Date: 9th September 2024.

Market Update – How Aggressively Might the Fed Cut Interest Rates?

The August jobs data did not provide the clarity on the rate outlook that had been hoped and left the markets to their own devices. Concurrently, comments from Fed Governor Waller left the door open for an aggressive -50 bps cut after he said he favored front-loading policy action, but stressed only if appropriate.

Asia & European Sessions:

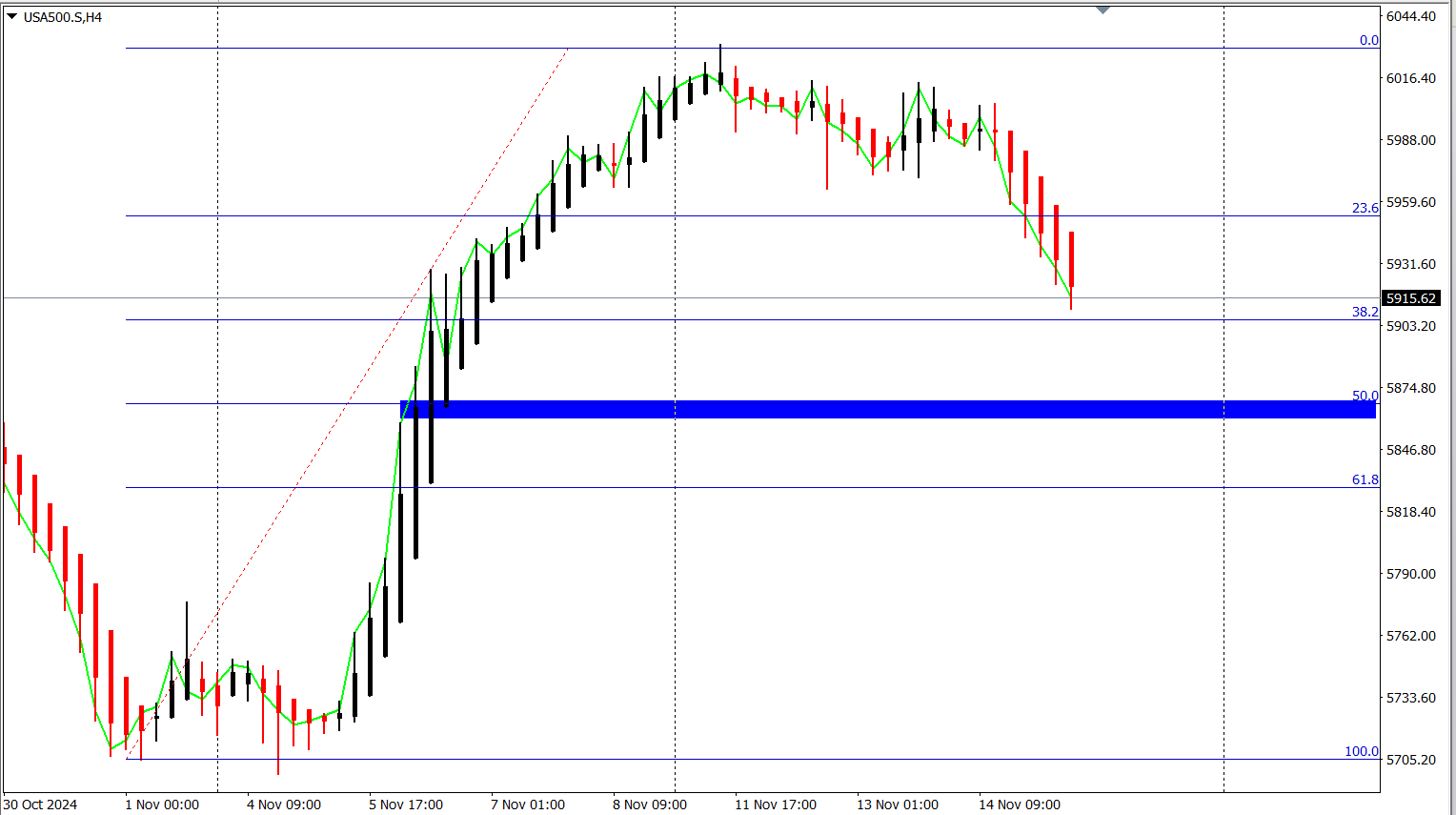

*European & US equity markets open in the green, following a recent selloff due to weaker-than-expected US jobs data. Wall Street plunged on Friday, as the NASDAQ collapsed -2.55%, with the S&P 500 and Dow down -1.73% and 1.01%, respectively.

*Asian markets followed the global downturn, with stocks in Taiwan, Australia, and Japan experiencing declines. Nikkei dropped for a 5th consecutive day.

*Asia’s benchmark index fell to a 3-week low. Chinese stocks are on the brink of falling to the 5-year low seen in February due to weak earnings and economic recovery. The CSI 300 Index has fallen over 13% since its peak in May, reflecting ineffective policy efforts to revive the economy. Market pessimism in China is fueled by deflationary pressures, weak consumer demand, and a prolonged property slump.

*Economic experts suggest that unless there is a significant policy shift, bearish sentiment may persist.

*Japan: Q2 GDP was revised down to a 0.7% pace, bouncing from the -0.6% contraction in Q1. It ties Q2 2023 for the fastest pace of growth since the 1.3% rate in Q1 2023. The deflator was revised up to a 3.2% y/y rate from 3.0% y/y.

*BOJ: The data leave the door open for another BOJ hike down the road, though we suspect policymakers will be sidelined at the upcoming meeting on September 20 to further assess conditions.

*China CPI edged up to a 0.6% y/y rate in August. It is a seventh month in positive territory after four straight months of deflation (from October through January). Nevertheless, price weakness continues to reflect the slack in demand and the very sluggish growth pace in the economy. And even more serious, PPI plunged to -1.8% y/y in August from -0.8% y/y, the biggest drop since April. And producer prices have been in deflation since September 2022.

While a September Fed rate cut is expected, uncertainty remains about the scale and frequency of future cuts.

Financial Markets Performance:

*The USDindex slumped to 100.58 before bouncing to a 101.187 close.

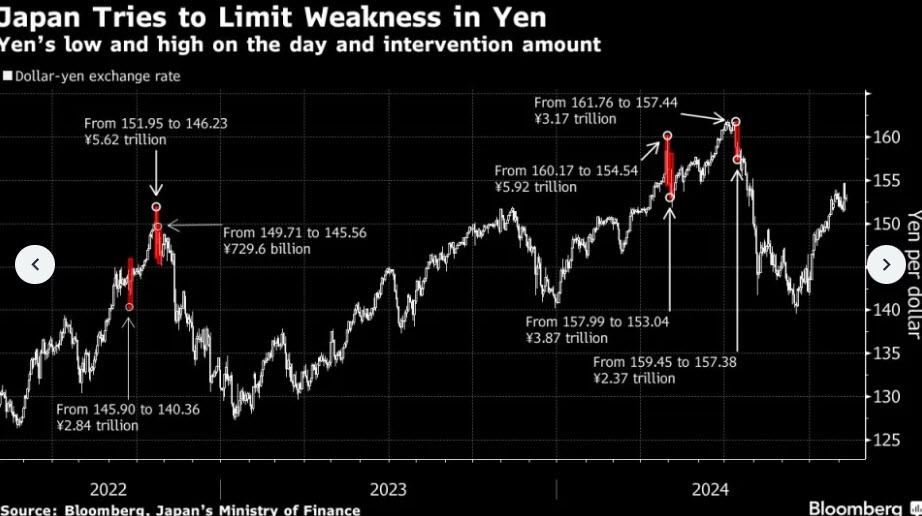

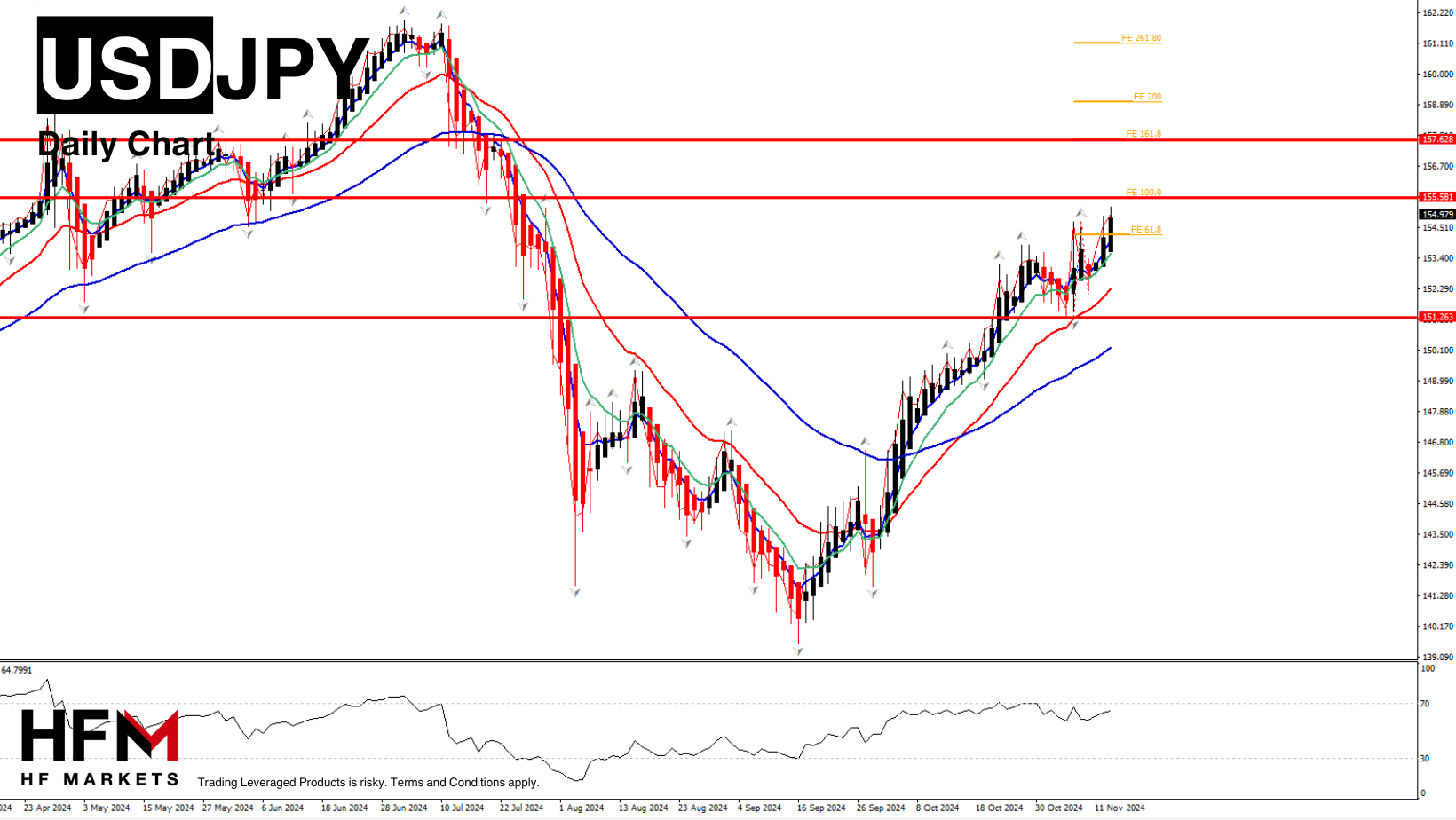

*The USDJPY lifted to 143.21. The Yen corrected, which helped to limit the slide in the Nikkei.

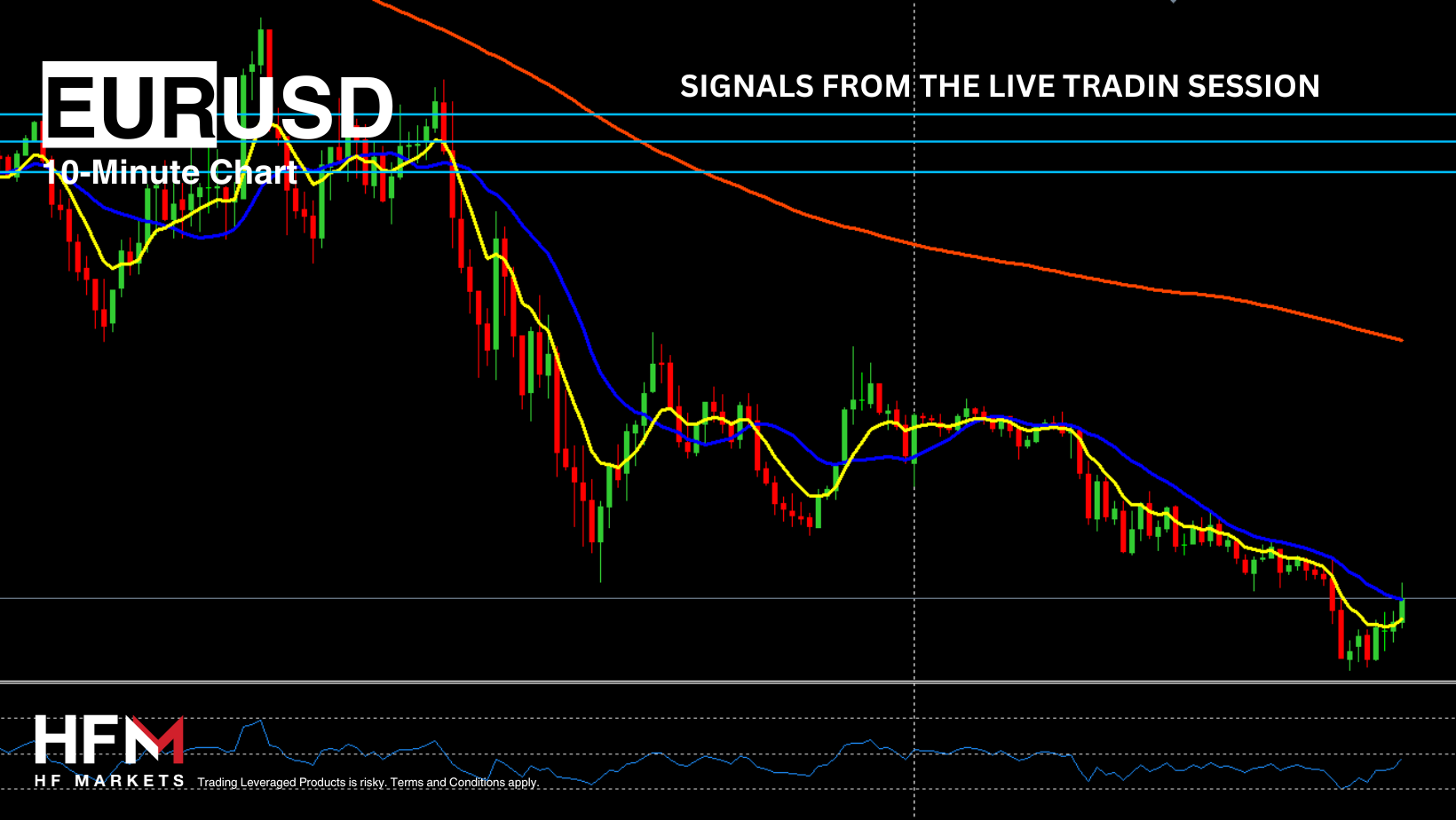

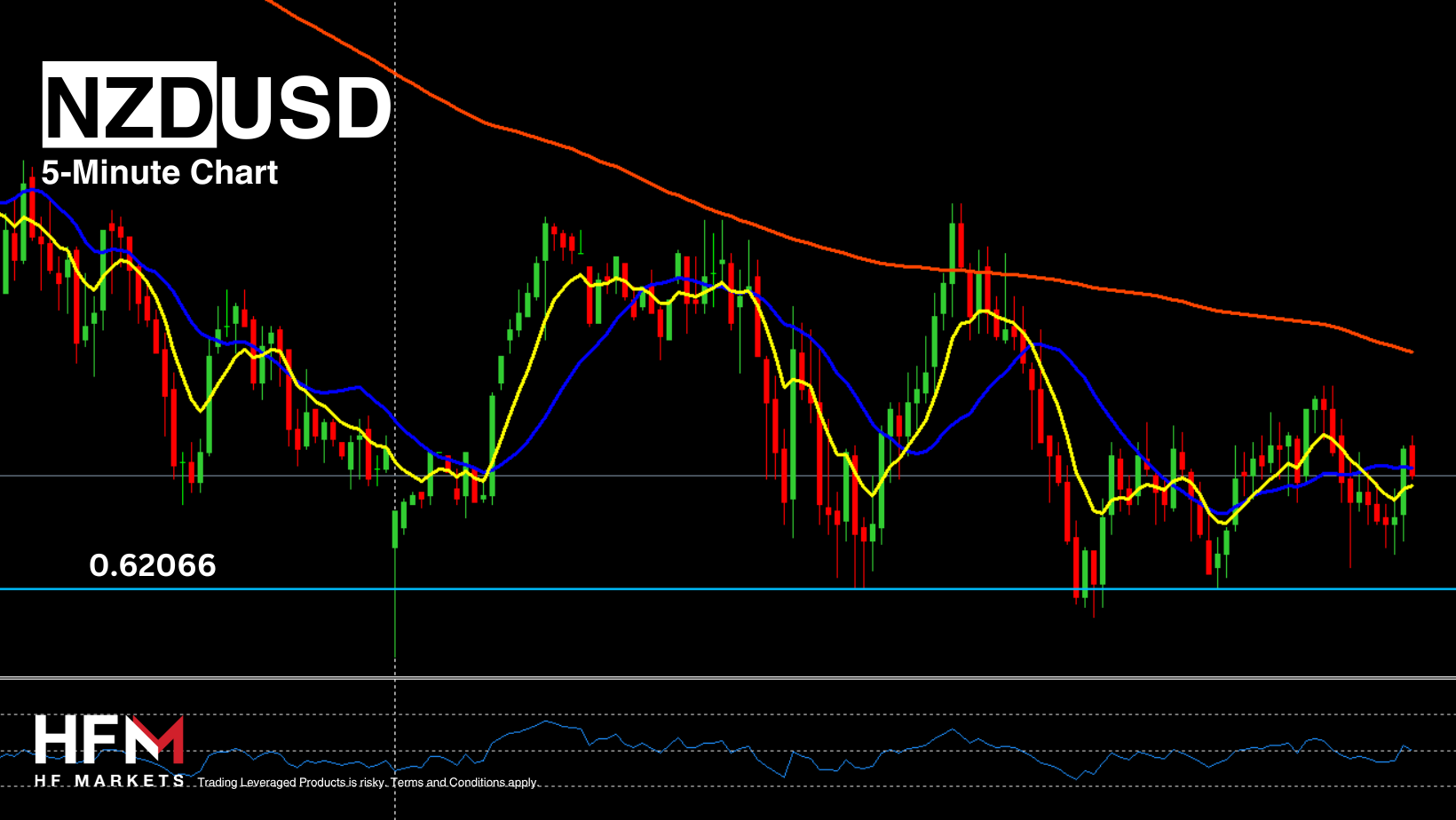

*The EURUSD and Cable are lower, at currently 1.1059 and 1.31 respectively.

*Oil drifted to $66.67 before recovering slightly to $68.20. Oil marked its lowest close since 2021 after a deep weekly loss pushed futures near levels regarded as oversold, with the focus on weather risks (Storm in Mexico) and reports this week that may clarify the demand outlook.

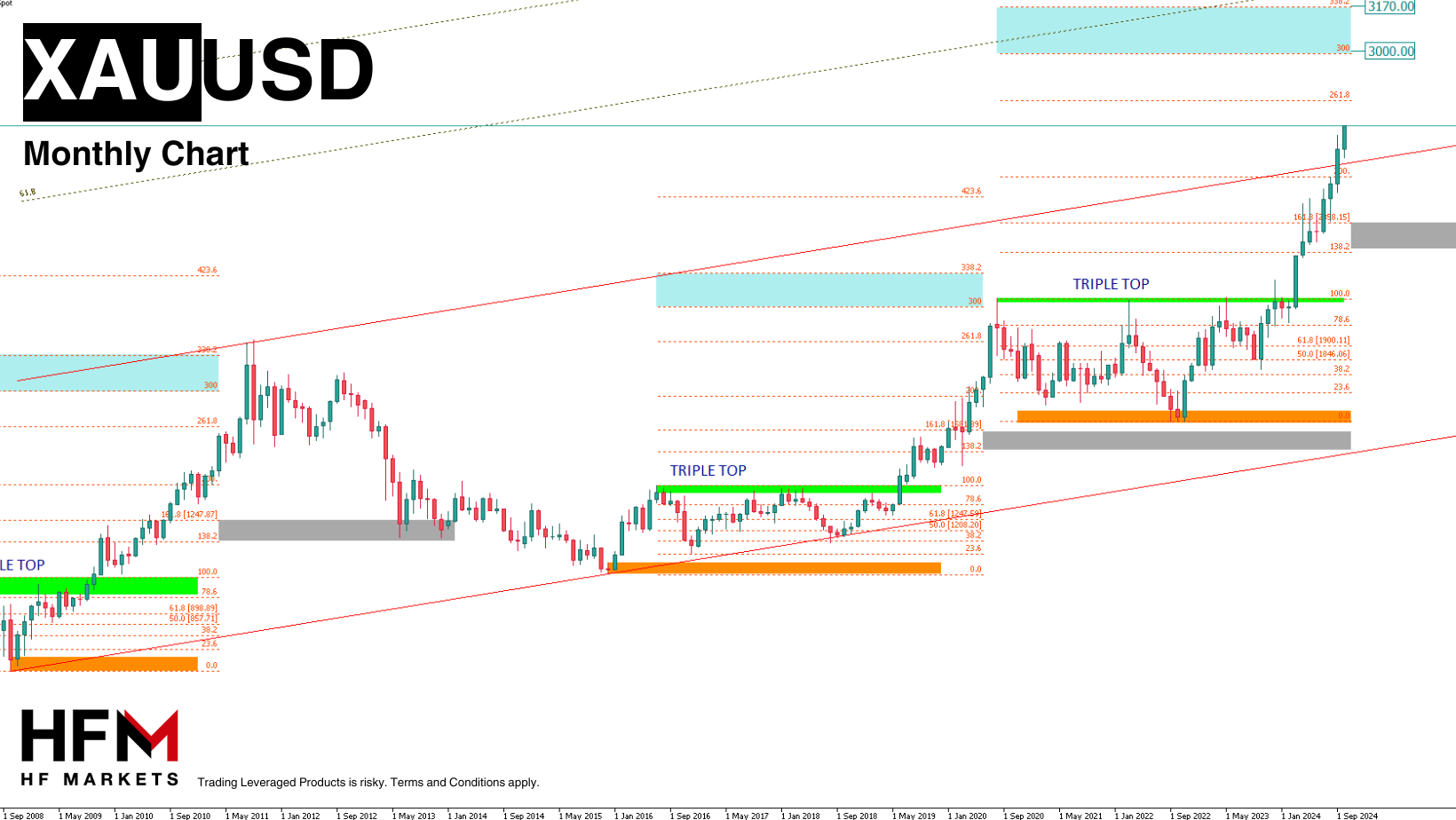

*Gold tumbling between $2485-2500.

*Iron ore prices fell below $90 per ton for the first time since 2022.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote