Date: 21st October 2024.

Gold at historic high, US equities nearly at record high!

Trading Leveraged Products is risky

Asia & European Sessions:

*Global financial markets are being influenced by the health of the US & Chinese economies, alongside the impact of Middle East conflicts and broader geopolitical concerns.Chinese banks’ decision to lower lending rates follows a series of government measures aimed at spurring economic growth and stabilizing the housing market.

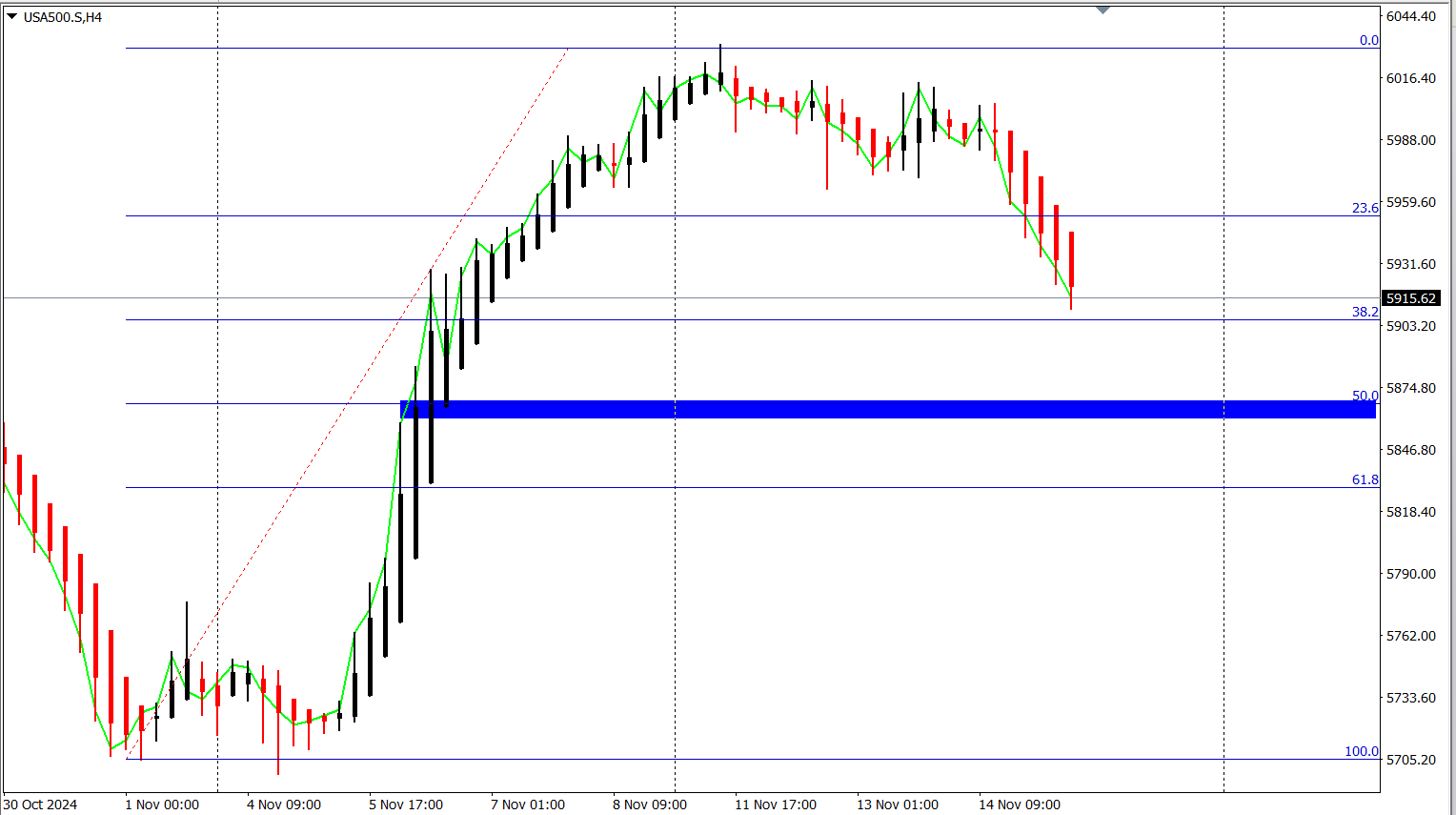

*Wall Street finished in the green on the day and for the week. Earnings beats added to signs of a strong economy and a pick up in big tech to boost the major averages.

*The Dow rallied another 0.09% to 43,275 for its 39th record high of the year. The S&P500 was 0.40% higher at 5864, its 47th peak for 2024.

*Asian markets showed mixed performance as investors awaited new catalysts for trading.

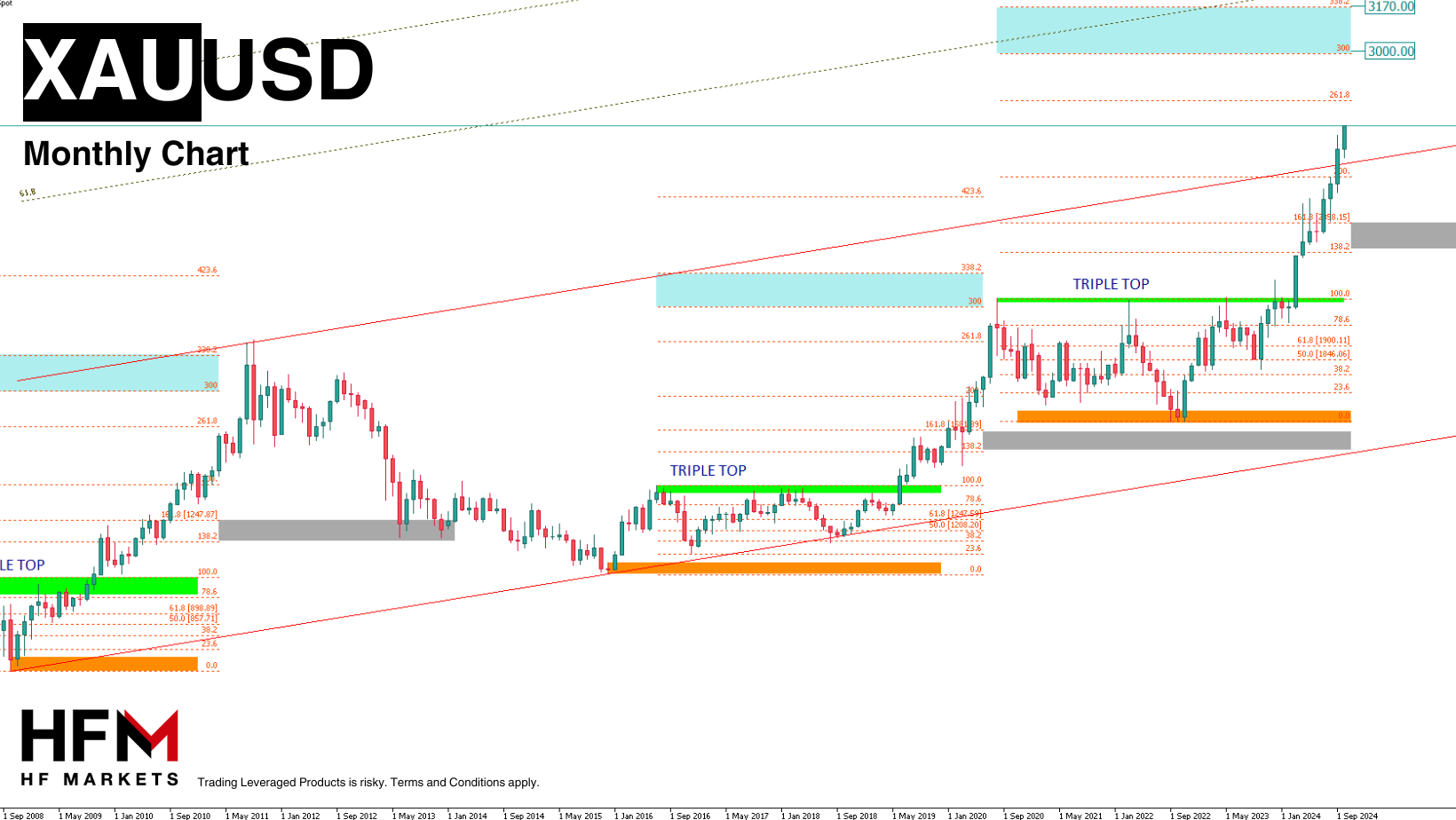

*Gold surged to a record high, $2732, with silver, palladium, and platinum also rising, driven by rising demand amid Middle East tensions and positioning ahead of the upcoming US presidential election.

*Oil prices ticked higher after sharp declines the previous week, as concerns eased over potential Israeli strikes on Iranian oil facilities in retaliation for a missile attack earlier in the month. Iran, a major crude producer, plays a key role in global exports, particularly to China. Lingering concerns over China’s demand have also weighed on oil prices.

*Big week ahead with: BoC rate decision, lots of ECB & Fed Speeches, global PMIs, US retail sales, earnings from Tesla, Verizon, Coca-Cola, IBM and Amazon.

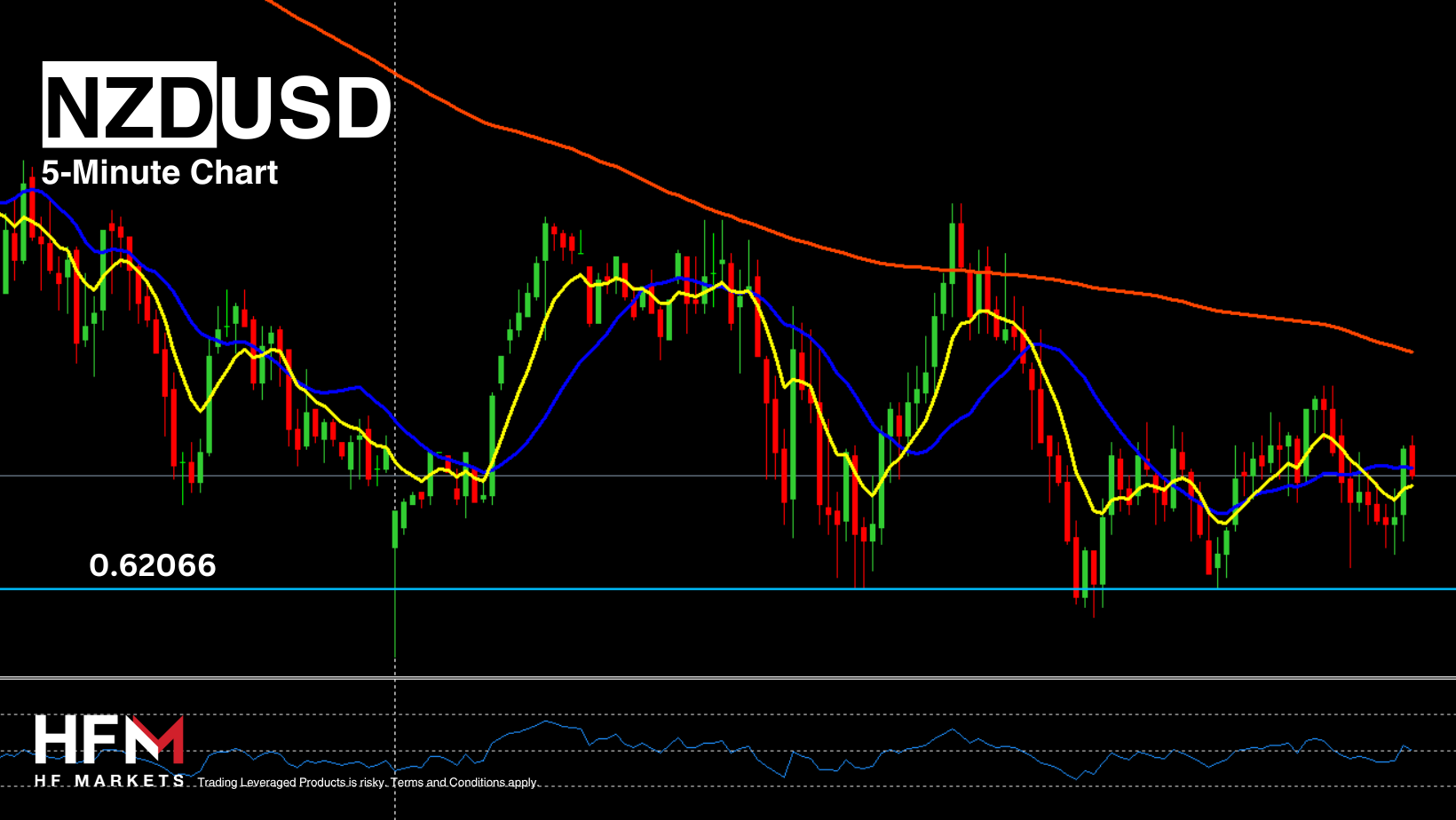

Financial Markets Performance:As the US election approaches, investors are positioning themselves for potential outcomes, with odds leaning toward a Trump victory and Republican control of Congress. Traders are reviving bets on assets that performed well after Trump’s 2016 win, particularly focusing on the impact of potential policies like increased trade tariffs.

*The USDIndex pulled back to 103.40.

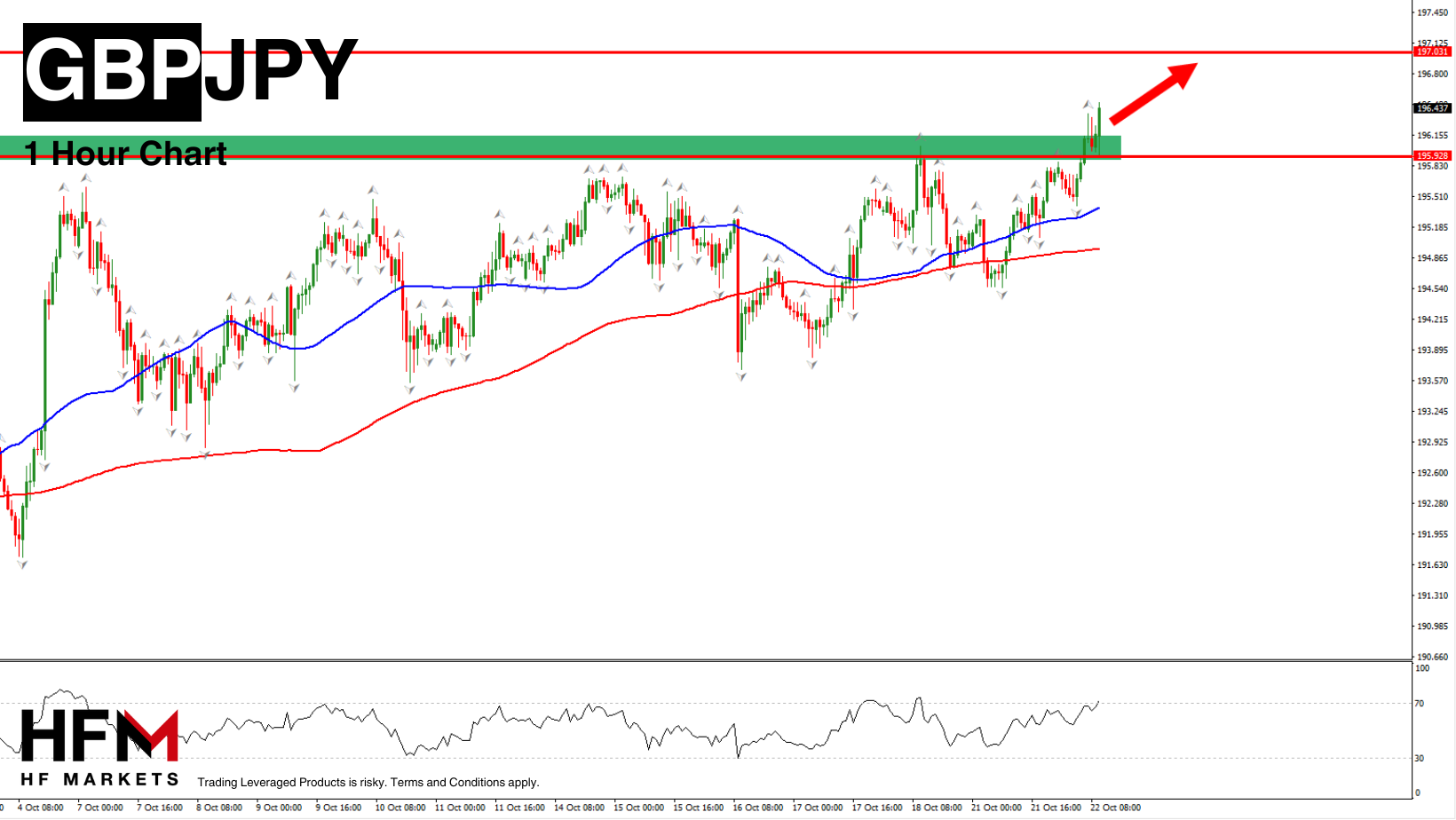

*The USDJPY fell to 149.07, as the Yen strengthened for a 2nd day against the US Dollar, as traders positioned for Japan’s parliamentary election on Sunday. Polls suggest that the ruling Liberal Democratic Party and Komeito coalition could fall below the 233-seat majority threshold.

*Oil prices closed in the red, testing $68.69 per barrel before closing -1.8% lower at $69.37 per barrel and the weakest of the month, largely on supply concerns.

*Bitcoin neared $70,000 today, supported by strong inflows into ETFs ($2.4 bln) and optimism regarding US regulatory developments for the largest digital asset.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote