Date: 03rd October 2024.

Dovish ECB Comments Send Euro Downward as Investors Eye US Jobs Data

Trading Leveraged Products is risky

*US employment data indicates a resilient employment sector ahead of tomorrow’s NFP data.

*Latvia’s governor, Mr Kazaks, says that officials have sufficient grounds to support further interest rate cuts at the October meeting

*Investors continue to predict a cautious 0.25% cut due to strong employment data.

*The US Dollar continues to be the week’s best performing currency due to a more hawkish approach and a lower risk appetite.

EURUSD – Investors Ditch the Euro For the US Dollar!

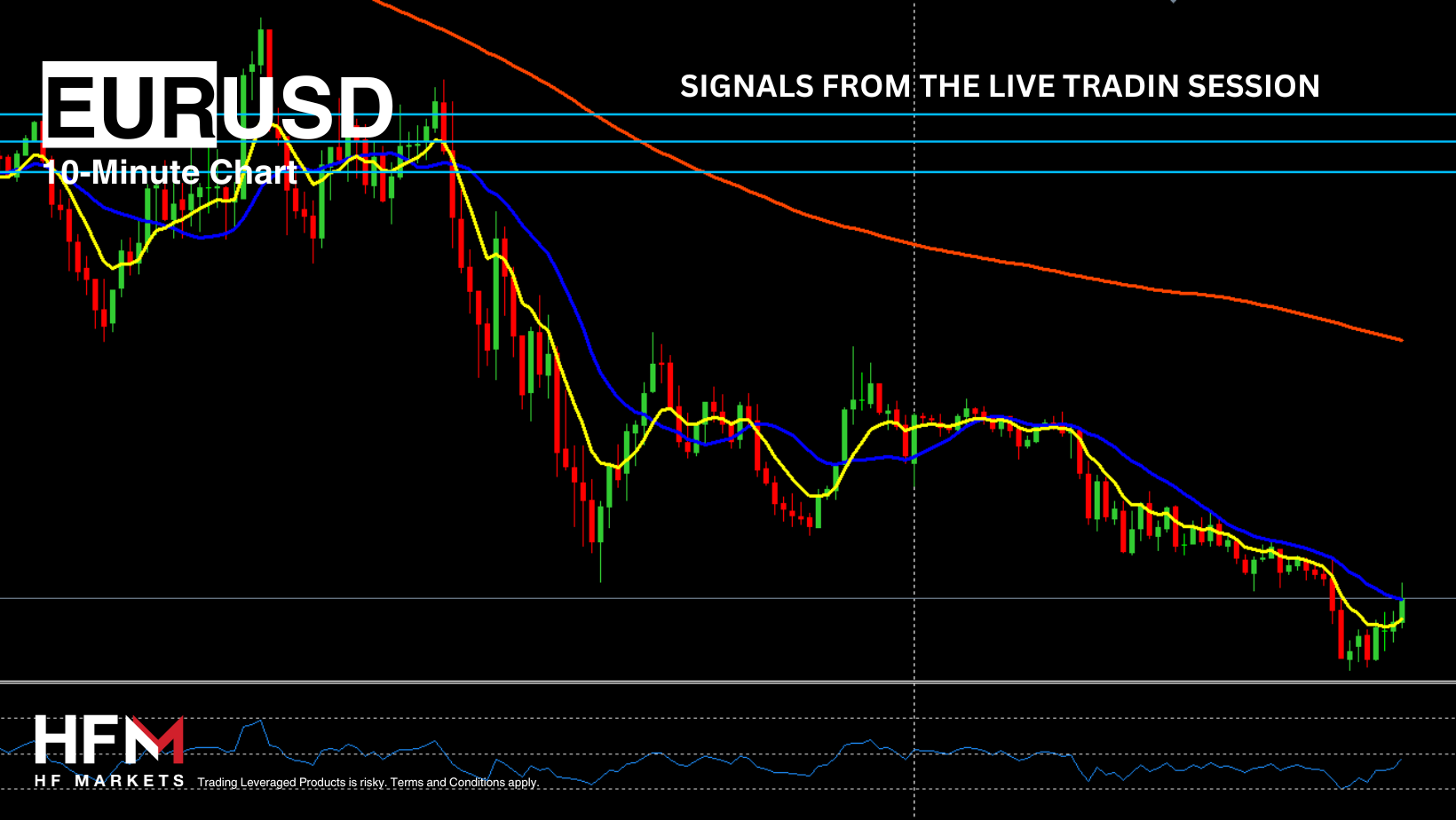

The market continues to drive the EURUSD lower due to expectations of the more competitive US market and monetary policy. In addition to this, investors are increasing exposure to the US Dollar due to a lower risk appetite while the Middle East conflict escalates. Yesterday’s Live Trading Session Click pointed out the sell indications between 1.10735 and 1.10684, of which now the price is trading 0.45% lower.

However, as the price is now extremely close to the previous support levels from September 3rd and 11th, Investors should be cautious of buyers re-entering the market at these levels. The support levels can be seen between 1.10256 and 1.10050. In order to break these levels, investors may require further drivers such as tomorrow’s US Employment Change and Unemployment Rate.

Analysts also expect the NFP Employment Change to add 144,000, very similar figures to the previous month. Though some economists now believe this data could beat expectations due to stronger employment data as NFP Friday approaches. Tomorrow’s employment data will trigger significantly higher volatility for the EURUSD.

The Institution For Supply Management (ISM) will publish their second PMI report of the week this afternoon. The Manufacturing PMI read lower than expectations, however, the market gave higher importance to the employment data. Yesterday’s ADP NFP Employment Change read 143,000 which is 19,000 more than the previous prediction. The higher ADP data was driven by leisure and entertainment (34K), construction (26K), and education and healthcare (24K). Today investors will turn their attention mainly to the US Services PMI as well as the Weekly Unemployment Claims.

Meanwhile, ECB Vice President Luis de Guindos mentioned that short-term economic growth in the region could be slower than anticipated. However, he expects future recovery to gain momentum, driven by rising real household incomes and easing monetary policy. Latvia’s central bank governor, Martins Kazaks, added that officials have sufficient grounds to support further interest rate adjustments at the October meeting, citing slow wage growth, declining corporate profits, and weak economic recovery across much of Europe. The ECB’s dovish comments also continue to pressure the EURUSD.

Economists currently advise the European economy will not be able to see higher growth unless the ECB opts to cut interest rates to no more than 2%. For this reason, the Euro has been the worst performing currency of the past month only behind the Japanese Yen. Market participants expect the Federal Reserve to cut 0.25% in November and 0.25% in December.

The price movement of the exchange rate will largely be driven by the price movement of the US Dollar and US news. Therefore, the US Dollar Index will be key. If the ISM Services PMI and Weekly Unemployment Claims are lower than expectations, the EURUSD may be at a good level to retrace back upwards. This is due to the price being at a support level and having already fallen 1.65%. However, even with a retracement upwards, the EURUSD on the 2-Hour Chart remains below the trend-line and below the neutral level on most oscillators.

If the price remains below 1.10427, any short-term upward price movement will form nothing more than a retracement. As a result, medium-term buy signals potentially remain intact for the EURUSD.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote