Date: 21st August 2024.

Market News – Sentiment stabilize; EU stocks higher after mixed Asian session.

* Safe Havens were boosted by rate cut expectations for the FOMC, as well as the ECB and BoC, and after a dovish cut by the Riksbank. Adding to the strength in the rally are the weaker USD, debt concerns (especially for the US), portfolio hedging, haven demand, along with buying from the PBoC and other central banks.

* Geopolitical risks remain a significant factor too, though they were tempered slightly late yesterday after news Israel had agreed to a cease-fire proposal.

* US bond yields dropped to their lowest since August 5, driven by fears of a recession after weak jobs data earlier in the month.

Asian & European Open:

* European stock markets are slightly higher in early trade, after a mixed close across Asia.

* Chinese tech companies listed in Hong Kong were under pressure and the Hang Seng underperformed with a -0.8% loss.

* Sentiment seemed to stabilize at the start of the European session, and US futures are marginally higher as markets wait for Jackson Hole and signals from major central banks that rates will go down next month.

Financial Markets Performance:

* The USDIndex fell to its lowest level this year against euro as traders prepared for key US payroll data revisions & Fed Powell’s upcoming speech. EURUSD rallied to 1.1132.

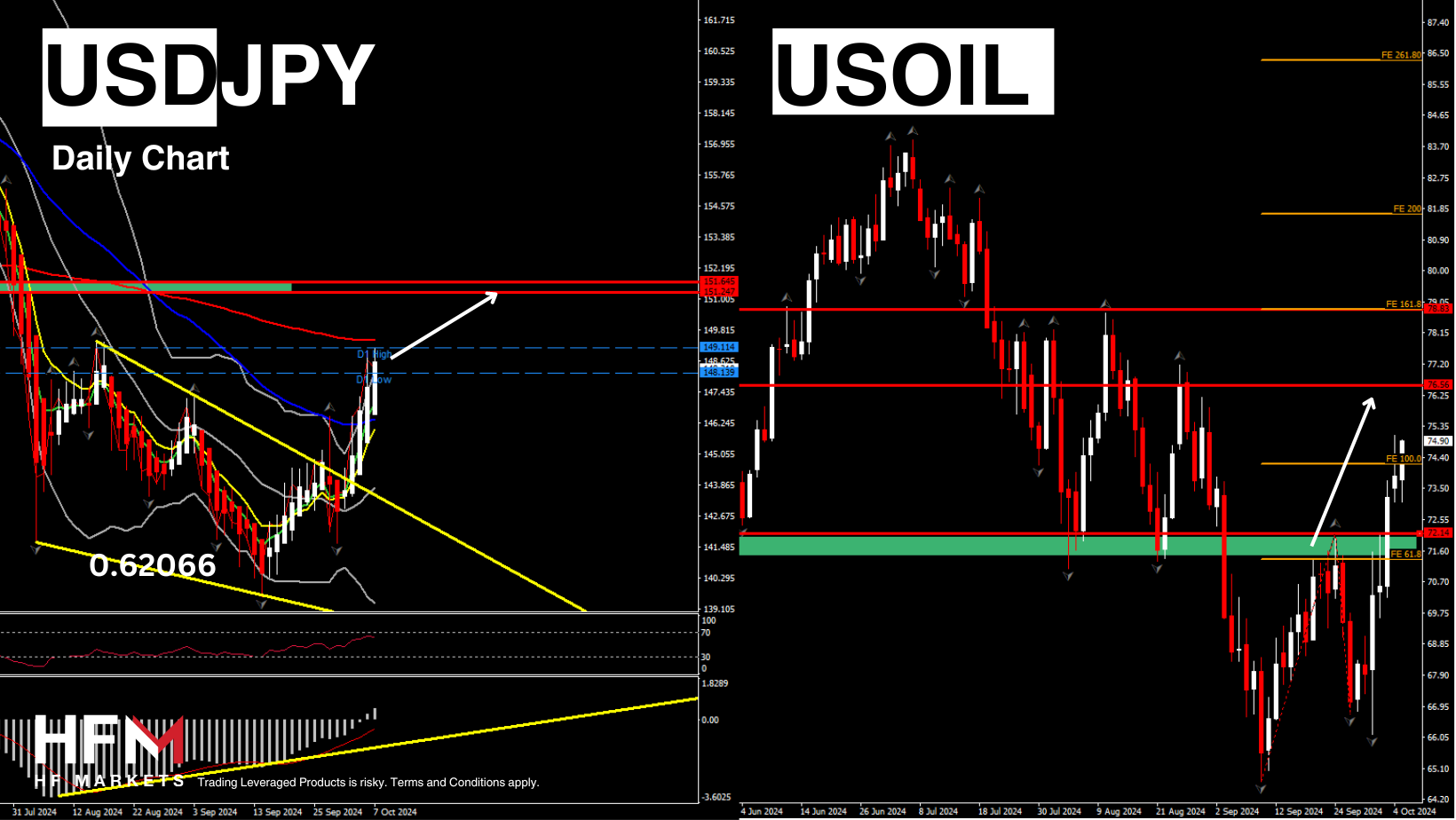

* The Sterling and the Yen showed mixed performance against the USD, with traders eyeing Japan’s parliament session and BOJ Governor Ueda’s upcoming testimony. GBPUSD spiked to 1.3050 and USDJPY bottomed to 144.92.

* SMBC economist Ryota Abe expects the US Dollar to weaken to 138 Yen by next year, with the Fed’s rate-cut pace being a critical factor.

* The Aussie hovered near a 1-month high, while the Kiwi touched its highest level since July before slightly retreating.

* USOil was steady close to its $72 floor.

* Gold continued to trade at about $2,500 close to its all-time high, fueled by expectations of impending Fed rate cuts.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote