Date: 17th October 2024.

Stocks steady ahead of ECB, BTC Up, Oil below $70.

Trading Leveraged Products is risky

Asia & European Sessions:

*Wall Street, Treasuries, the US Dollar, and Gold all gained yesterday amid a variety of factors. Earnings beats, rate cut expectations, growth concerns, geopolitical risks, some stability in oil all contributed. The market continues to price for -25 bp rate cuts in November and December.

*The Dow bounced 0.79% to 43,077 to its 38th record high of the year. Financials helped pace after more earnings beats, this time from JPM. Weakness in some tech shares, including ASML, limited the advance in the S&P500 and NASDAQ.

*Asian shares predominantly rose today following stronger-than-expected earnings reports from major companies like Morgan Stanley and United Airlines. Chinese markets lost momentum after a press briefing on the property market failed to announce significant stimulus measures.

*European stocks are expected to have a lackluster opening as traders await a decision from the ECB regarding monetary policy.

*The rally in Chinese shares lost momentum after a press briefing on the property market failed to announce significant stimulus measures. The CSI 300 in China reversed a rally of up to 1.3% after officials revealed plans to expand support for “white list” projects to 4 trillion yuan ($562 billion) from the previously deployed 2.23 trillion yuan.

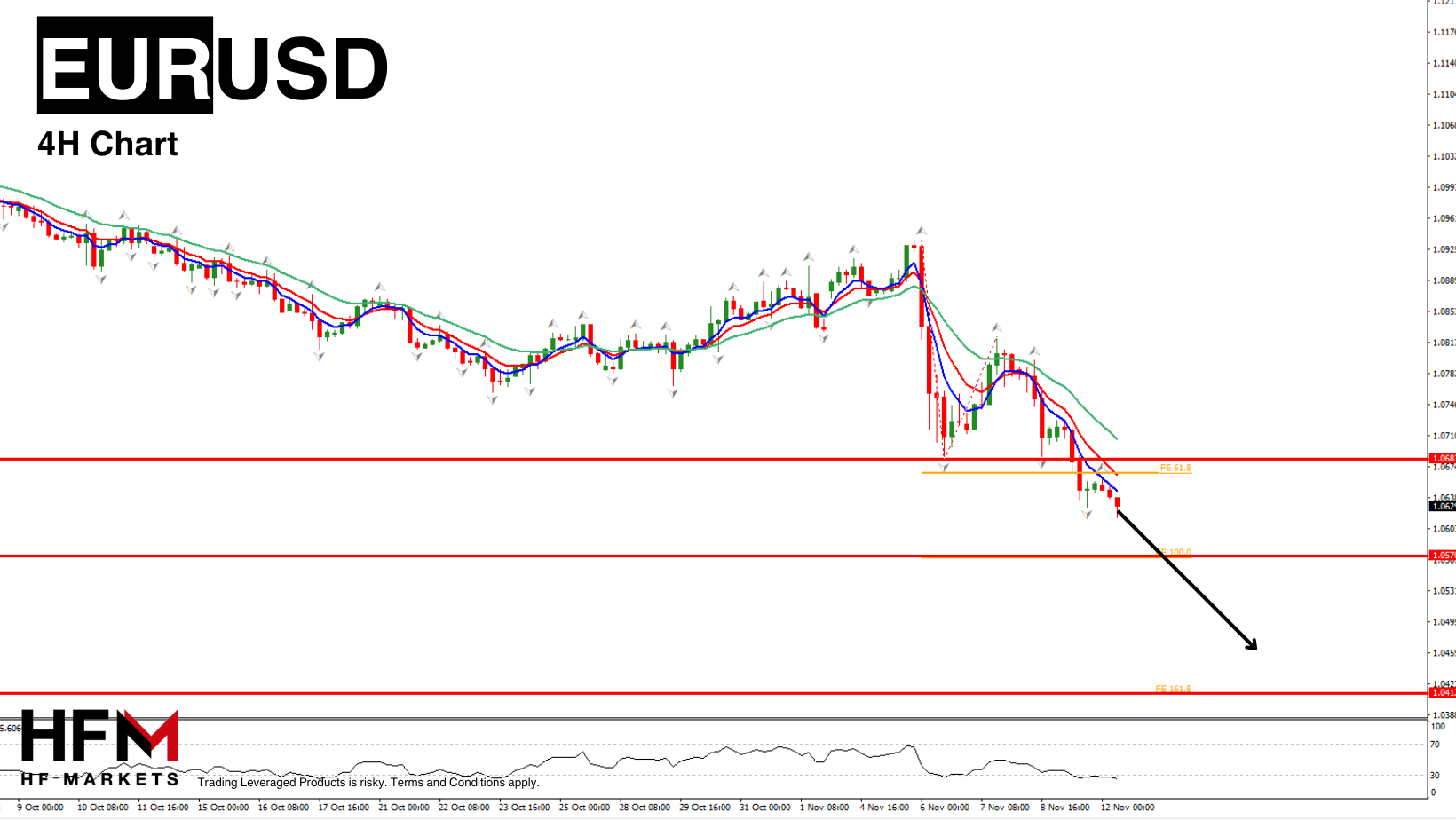

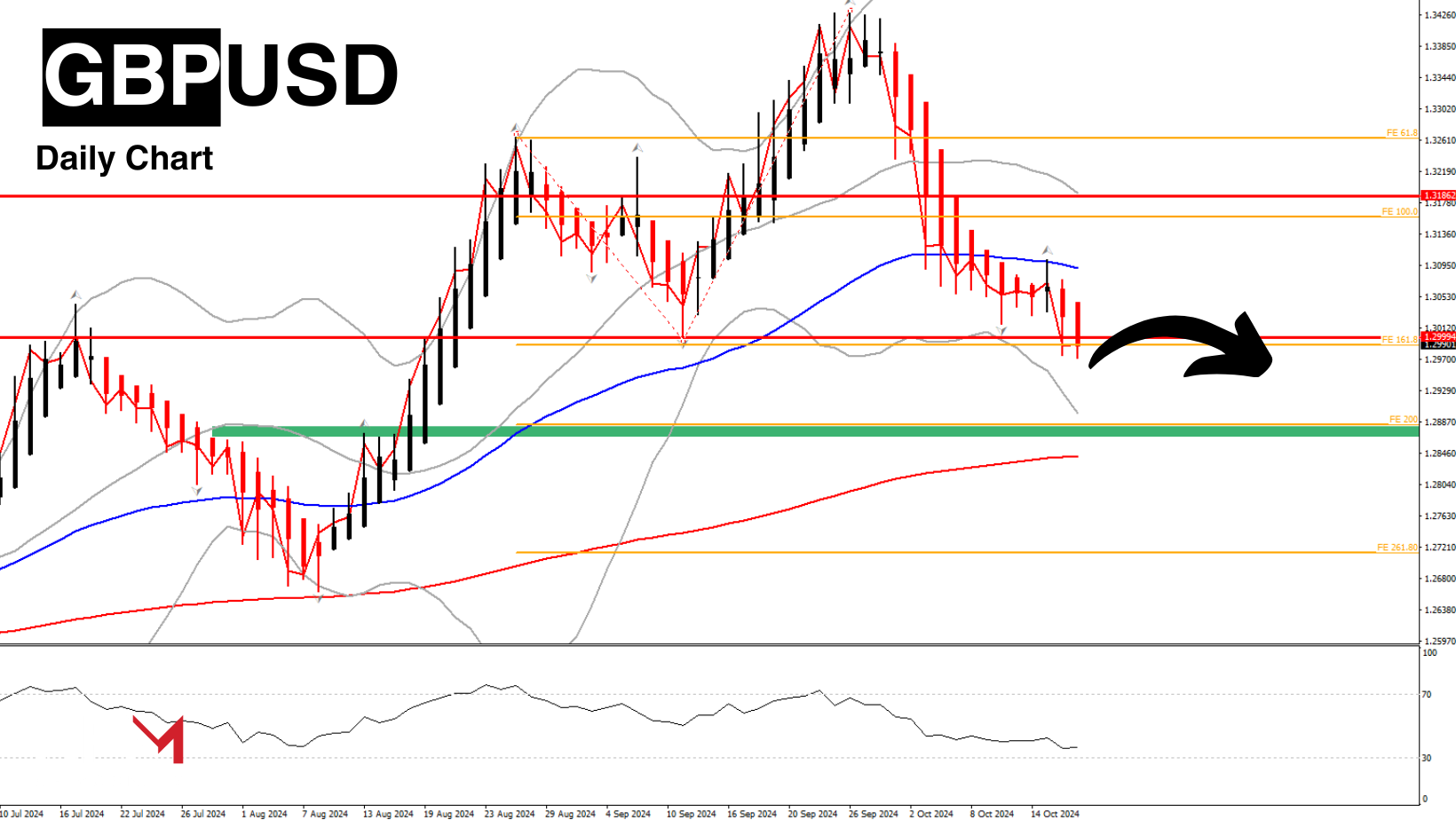

*ECB Preview: with headline inflation below target and signs that services price inflation has peaked, the ECB’s focus has switched from inflation risks to growth concerns. The flurry of comments from ECB officials over the past week have pretty much confirmed that Lagarde will deliver another 25 bp cut on Thursday. We expect the ECB to cut again in December, although the central bank head may once again stop short of committing to another move just yet. Even if the ECB cuts rates by a further 50 bp this year, policy settings will remain restrictive and the “end-rate” of the current easing cycle is likely to be higher than markets expected initially and clearly above the low point of the last easing cycle. That will likely keep bonds volatile.

Financial Markets Performance:

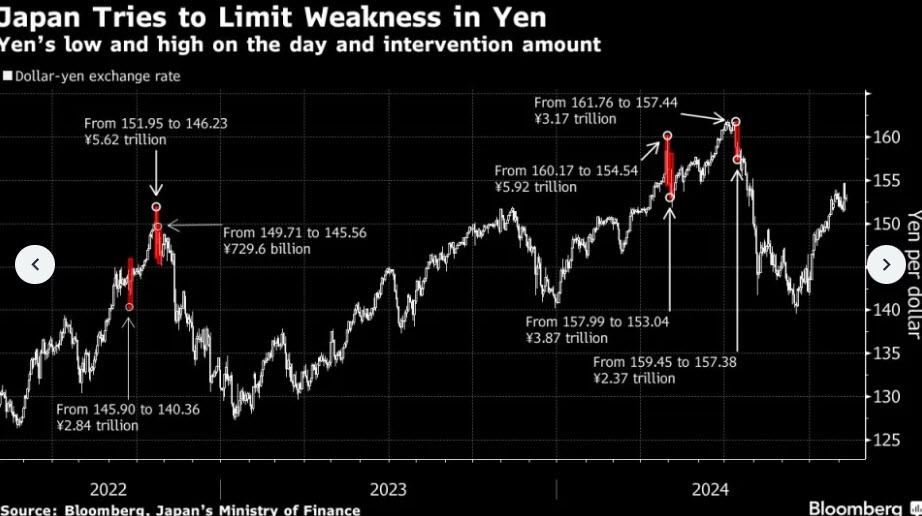

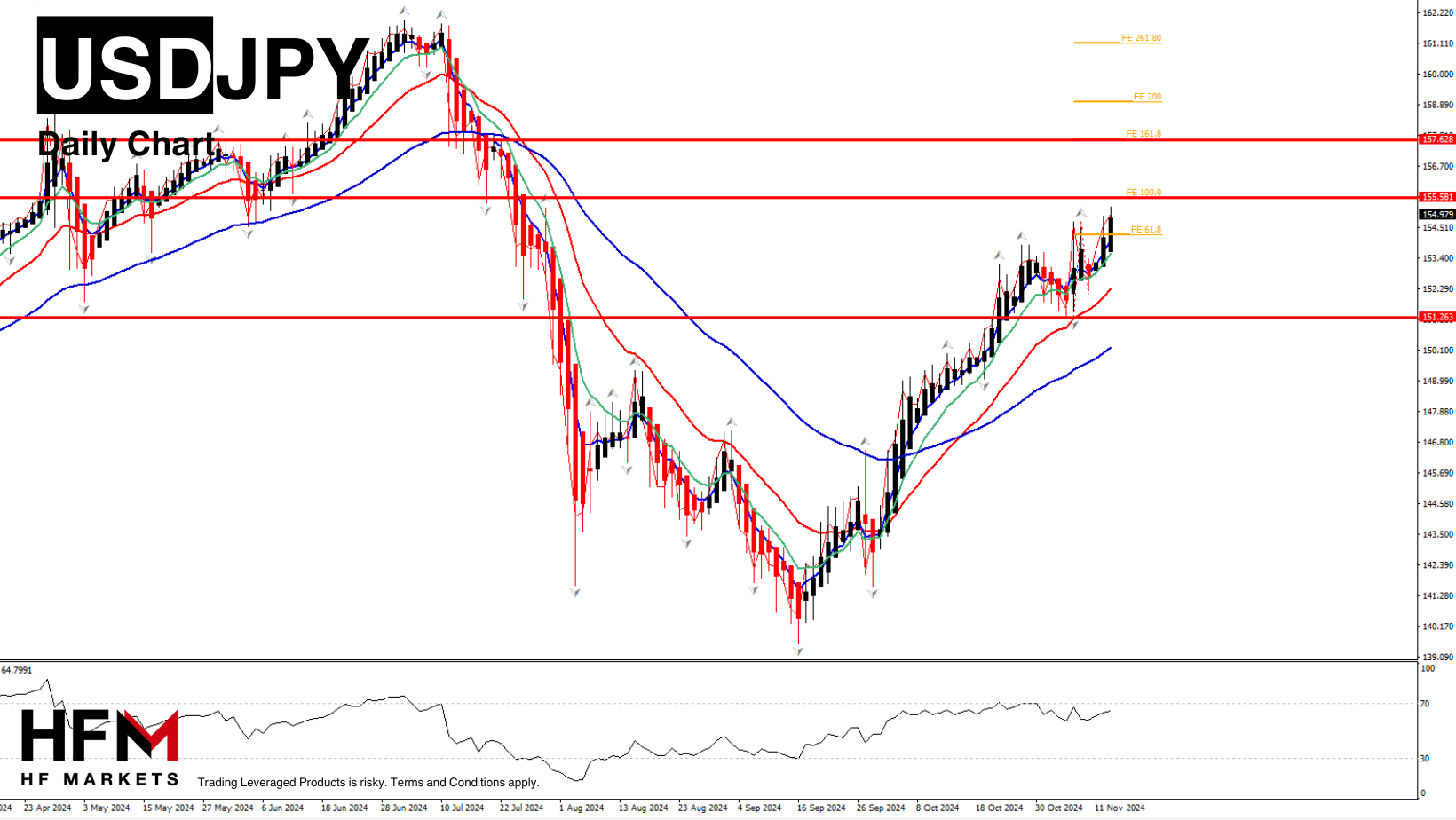

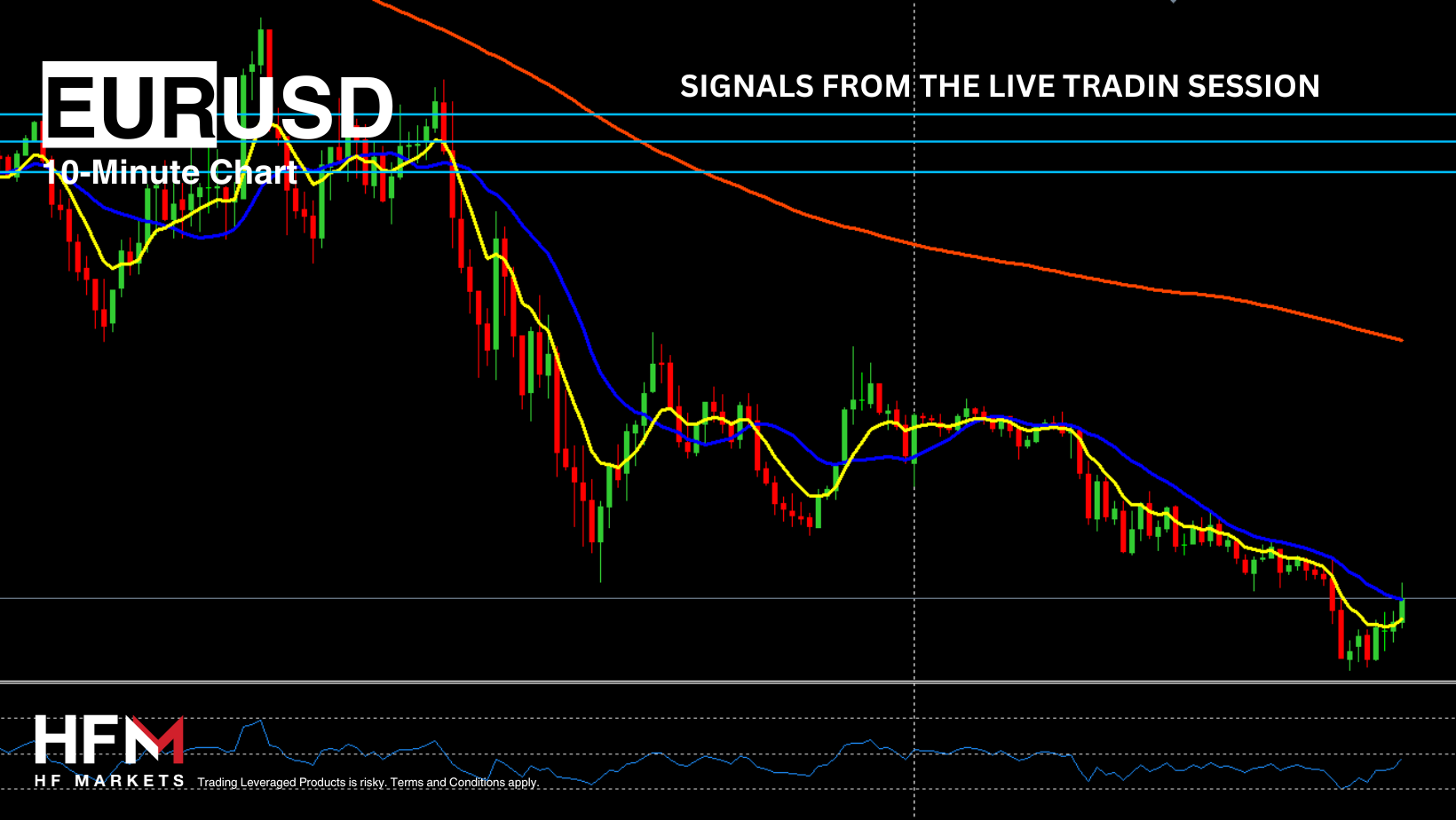

*The USDIndex climbed to 103.55, a third straight session over 103 and is up 3 handles from the 100.79 close on September 30. The rally broken the 200-day SMA.

*Oil dipped below the $70.00 per barrel. Energy prices have generally been influenced by oil market fluctuations, particularly as fears diminish over potential Israeli attacks on Iranian oil facilities, which could disrupt exports to China and other regions. Additionally, concerns about demand strength amid China’s economic slowdown have impacted oil prices.

*Bitcoin rallied with markets viewing the climb as a sign that markets anticipate a victory for pro-crypto Republican candidate Donald Trump in the US presidential election.

*Gold rose to $2685 per ounce.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote