Date: 24th September 2024.

Market Update – Risk-on Mood due to stimulus measures; Commodities climb.

Asia & European Sessions:

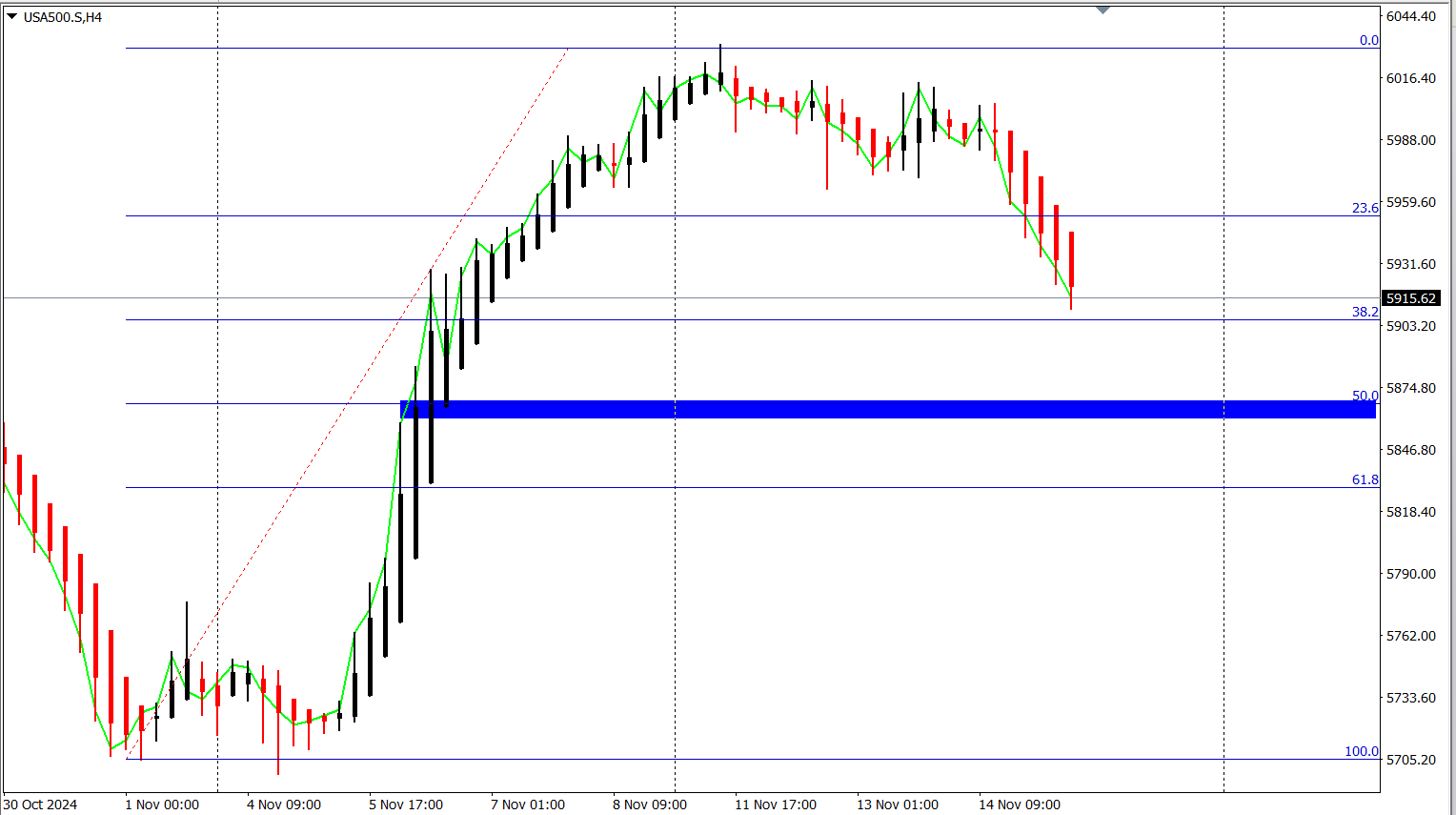

*More new highs were set on Wall Street today as the Fed’s jumbo rate cut continues to reverberate. Fedspeakers indicated more cuts are in the future.

*European stocks are poised for a positive open, following a rally in Asian markets driven by China’s latest economic stimulus efforts aimed at stabilizing its stock market.

*China’s plan to inject 800 billion yuan ($114 billion) in liquidity support for its stock market alongside measures allowing brokerages to access central bank funds to buy equities, boosted investors’ confidence. These moves are part of a broader stimulus package that includes cuts to short-term interest rates and reduced borrowing costs on up to $5.3 trillion in mortgages.

*While the market responded positively to these policies, analysts warn that the rally could be short-lived, as underlying issues like deflation remain unresolved.

*The RBA held its cash rate at 4.35% for the 7th consecutive meeting, while leaving future policy options open.

*Euro Stoxx 50 futures rose 0.5%, as the MSCI Asia Pacific Index marked its fourth consecutive daily gain. Hong Kong stocks surged over 4%.

*US Stock market remains positive, with the S&P rallying another 0.28% to 5719 while the Dow was up 0.15% to 42,125. This is the 40th new record this year on the former and the 30th for the latter. The NASDAQ rose 0.14% to 17,974.

Financial Markets Performance:

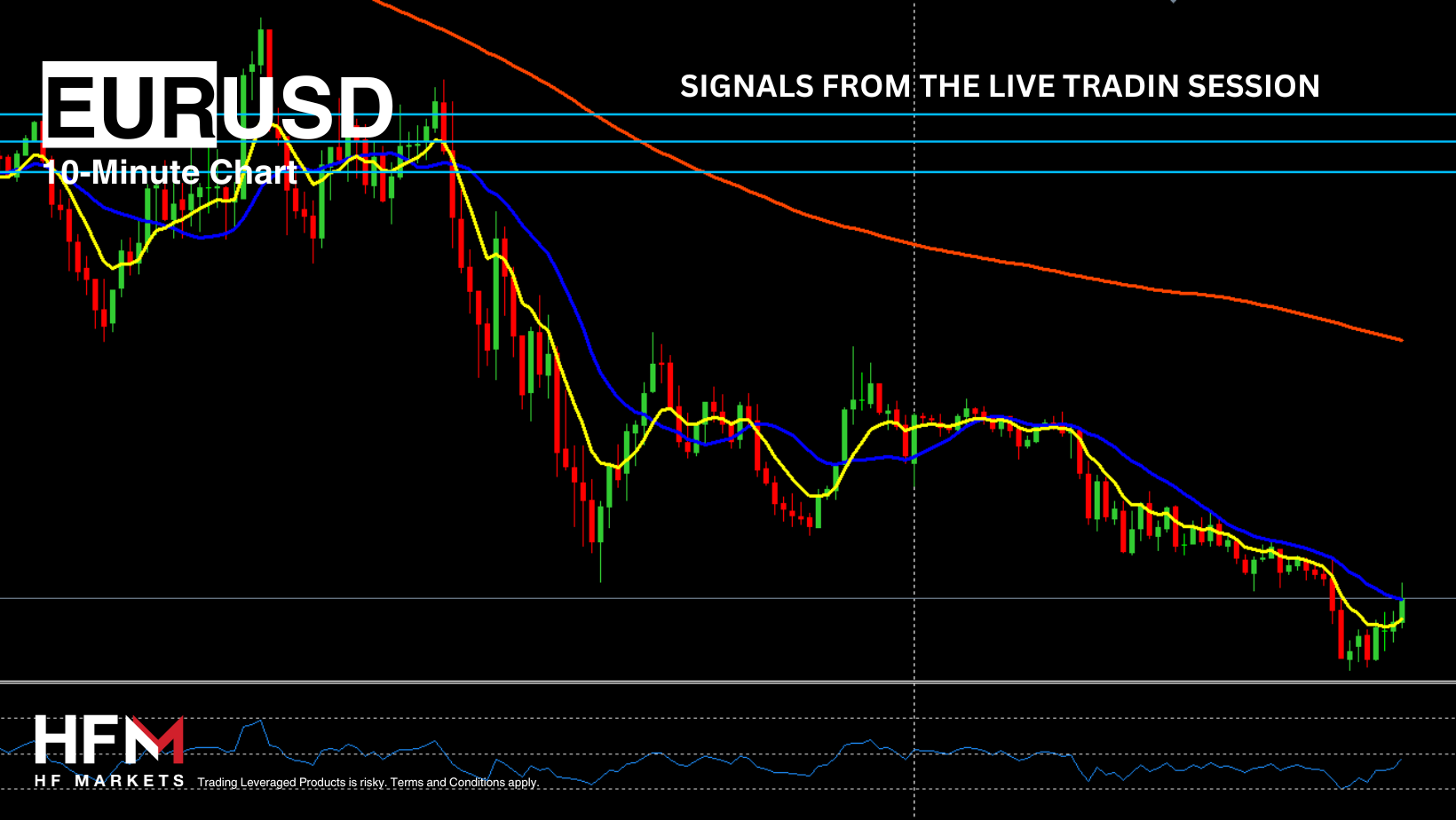

*The USDIndex was up slightly to 100.898, but failed to hold the test of 101.229.

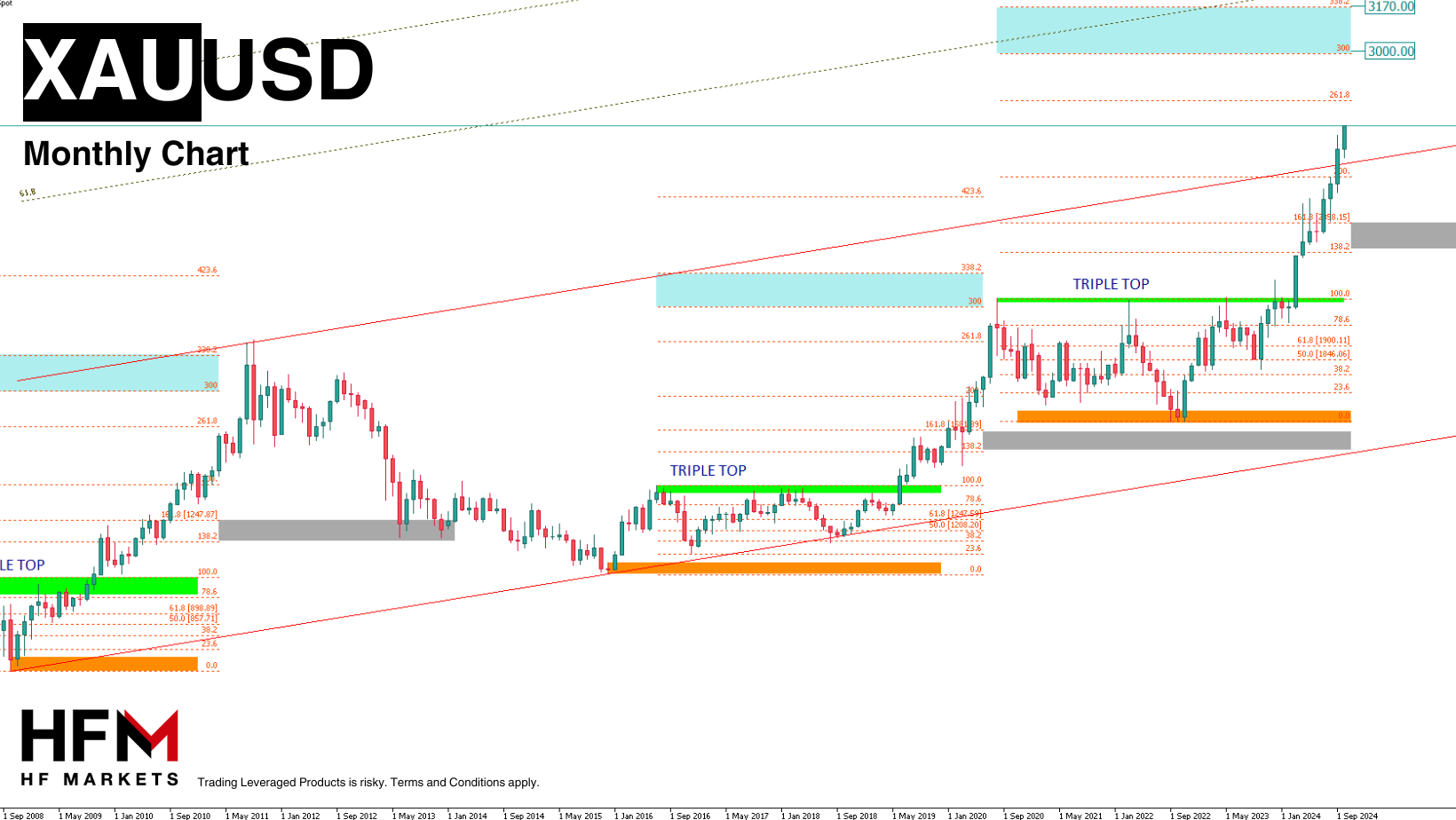

*Gold managed another fresh peak too, rising 0.18% to $2640 per ounce, supported by rising geopolitical risks, central bank buying, and expectations for further declines in interest rates.

USOil pr*ices recovered yesterday’s losses amid rising tensions in the Middle East after Israeli airstrikes in Lebanon.

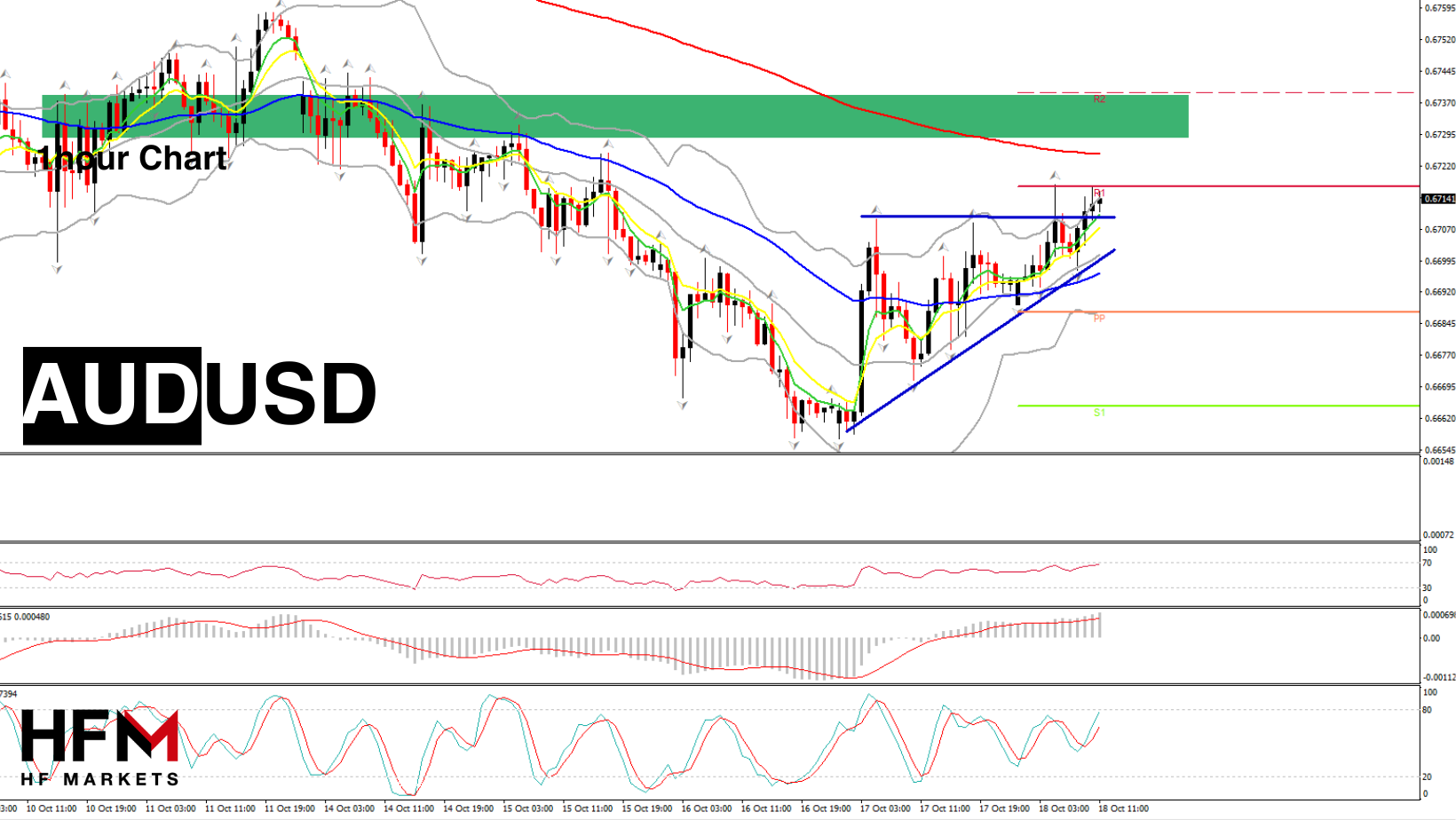

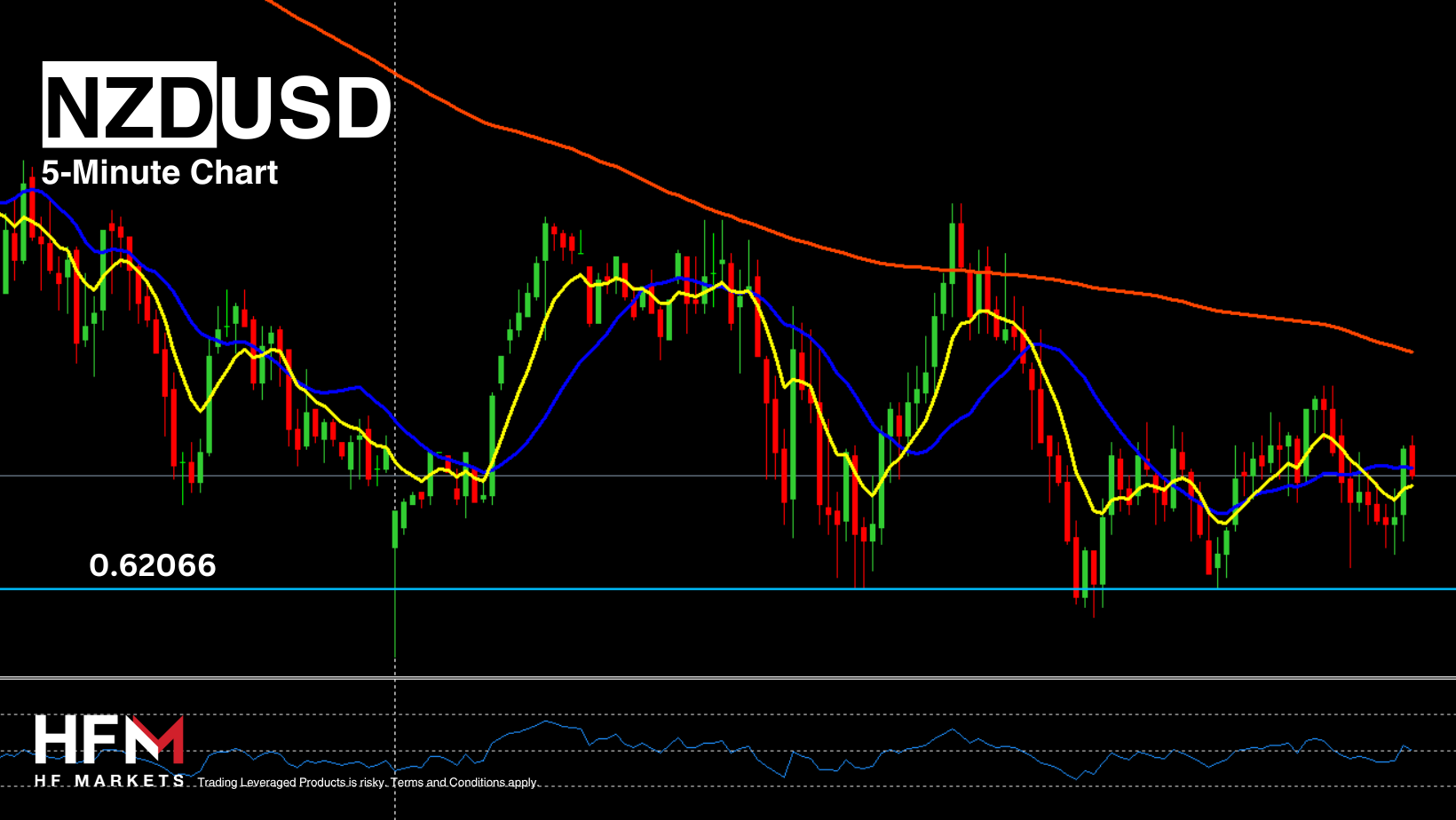

*Μost Asian currencies strengthened against the US Dollar, with the Aussie rising against US dollar, i.e. AUDUSD falling to 0.6820, and the yield on 3-year bonds fluctuated.

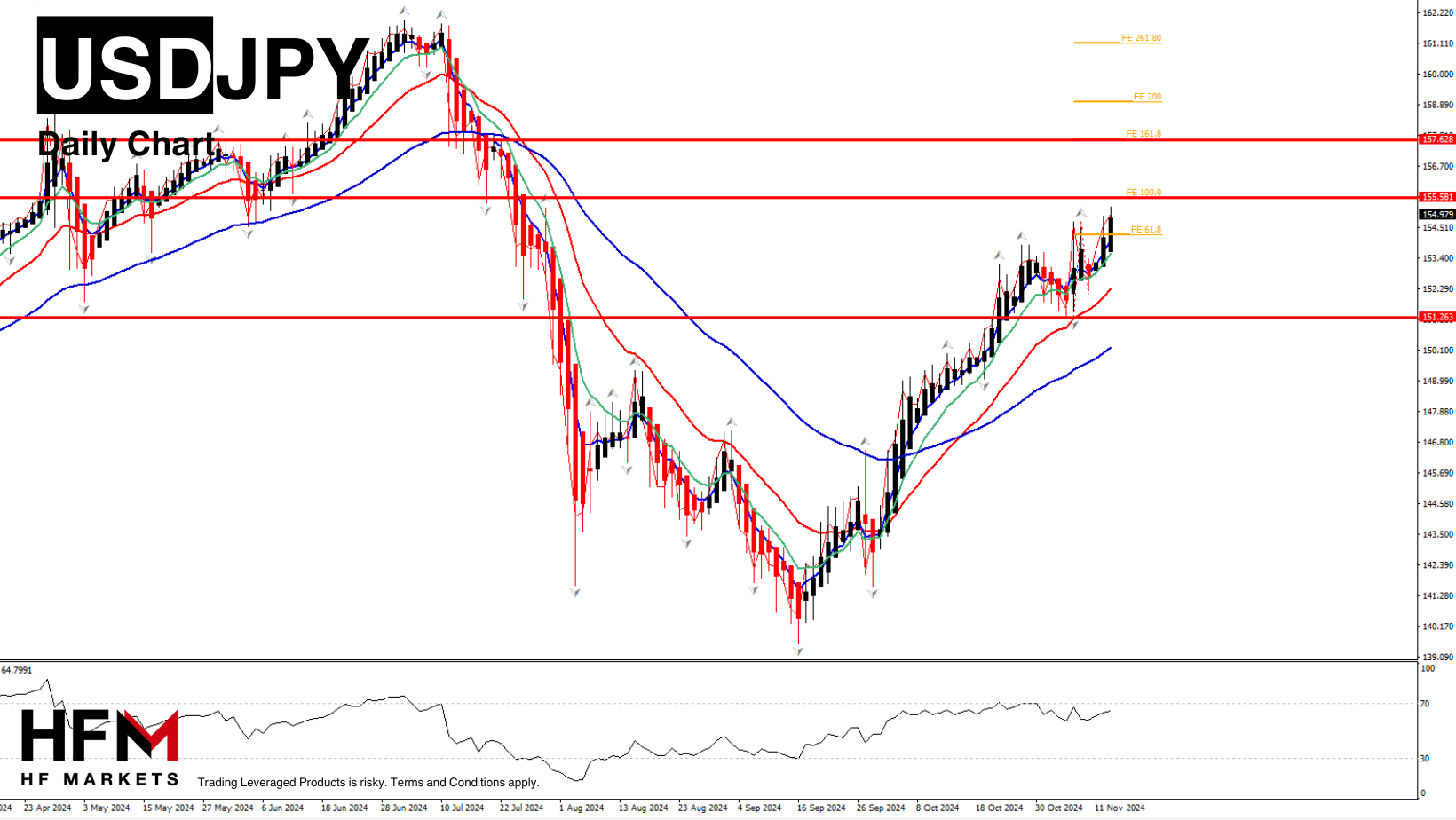

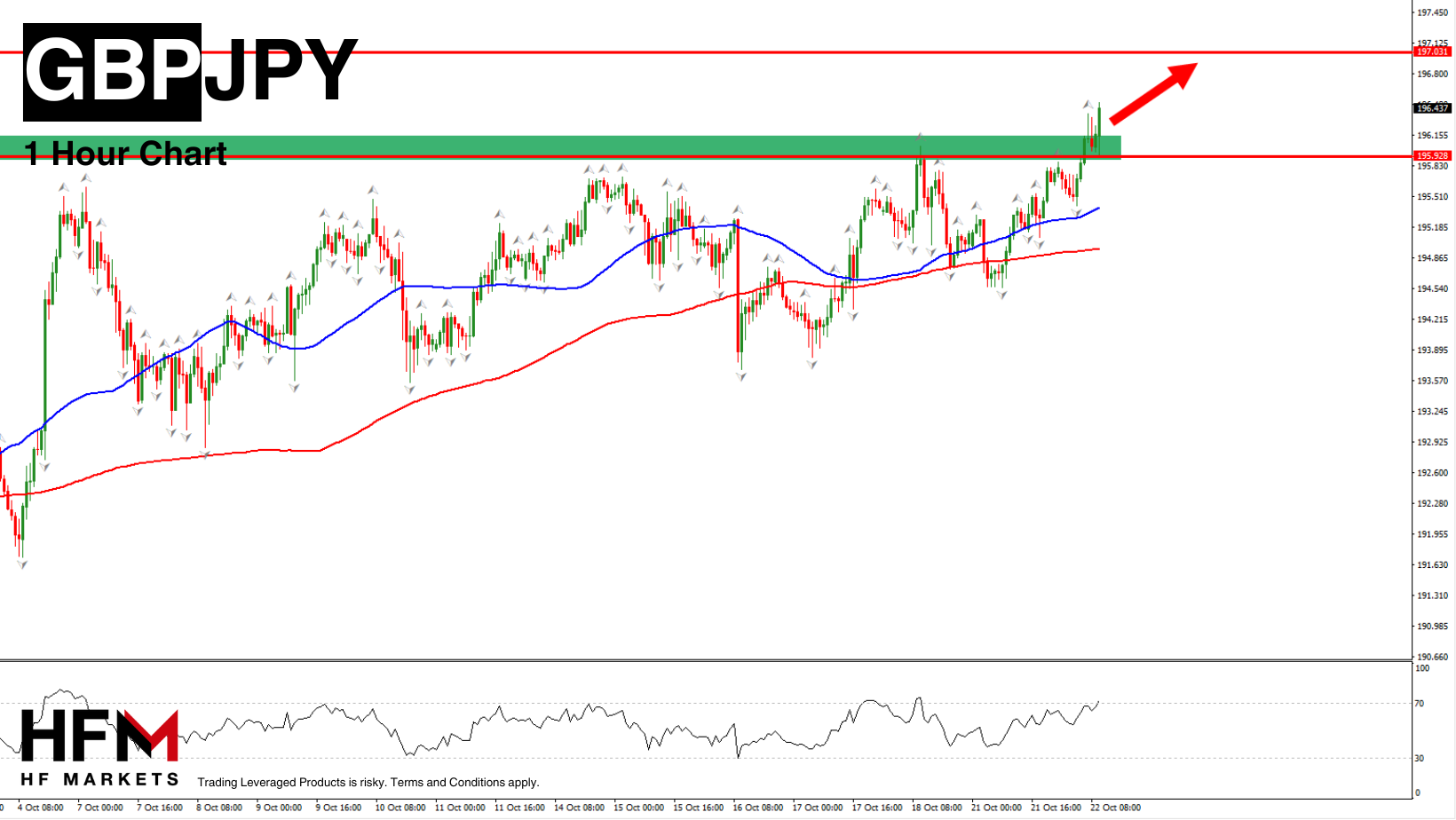

*USDJPY retests 144.70 (top of falling triangle).

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote