Date: 11th October 2024.

Treasuries close mixed, Wall Street lower, US Dollar steady after data – Eyes on PPI.

Trading Leveraged Products is risky

The hotter CPI and cooler jobless claims made for mixed action in the markets. There was also some marginal impact from the 30-year auction and Fedspeak.

Treasuries were bifurcated in a curve steepening trade with the front end outperforming. The jump in claims, even if due in part to weather, strikes and other factors, supported expectations for additional rate cuts ahead, though of the -25 bp variety. The 2-year yield closed -5.6 bps lower at 3.966%. Dip buyers from the 4% rate also underpinned. Meanwhile, the long end was heavy on the hotter CPI and with the weight of supply. The 10-year was fractionally lower at 4.067%, but had spiked to 4.115% on the pop in inflation. The curve closed at 10.4 bps from 4 bps Wednesday.

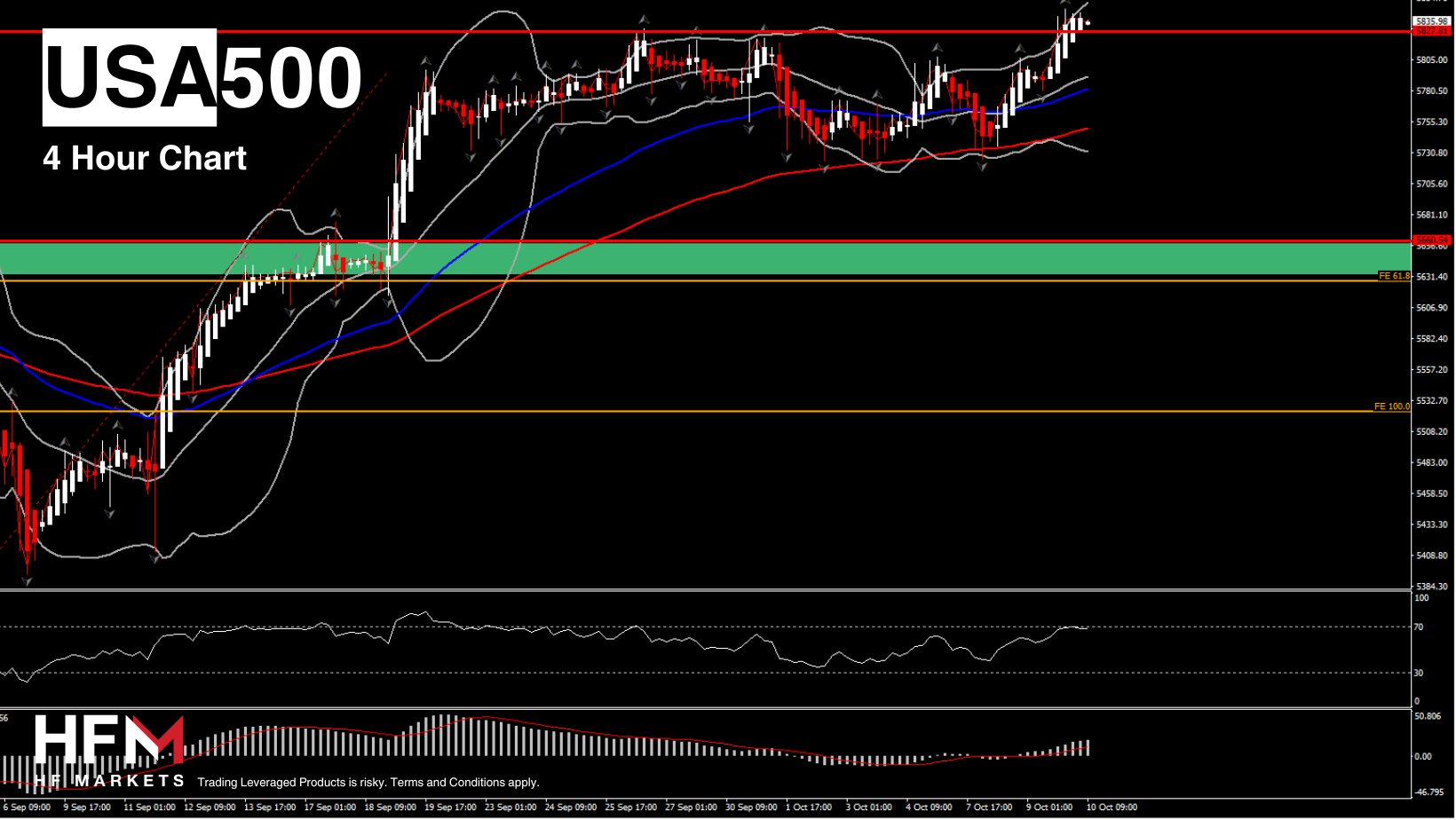

Wall Street finished in the red after the Dow and S&P500 hit fresh records previously. The indexes were well off their lows at the end of the day. The NASDAQ dipped -0.05%, while the S&P500 was -0.21% lower and the Dow was down -0.14%.

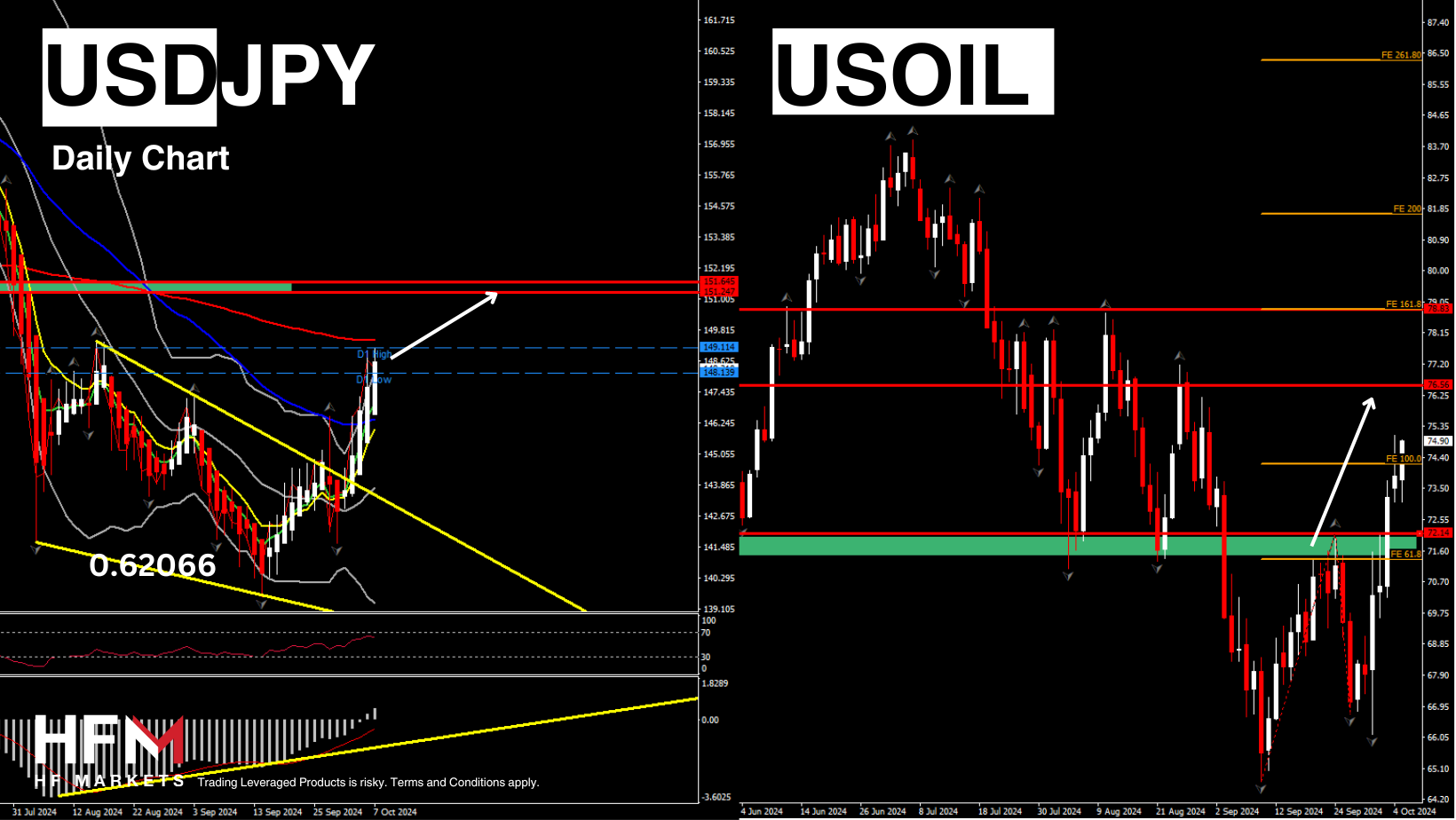

The USDIndex finished little changed at 102.70 after jumping to a session high of 103.178 on the CPI then slipping to the day’s low of 102.720 on the claims numbers.

Oil climbed 3.26% to $75.63 per barrel and Gold rose 0.84% to $2629.51 per ounce.

Implied Fed funds futures continue to price in -25 bp cuts ahead, with some chance for no action rather than another jumbo -50 bps. Indeed, the latter has been priced out. This view was supported by the FOMC minutes yesterday that showed a big debate and some push back over the decision to lower rates by -50 bps on September 18. We continue to expect two quarter point reductions over the rest of this year.

In spite of being data dependent, we highly doubt the FOMC will skip November as they kick off their normalization process, especially as officials will be loath to do a start-stop so soon. And Chair Powell and others have told us to monitor the dot plot reflecting -25 bps in November and December as the base case.

Looking Ahead:

The hotter CPI puts attention on PPI and the inflation components of the consumer sentiment report due out Friday. Respective gains of 0.1% and 0.2% are projected for headline and core producer prices in September after increases of 0.2% and 0.3% in August. Results in line with the estimates would see the headline pace dip to a 1.6% y/y rate from 1.7% y/y previously, while the core rate should rise to 2.6% y/y from 2.4% y/y.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Andria Pichidi

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote