Date: 8th November 2024.

Can Trump Bring Oil Prices Down To $40? NASDAQ Renews Its Highs!

Trading Leveraged Products is risky

*The NASDAQ, Dow Jones and SNP500 continue to renew their all time highs for a second consecutive day.

*NVIDIA tops the NASDAQ as the most influential stock, surpassing Apple and Microsoft.

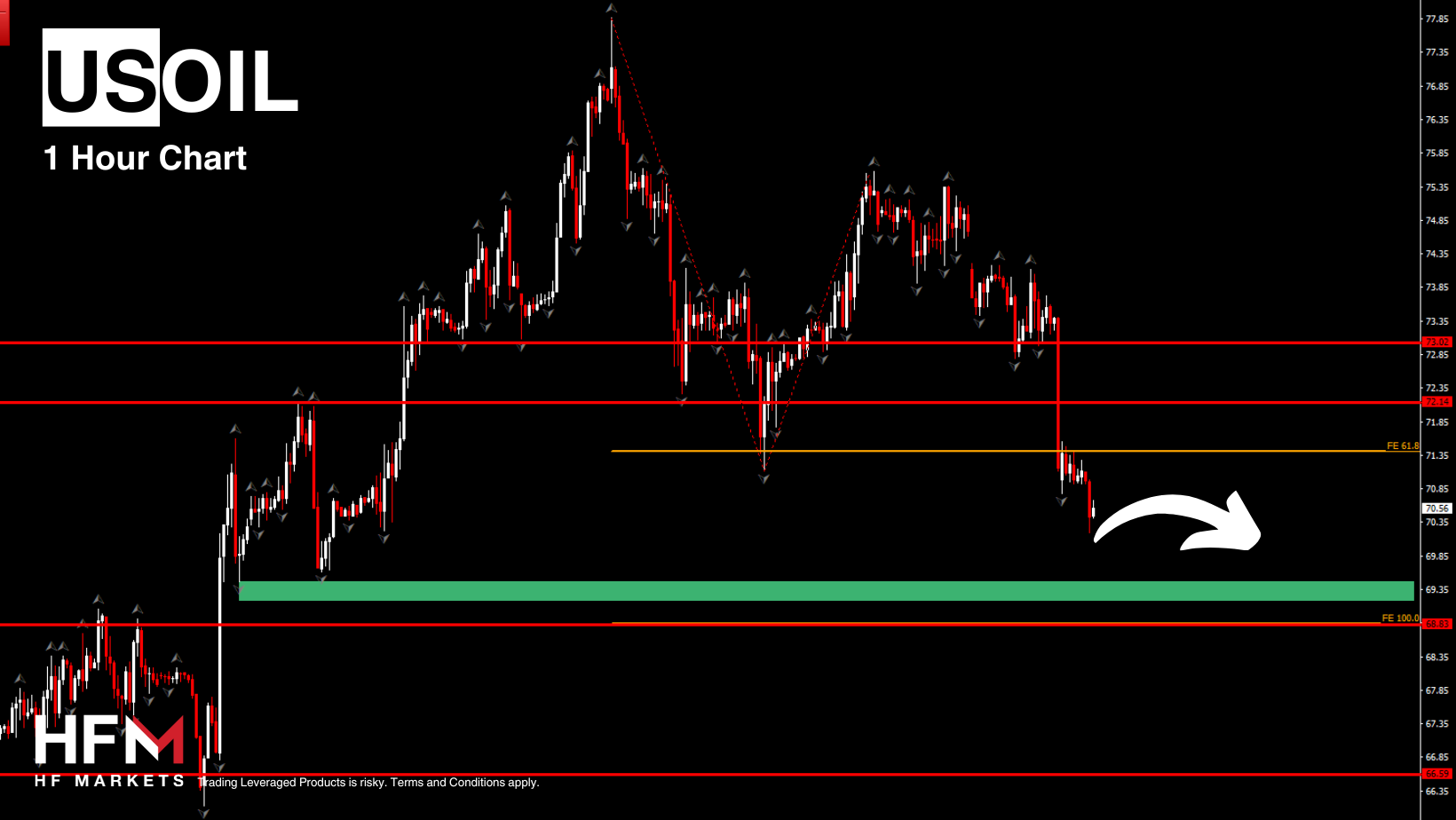

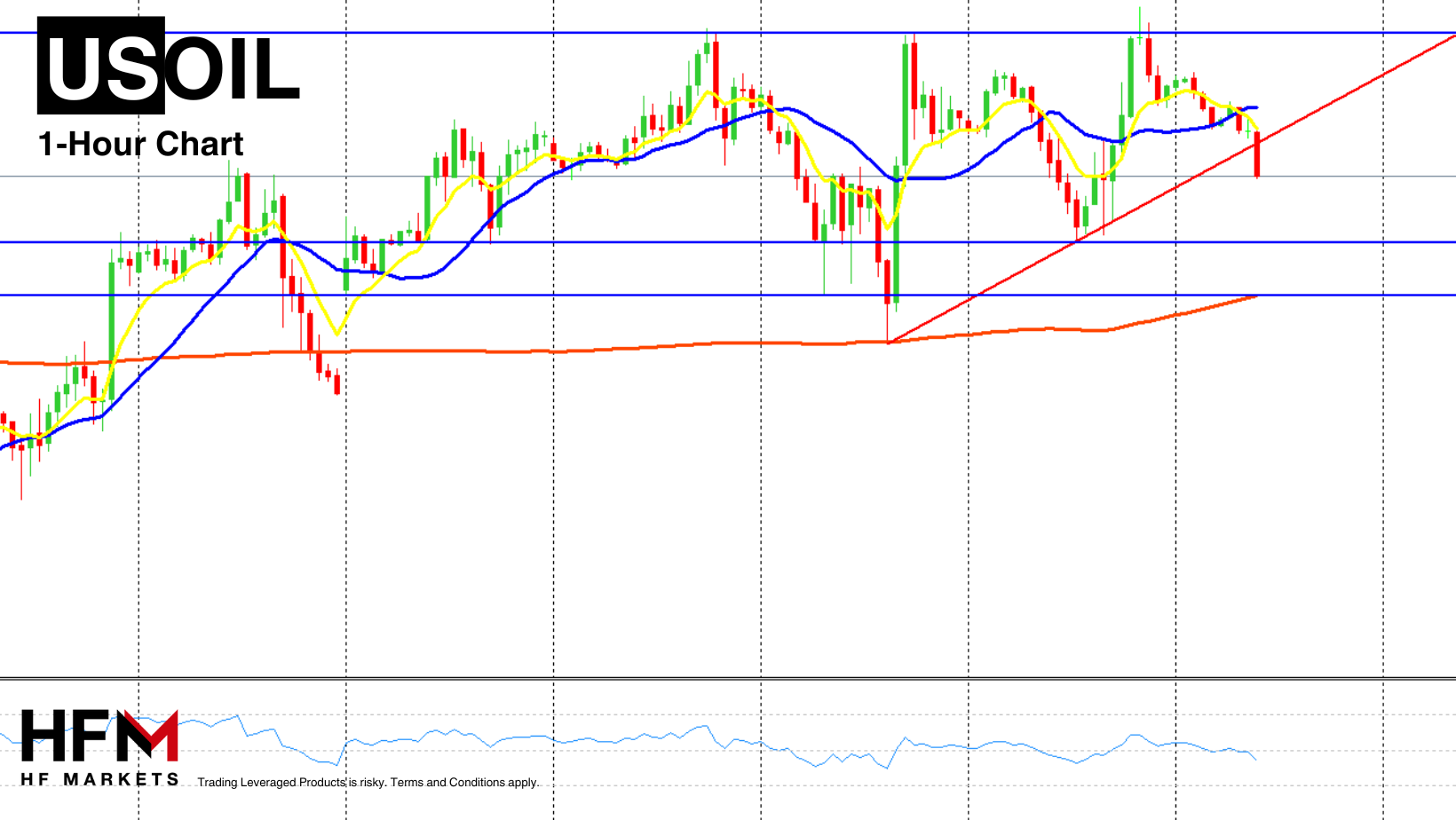

*Crude Oil prices break below the ascending triangle pattern as investors closely monitor any signals from President-elect Trump on how he plans to bring oil prices down.

*The Federal Reserve indicates that it will keep lowering interest rates but plans to pause for an extended period at a certain point.

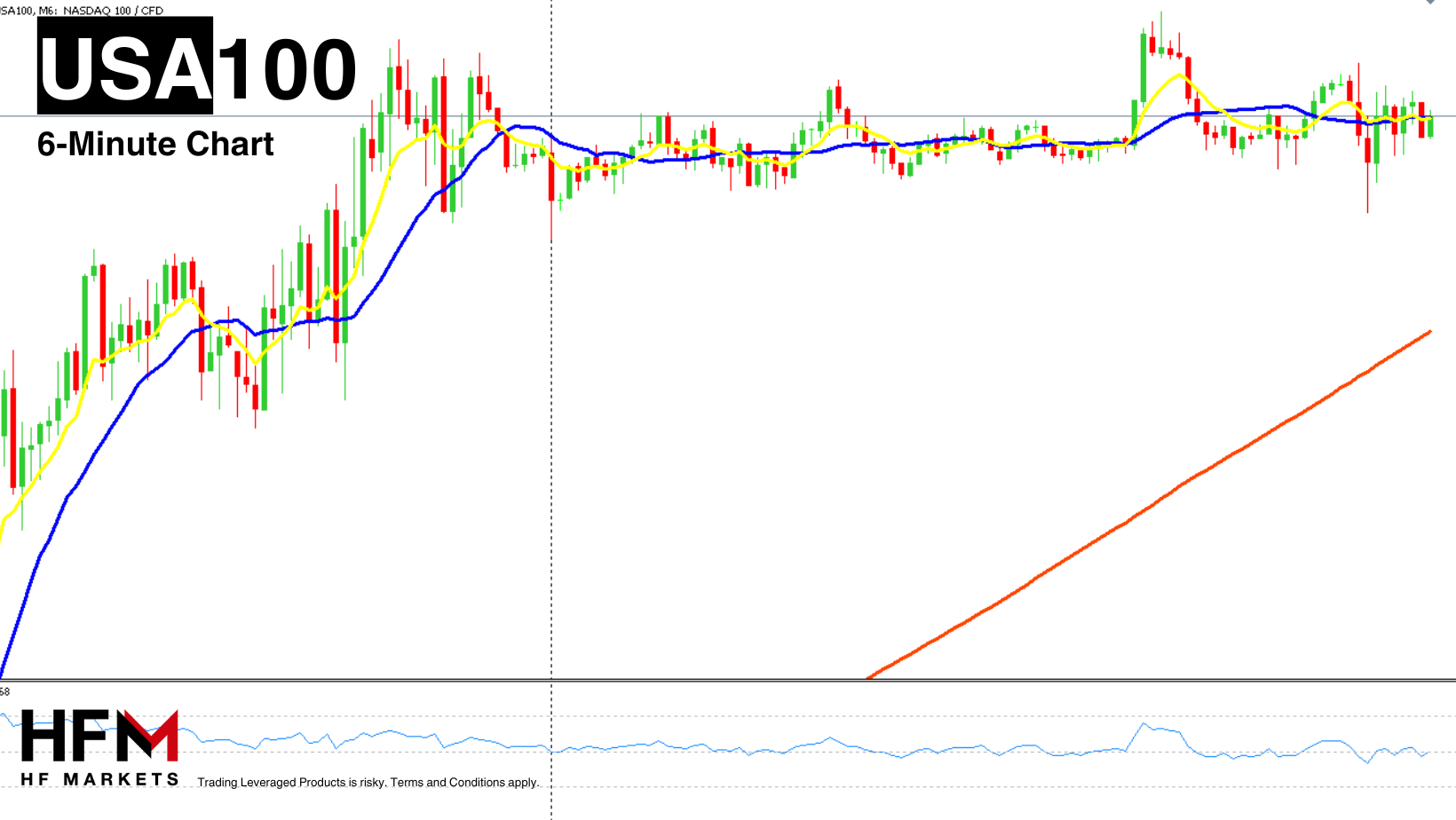

NASDAQ – The NASDAQ Continues To Renew Price Highs!

The NASDAQ continues to increase in value and renew its all time high for a second consecutive day. This week the index has risen 5.70% and investors are contemplating if the index will retrace this Friday due to the large impulse wave. However, investors will be looking for larger downward momentum before determining whether a retracement throughout the day is possible.

One of this week’s best performing stocks for the NASDAQ which is gaining more momentum and attention is Tesla. During the presidential race, Elon Musk, the company’s CEO, endorsed Trump’s candidacy, contributing $75 million to his campaign. In return, Donald Trump pledged to appoint Musk to lead the Commission on Government Efficiency, which oversees budget expenditures. This appointment would enable Tesla Inc. and Space Exploration Technologies (SpaceX) to secure new contracts. Over the past decade, collaboration with the government has brought the company $15.4 billion.

Investors continue to also evaluate the comments from the Federal Reserve on Thursday evening. At a press conference, Federal Reserve Chair Jerome Powell stated that while inflation remains slightly above the 2.0% target, monetary authorities are confident it is under control. However, the growth rate of consumer prices, excluding food and energy costs, is still “somewhat elevated.” Powell added that despite the current easing of monetary policy, officials are prepared to pause if macroeconomic data suggest the need.

The Fed is also considering a scenario in which borrowing costs hold steady at current levels during its December meeting. Powell further noted that actions by the incoming government and Congress could affect the economic outlook over time, and forecasts of these impacts will be incorporated into models that assess various aspects of the US economic system.

As mentioned above, investors are taking into consideration if the price will retrace after such a strong upward trend throughout the week. However, elements do still continue to point to short term upward price movement. For example, the VIX Index continues to fall as have bond yields. The VIX index trades 3.00% lower on Friday and the 10-Year Bond Yields has fallen 37 points.

Crude Oil – Can Trump Achieve $40 Per Barrel?

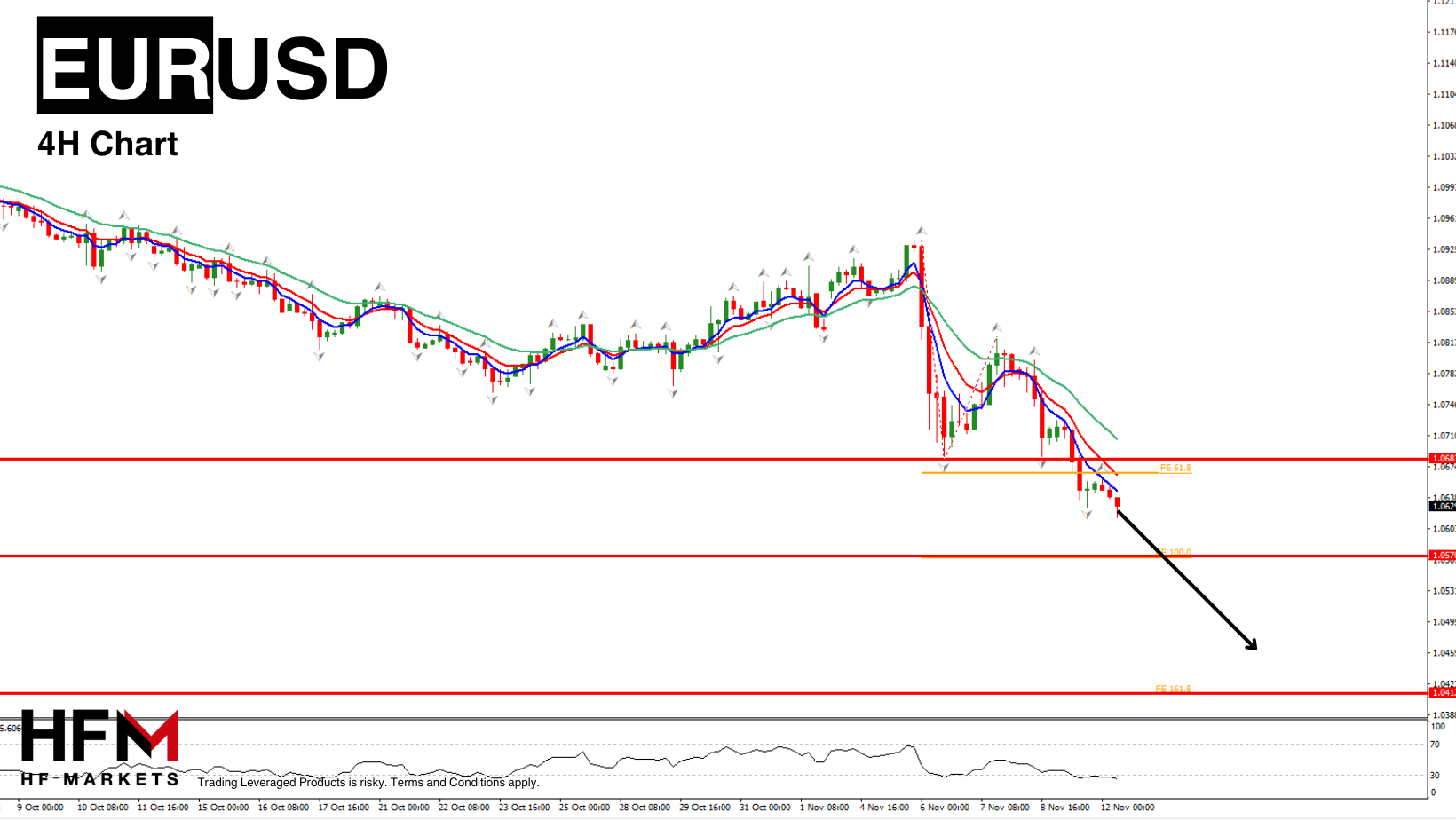

The Euro continues to witness a lack of demand and is again one of the weakest currencies of the day. The Euro index is currently trading 0.20% higher which is only better than the US Dollar Index and Swiss Franc. The best performing currencies of the day are the New Zealand Dollar, Australian Dollar and Canadian Dollar.

The price movement of Crude Oil over the past week has formed an ascending triangle pattern. However, the support level was broken this morning after the corrective wave surpassed 1.75%.

Oil traders worry that the new US President-elect will put considerable pressure on the Chinese economy. This can potentially lead to a sharp drop in oil demand from the world’s largest importer. The EIA’s weekly report yesterday showed an increase in oil reserves by 2.149 million barrels, much higher than the expected 0.300 million barrels, with gasoline reserves rising by 0.412 million barrels and distillates by 2.947 million barrels. The decline could have been steeper, but Hurricane Rafael had closed 17% of oil production capacity in the Mexican Gulf.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote