Date: 22nd August 2024.

Market News – Eyes on Euro, Stock Markets in Green, But Cautioness Prevails Ahead of Fed & BoJ.

FOMC minutes showed that the Fed was on the verge of cutting rates at the July 31 meeting, and the report sets up a reduction in rates with the September 18 decision. Expectations were further reinforced by the BLS’s downward revisions to Nonfarm payrolls.

* Treasury yields tumbled on the payroll revision and were down further after the FOMC minutes, but closed off their lows in a bull flattening trade.

* Wall Street bounced back marginally, looking to start another win streak after the modest declines Tuesday prevented a ninth straight gain in the S&P500, which would have been the longest since 2004.

* European stock markets are slightly higher in early trade, after a largely stronger close across Asia. The Nikkei closed 0.7% higher, the Hang Seng bounced 1.2%, after yesterday’s correction. Gains in Europe are more modest, with DAX and FTSE 100 up 0.1% and 0.2% respectively.

* The NASDAQ rose 0.57%, with the SP500 up 0.42%, while the Dow was 0.13% higher.

* The VIX jumped 2.86% to 16.87.

* Eurozone Composite PMI unexpectedly bounced back in the preliminary reading for August. The Manufacturing PMI still declined to an 8-month low and Services index outperformed. Confidence levels have dropped to the lowest so far this year and are below the “series average.” So the improvement in the headline doesn’t necessarily signal a rebound in overall activity, and the numbers are unlikely to prevent the doves at the ECB from pushing for another rate cut in September.

Financial Markets Performance:

* The USDIndex has extended its declines, falling to 100.93. The buck has not closed with a 100 handle since April 2022.

* The Euro surged to a 1-year high against the US Dollar in August, driven by expectations of upcoming Fed rate cuts. The euro-dollar pair sees around $2.29 trillion in daily turnover, making it a key vehicle for betting against the US economy. Money managers have been buying euros daily for the past two weeks, anticipating a Fed interest-rate cutting cycle.

* However, the US rates staying higher than European rates could restore the Dollar’s appeal.

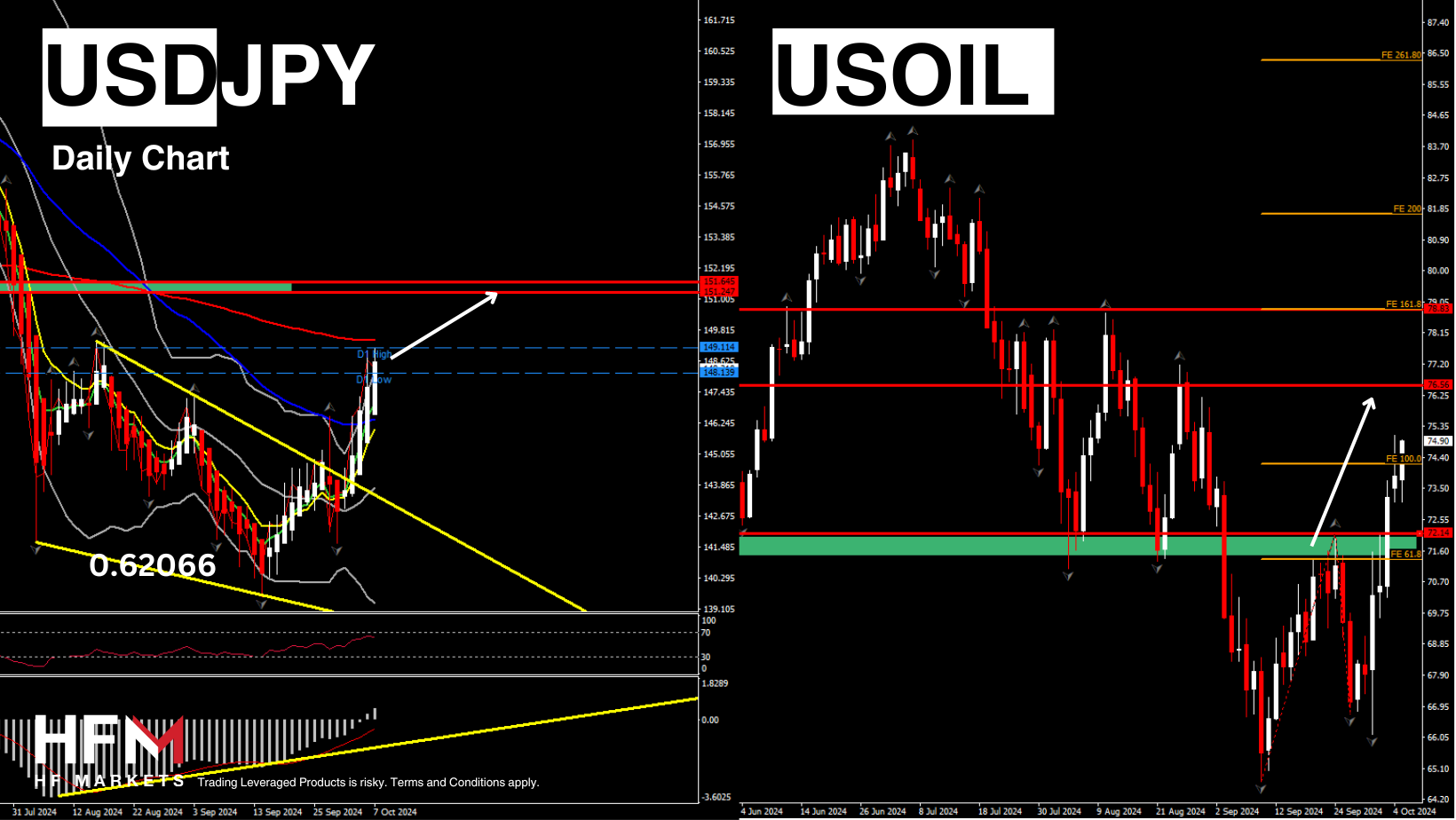

* USOil prices slipped -1.7% to $71.92 per barrel.

* Gold was fractionally lower at $2512.01 per ounce after rising to a new record high of $2513.99 on Tuesday.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote