a second straight session, pressured by rising US crude inventories and persistent concerns over global trade tensions.

*Brent crude dropped 0.7%, trading near $70 per barrel.

*West Texas Intermediate (WTI) crude hovered around $66 per barrel.

The American Petroleum Institute (API) reported a 4.6 million barrel build in US crude stockpiles last week, although inventories in Cushing, Oklahoma, declined. Official EIA data is due later Wednesday.

Market sentiment remains fragile as investors assess OPEC+ supply increases and weak demand in China, compounding concerns over a potential economic slowdown. Geopolitical tensions remain in focus, particularly in the Middle East and Russia-Ukraine conflict. The Biden administration is closely monitoring Iranian involvement in Houthi attacks, while Russian President Vladimir Putin rejected US calls for a ceasefire, instead limiting strikes on Ukraine’s energy infrastructure.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote