Date: 26th August 2024.

Market News – FED: “The time has come for policy to adjust”.

This year’s Jackson Hole central banker symposium provided the opportunity for Fed Chair Powell to set the policy course for the FOMC, looking to join the other core central banks already in rate cutting mode. The markets got a big boost after he confirmed the FOMC will begin lowering rates on September 18.

The question on size could be answered by upcoming jobs numbers.

* Europe & UK: The ECB is also likely to reduce rates again next month, while the BoE’s Bailey sounded a more cautious tone. Like the ECB, the BoE seems more likely to stick to meetings with updated projections and detailed analysis, which would mean the BoE will sit out the next meeting and move again in November.

* Japan: Governor Ueda signaled the BoJ remains on its normalization course, but a hike as soon as September 20 seems unlikely.

Asia & European Sessions:

* Asian stock markets have shown mixed performance so far today, with the Hang Seng rising more than 1%, while Japanese markets corrected as the Yen rallied.

* Japan’s Nikkei 225 index dropped by 1.1%, reaching 37,944.68. Hong Kong’s Hang Seng index gained 1.0% to 17,786.31. Shanghai Composite index slightly declined by 0.1% to 2,852.34. Australia’s S&P/ASX 200 rose 0.7% to 8,076.10.

* European stock markets are mostly lower, with the DAX currently posting a loss of -0.2%. UK markets are closed for a holiday.

* The Dow climbed 1.1% to 41,175.08, surpassing the 41,000 mark for the first time since July.

Financial Markets Performance:

* The USDIndex saw a session low of 100.53 after plunging on Friday. It is currently trading at 100.41.

* EUR and Sterling have benefited from dovish Fed bets and the correction in the Dollar. The EURUSD pulled back from 1.1200 and is currently at 1.1177. The GBPUSD broke key resistance at 1.31 and is retesting 1.3200 currently.

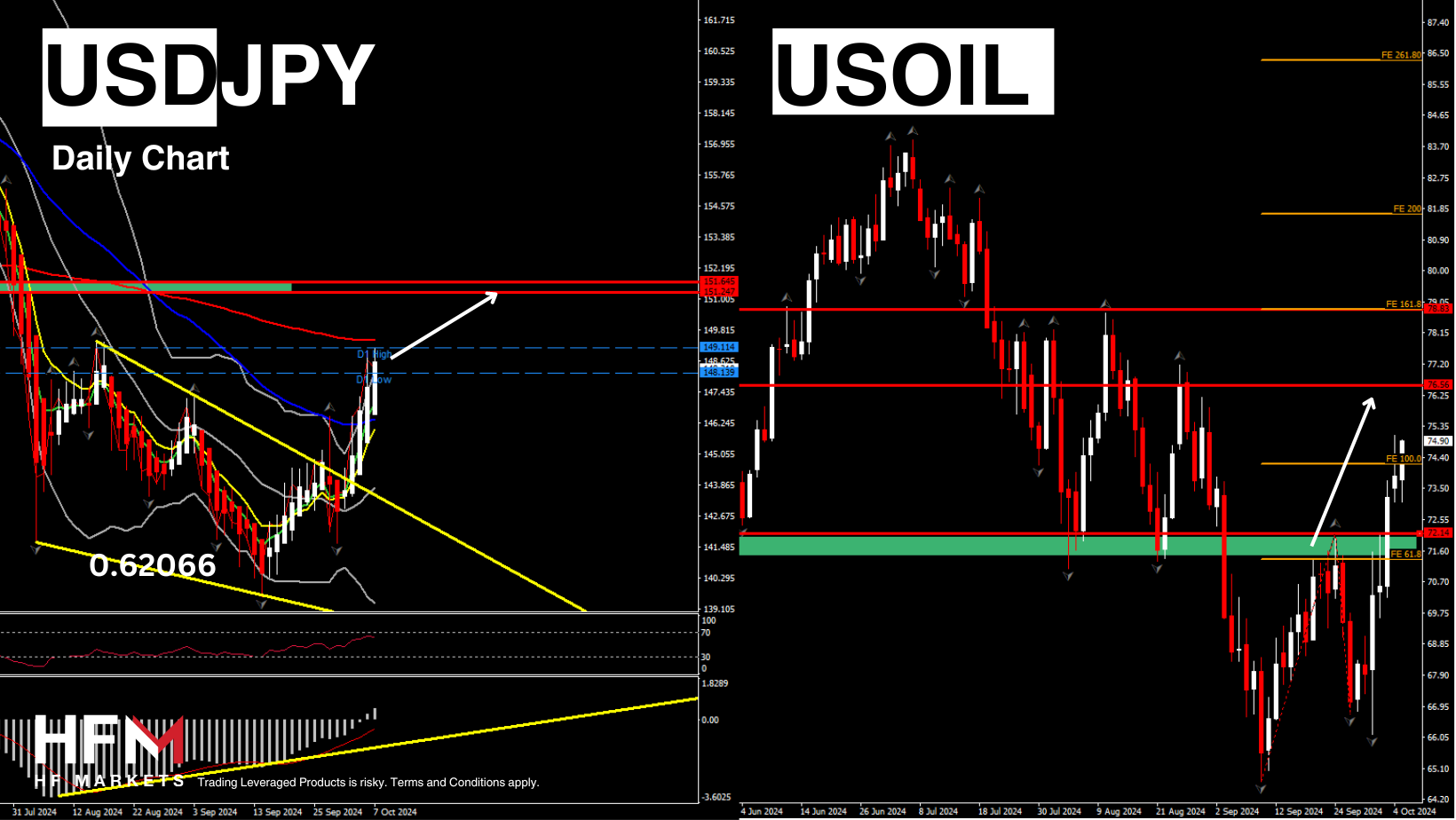

* The Yen outperformed, and rallied against most currencies.t is currently settled at 143.43.

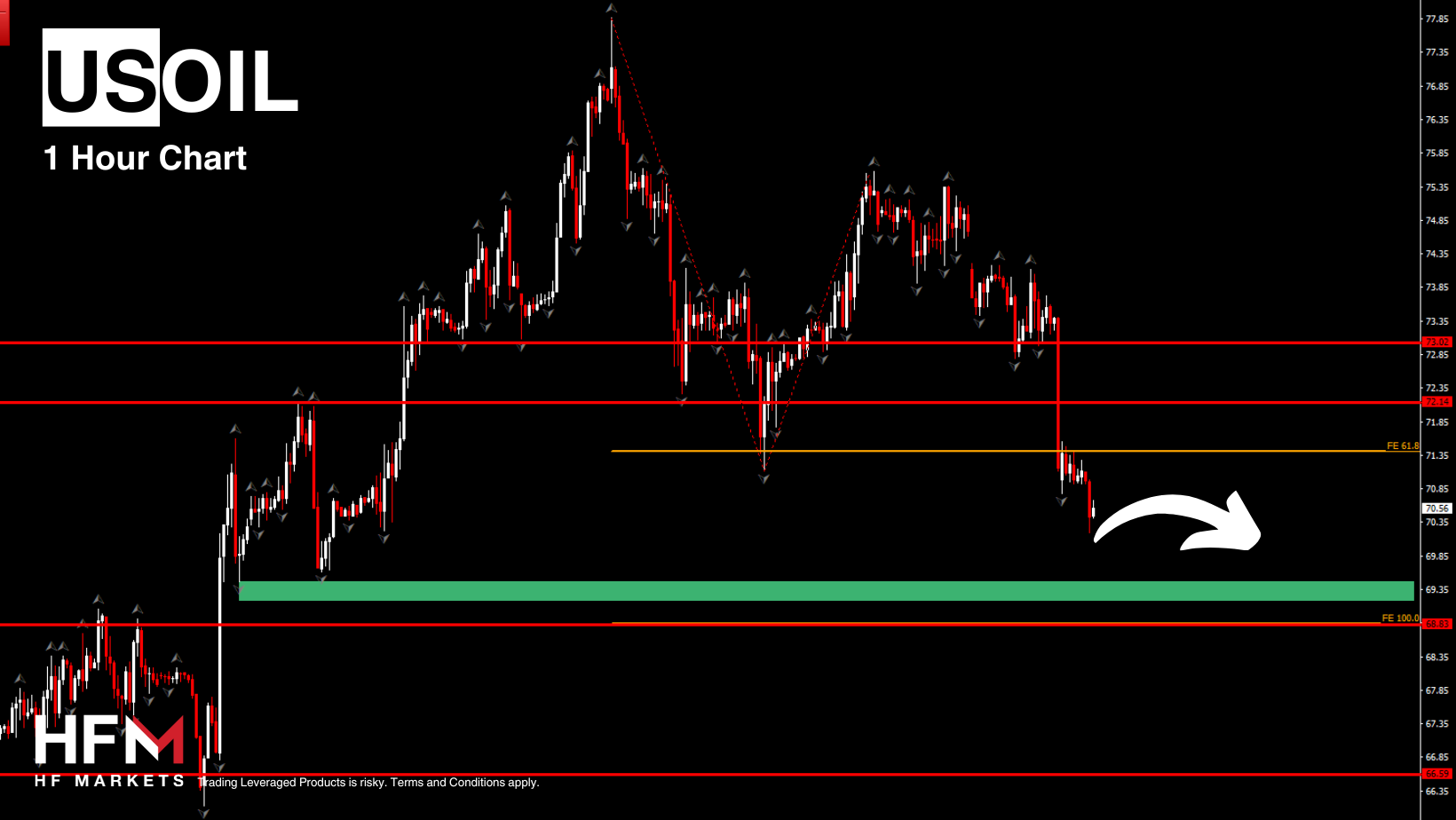

* USOil spiked to $75.28. Safe-haven buying due to increasing tensions in the Middle East, alongside bets on the Fed, contributed to market movements. Oil prices rose 0.7% as the region prepared for further conflict following an Israeli strike on Hezbollah targets in southern Lebanon.

* Gold recovered to $2524.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote