Date: 20th September 2024.

Bigger Interest Rate Cuts Spark Surge In Demand For The NASDAQ!

*Stocks rally after the Federal Reserve chooses to “go-large” with a 0.50% interest rate cut.

*The NASDAQ rises more than 2.50% and the Dow Jones 1.26%. The Dow Jones trades at an all-time high.

*UK Retail Sales rose significantly above expectations. The Great British Pound Index rises 0.35% and is the best performing index after the Japanese Yen.

*Gold attempts to break an all-time high as analysts expect the Federal Reserve to cut a further 0.50% by the end of the year.

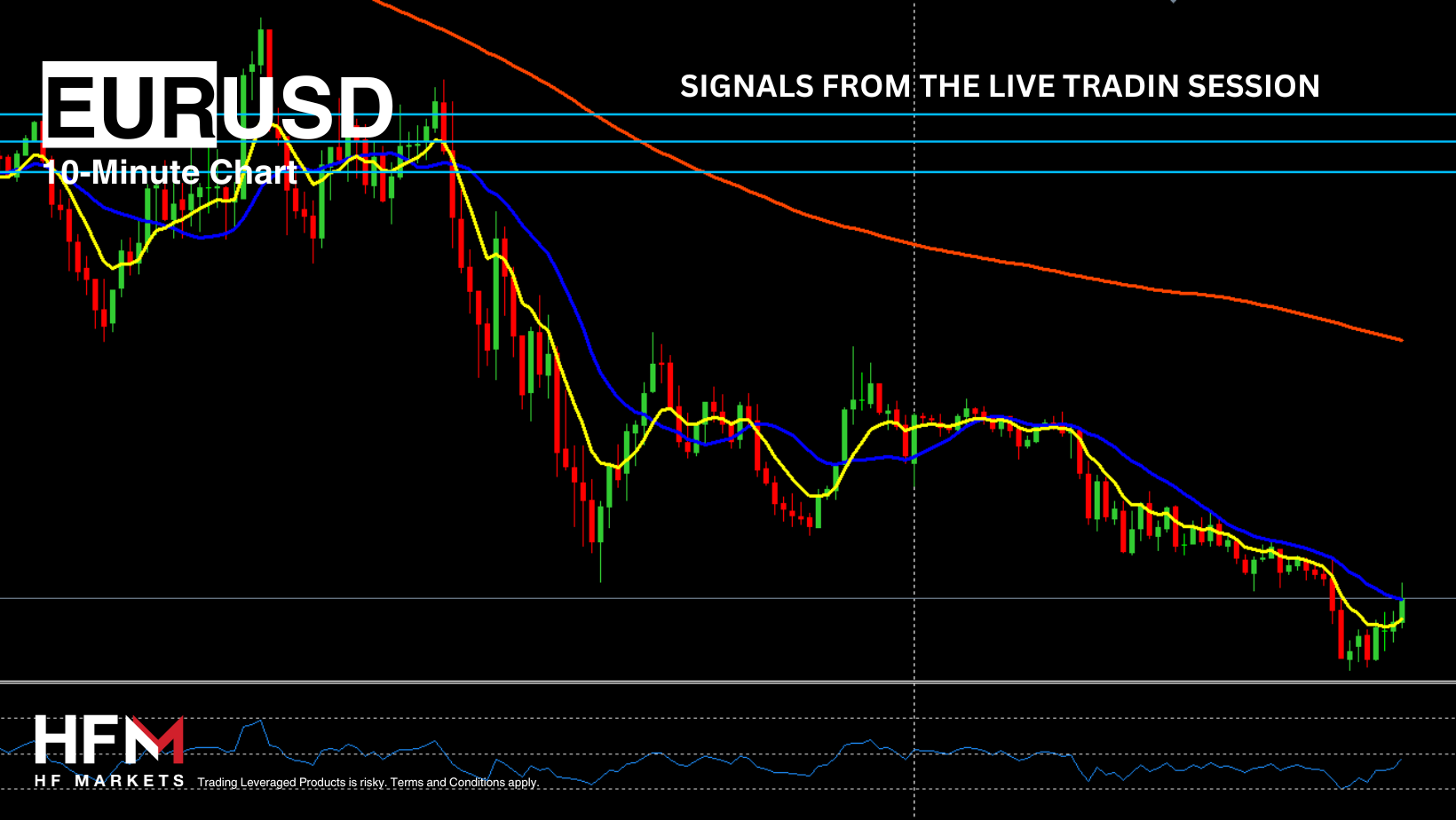

NASDAQ – Larger Interest Rate Cuts Prompt Higher Demand

The NASDAQ saw a clear bullish trend with the index rising for 5 consecutive hours as the US Session opened. The higher demand is a clear result of the Federal Reserve’s decision to cut interest rates 0.50% and not 0.25%.

The US Federal Reserve announced a 50 basis point reduction in the interest rate, lowering it from 5.25–5.50% to 4.75–5.00%. In his remarks, Fed Chairman, Jerome Powell, highlighted that the target inflation rate of 2% had been achieved but suggested further decreases could follow. The updated economic forecast projects consumer price growth at 2.3% by the end of the year, down from the previous estimate of 2.6%. Furthermore, economic growth is now forecasted at 2%, compared to the 2.1% predicted in July.

In terms of technical analysis, the medium-term picture remains neutral. This is due to the RSI trading at the neutral level, and the price trading above the trend-line and the 100-Period SMA, but retracing downwards. Therefore, the overall scenario remains neutral. However, if the price rises above $2,576.00, buy signals are likely to strengthen.

GBPJPY – UK Inflation Holds at 2.2%, Yen Struggles to Gain Momentum Outside Asia!

The price of the GBPJPY trades considerably lower on Wednesday due to the higher value of the Japanese Yen. So far the Japanese Yen is the day’s best performing index and was trading 0.32% higher against the currency market. However, technical analysts have noted that the Yen’s performance becomes poorer within the European session. As the European session edges closer the Japanese Yen Index has fallen 0.06%. The price movement of the Japanese Yen will largely depend on the Fed’s rate decision due to recent correlations.

As a result, the Fed expects the key rate to drop to 4.50% this year and reach 3.40% by the end of 2025. Therefore, investors are changing their view as to the “intrinsic value” of the NASDAQ and the stock market in general. The NASDAQ on Thursday was the best performing index largely due to its exposure to growth stocks. Of the NASDAQ’s individual stocks, 85% rose in value on Thursday and none of the top ten influential stocks depreciated.

When monitoring other areas of the market, such as bond yields, indications still remain that buyers will control the NASDAQ. The US 10-Year Treasury Yields has fallen 0.024% during this morning’s asian session. Lower bond yields are known to be positive for the NASDAQ, and investors will continue monitoring the decline in yields throughout the day. The VIX index this morning is trading 0.15% higher; ideally buyers and shareholders would wish for the VIX to decline into a minus figure. Yesterday’s stronger employment data also continues to support the NASDAQ and stocks in general.

Technical analysis continues to indicate bullish price movement due to the upward momentum and volatility. However, as the NASDAQ is currently retracing, upward momentum will need to be regained in order for a buy signal to materialize. When attaching the Fibonnaci retracement levels onto the retracement, a potential buy signal can be seen at $19,920. However, investors are also concerned the price is trading at the resistance level from August 22nd.

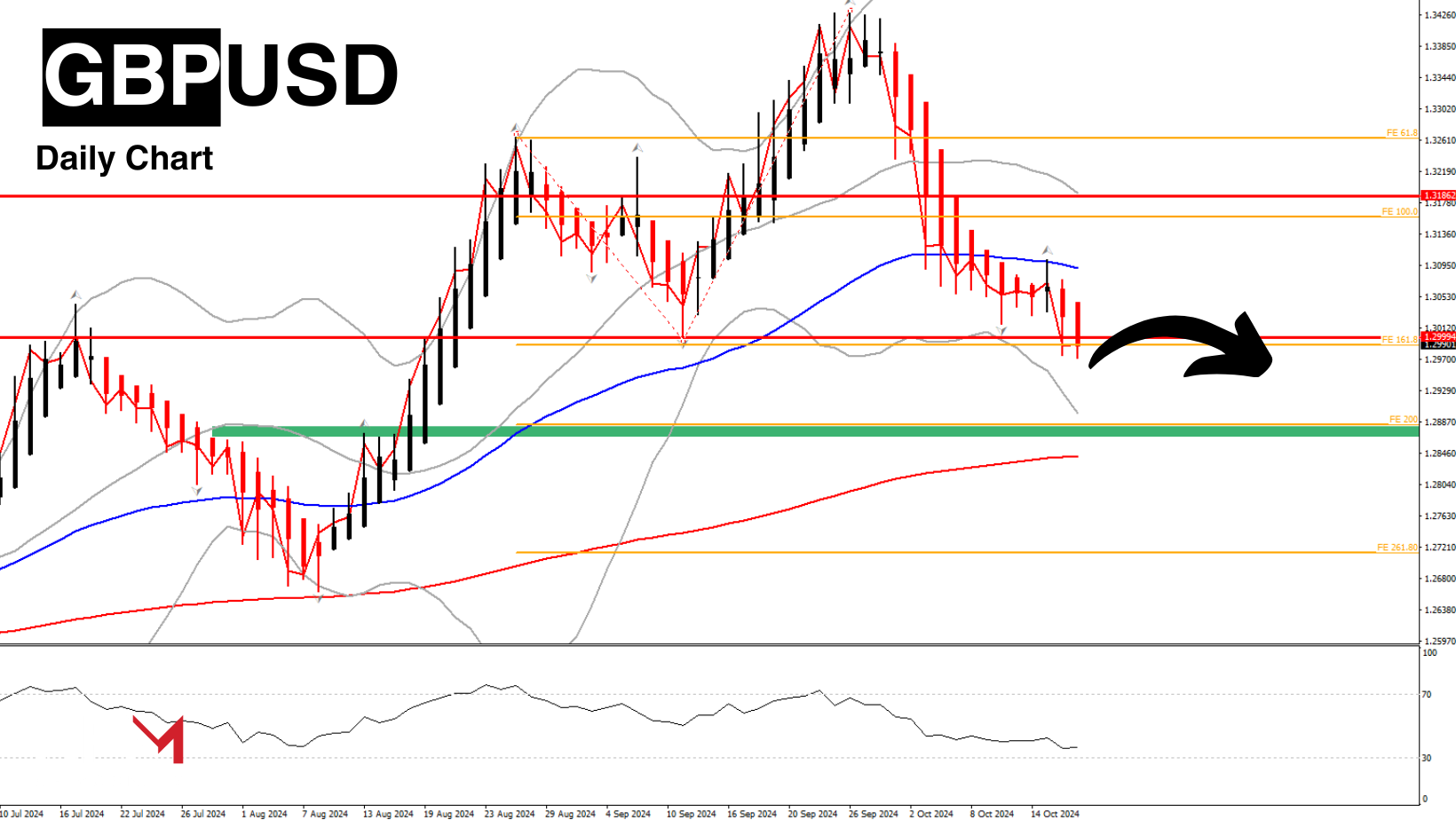

GBPUSD – UK Retail Sales Significantly Higher Than Expectations!

The GBPUSD rose to its highest level since February 2022 after rising 0.38% during this morning’s Asian Session. The bullish price movement is related to both the US Dollar’s decline but also the bullish price movement the Pound has seen against the whole currency market. Currently, the GBP is the best performing currency of 2024 so far but also of the day. So far in 2024, the British Pound has risen 4.42%.

The Pound’s upward momentum is largely due to the Bank of England’s decision to keep its interest rate at 5.00%, whereas other global regulators had opted to cut interest rates. In addition to this, the UK’s Retail Sales figure for August read 1.0%, significantly higher than the previous expectations of 0.2%.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote