Date: 07th October 2024.

Oil bets most Bullish in 2 Years, Stocks pared some gains.

Trading Leveraged Products is risky

The September NFP report was a blowout by almost every measure. It quickly knocked out lingering fears of a recession this year or early next, but also knocked out expectations for another jumbo -50 bp rate cut this year. So, what’s the market signaling right now? ‘Goldilocks’ scenario?

Asia & European Sessions:

*Equity markets have moved broadly higher across Asia, and European markets are also finding buyers in early trade. Recent US data have boosted growth optimism, and Chinese officials seem more committed to growth boosting stimulus measures.

*Japanese stocks closed higher on Monday, with the Nikkei rising by 2.05%, driven by gains in the Mining, Chemical, Petroleum & Plastic, and Power sectors.

*European equities continue to benefit from a positive US jobs report. The DAX and FTSE 100 have already started to pare opening gains and the DAX is down -0.1%, while the FTSE 100 up a mere 0.04%.

*Data:German manufacturing orders plunged -3.8% m/m in August & U.K. house prices rose 0.3% m/m in September, according to the Halifax index. German data added to signs that the German economy will contract again this year.

*This Week: The inflation data are in view and will have a little more importance as the jobs report has extinguished fears of a recession and boosted the potential for a pick up in price pressures ahead. We expect gains of 0.1% and 0.2% for headline and core CPI for September (Thursday). Increases of 0.1% and 0.2% are projected for September PPI (Friday). Along with the data, there is a host of Fedspeakers through the week and the FOMC minutes (Wednesday). Supply is also on tap with the Treasury selling $119 bln in 3-, 10-, and 30-year maturities.

*Earnings season looms: JPMorgan Chase is scheduled to report on Friday, with PepsiCo in the spotlight tomorrow and Delta Air Lines on Thursday.

Financial Markets Performance:

*The USDIndex traded within Friday’s range so far today and is at 102.32.

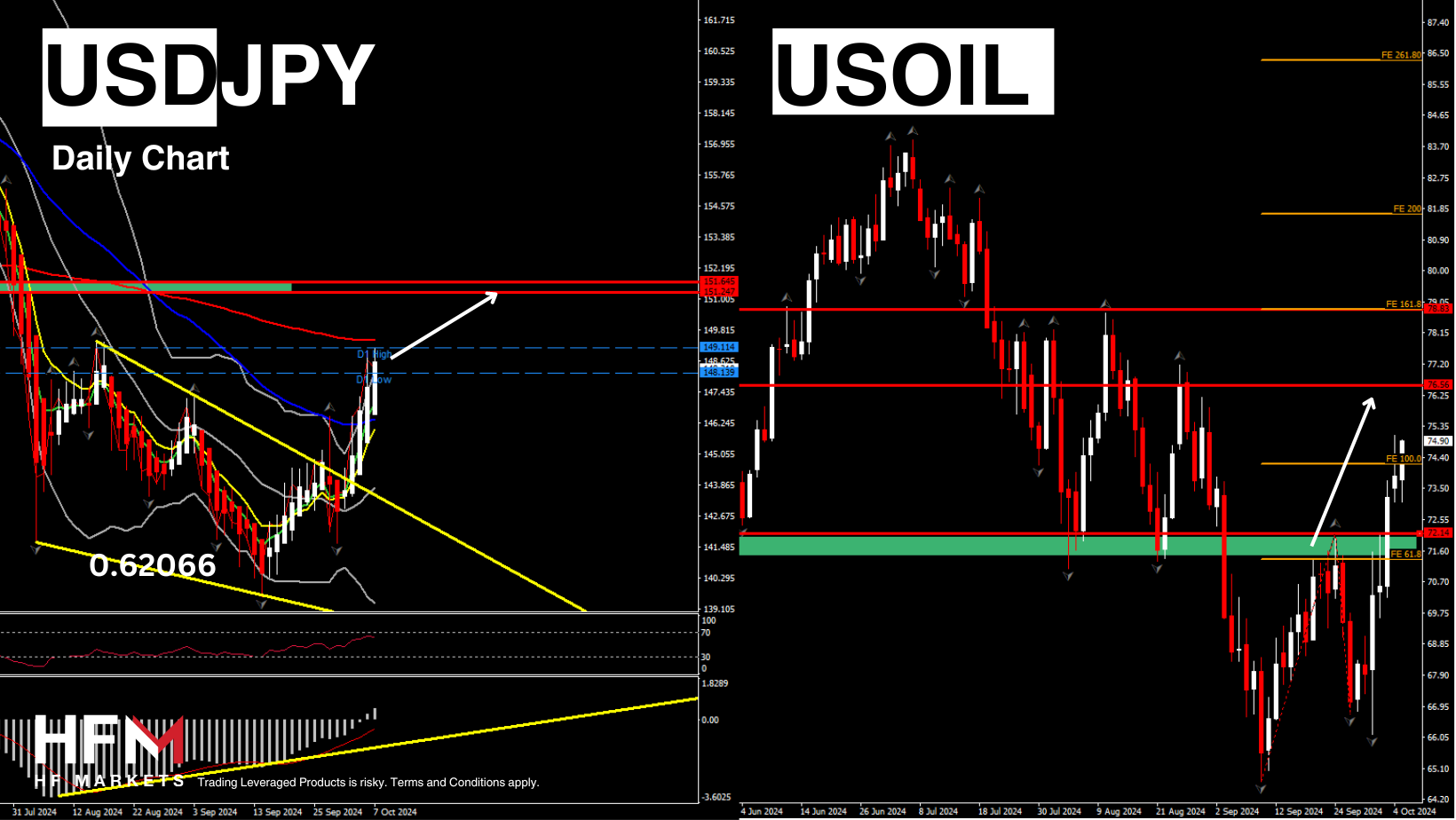

*The USDJPY surged to test 149.00 immediately after the data before drifting down to 148.80. Still, this is the strongest since July and early August were the pair hit a multidecade peak at 161.69 on July 3. Currebntly is at 148.13

*According to Bloomberg, Oil futures posted their largest gain in more than a year last week. USOILhas lifted to $74.63 per barrel as markets watch developments in the Middle East. Gold meanwhile is at USD 2649.19 per ounce.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

Thread:

Thread:

Reply With Quote

Reply With Quote