Date: 09th October 2024.

Mag 7 surged, Oil dipped as China weighed on the demand outlook.

Trading Leveraged Products is risky

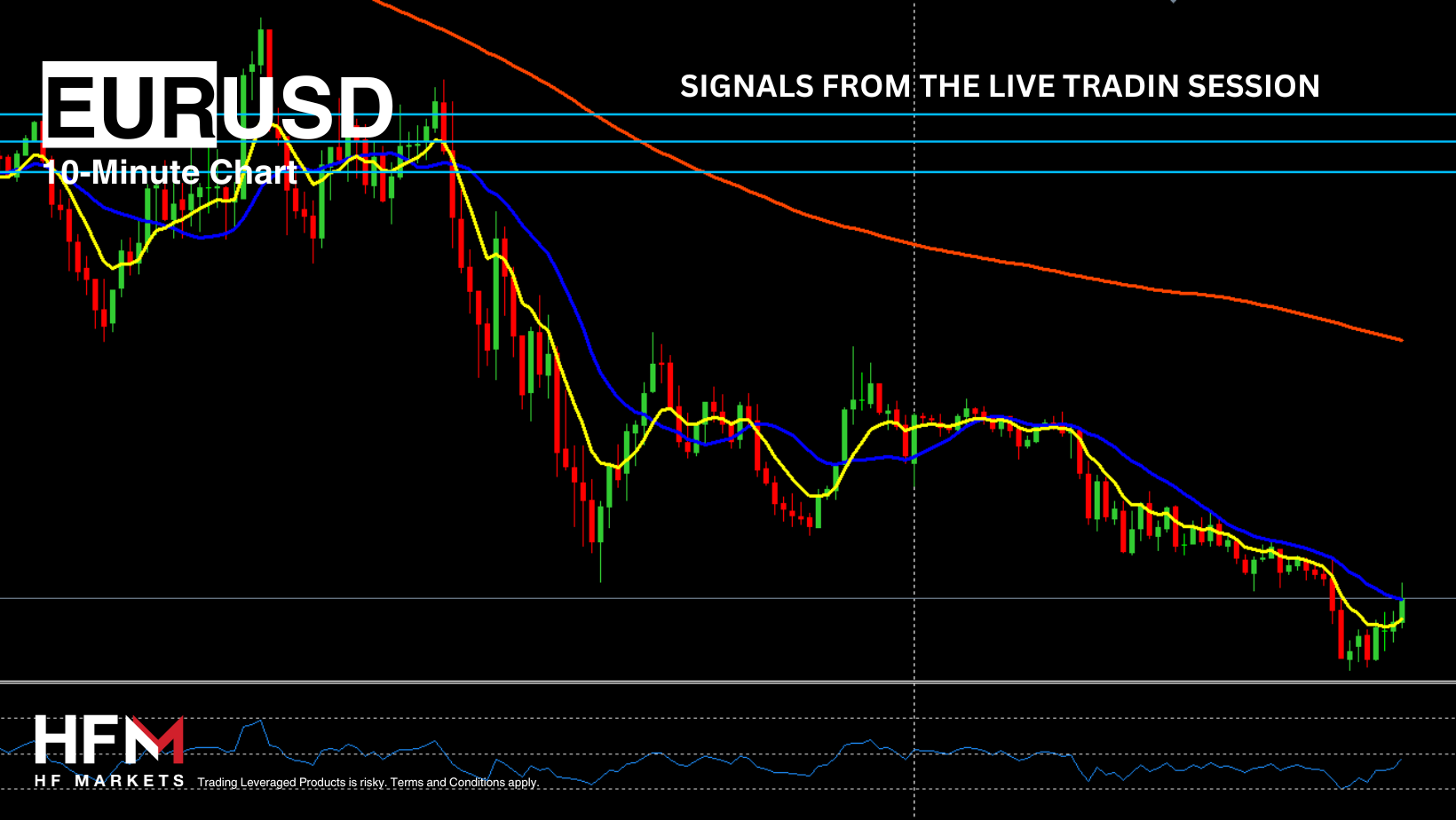

It is a real mix in the markets amid a confluence of factors including positioning, Fed policy outlooks, growth and inflation outlooks, election uncertainties, and stimulus (or lack of) from China.

Asia & European Sessions:

*Wall Street climbed amid a surge in the Mag 7 stocks, paced by Nvidia (+4%). Stocks are recovering in general after the retreat to begin the month as unwinding of big rate cut bets and geopolitical angst weighed. Investor optimism has gotten a boost from signs of a solid labor market and economy, as well as from the stimulus from China.

*Goldman Sachs raised its outlook on the S&P500 to 6,000. The NASDAQ ended with a 1.45% advance, while the S&P500 was 0.97% higher, and the Dow was up 0.30%. The VIX fell -5.3% to 21.43.

*The US Justice Department announced on Tuesday that it may request a court order compelling Alphabet’s Google to sell off parts of its business, including its Chrome browser and Android operating system, which authorities argue are key tools in maintaining its illegal monopoly in the online search market (handles 90% of internet searches in the US, had established an unlawful monopoly).

*Nvidia surged 4% posting its 5th consecutive day of gains. Nvidia shares have risen nearly 14% in the past week and are up 190% over the past year. Several major investment firms, including KeyBanc, Citi, and Bernstein, reaffirmed their positive ratings on the stock. KeyBanc analysts also increased their 2025 sales forecast for Nvidia to $130.6 billion, driven by strong demand for its new Blackwell AI chips, which are expected to contribute $7 billion to fourth-quarter revenue. Wedbush analysts highlighted that the recent $6.6 billion funding round for OpenAI could spur further investment in AI startups, boosting Nvidia’s AI chip demand well into 2025.

Financial Markets Performance:

*The USDIndex was little changed at 102.50.

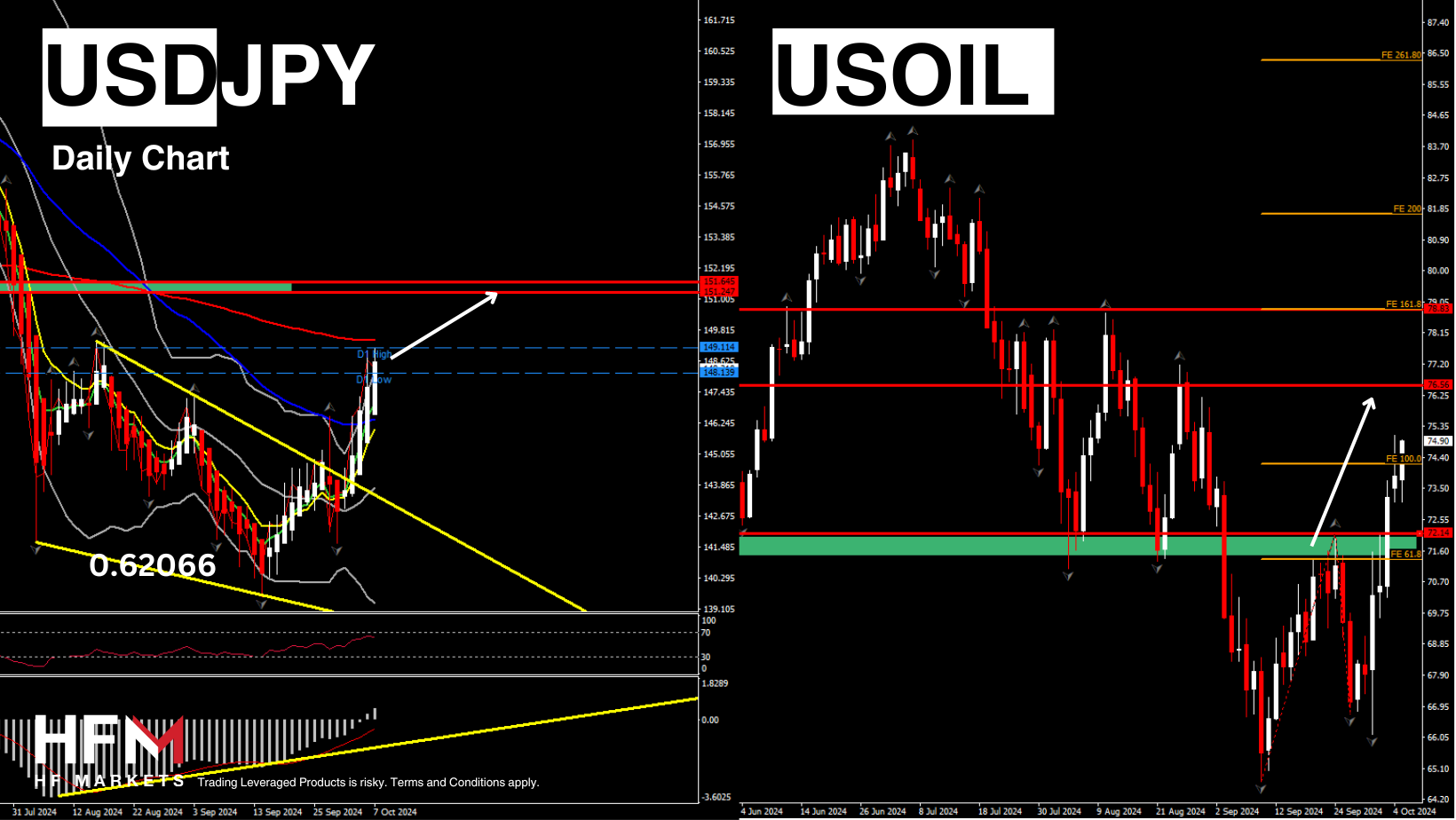

*USOil slid -4.17% to $72.26 per barrel following the climb to a session peak of $78.46 Monday, in part as China failed to add to its stimulus binge. Oil is facing a tug-of-war between fundamentals indicating a surplus in 2025 and geopolitical tensions.

*Gold broke below the key $2620 per ounce from the record $2672.38 from late September amid expectations for a benign CPI report ahead along with the firmer dollar. Risk aversion has been keeping demand for the precious metal underpinned, even against the background of a pickup in yields and a stronger dollar. OTC sales have also helped to boost prices, while central bank demand has eased somewhat with the rise in prices. Recent data showed that China’s central bank refrained from purchasing gold for its reserves for a fifth consecutive month in September.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote