Date: 8th August 2024.

The Dow Jones Drops 2% As JP Morgan Signal Possible Recession.

* JP Morgan advises markets that the economy is at a higher risk of a recession in 2024.

* Representatives of the Federal Reserve advise they will not call for an urgent meeting to cut interest rates.

* Disney beat expectations but theme park visitors significantly fell. Economists advise this shows the drop in consumer demand and the risks of inflation over the past 3 years.

* The Japanese Yen climbs after downward pressure in the first half of the week.

USA30 – The Dow Jones Reaches a Significant Support Level!

The Dow Jones price quickly collapsed after the opening of the US trading session and continues to remain low on Thursday. The decline was largely triggered by the poor performance of Amgen (-5.00%) and Walt Disney (+4.46%). Both stocks came under pressure by the quarterly earnings report which confirmed some risks. On Wednesday, only 35% of the Dow Jones rose in value, while 65% fell.

Disney’s Earnings Per Share for the latest quarter were significantly higher than previous expectations. Earnings were 16% higher while revenue came in as expected. However, the poor performance of the company’s theme parks dampened sentiment and the overall stock market. According to economists, the drop in revenue from theme parks is a result of inflation and lower consumer demand which not only influences Disney’s stocks but the overall market.

In addition to this, throughout the month of August, poor data can be followed by an overreaction as the market’s risk appetite remains low and on the lookout. The next significant quarterly earnings report for the Dow Jones is Home Depot on Tuesday before the market opens.

Another factor which is adding to pressure is the latest comments from JP Morgan, one of the largest US banks of all time. According to JP Morgan, the US economy is now at a higher risk of a recession in 2024, and a recent selloff has wiped out three-quarters of the global carry trade, erasing this year’s gains.

USA30 – Technical Analysis!

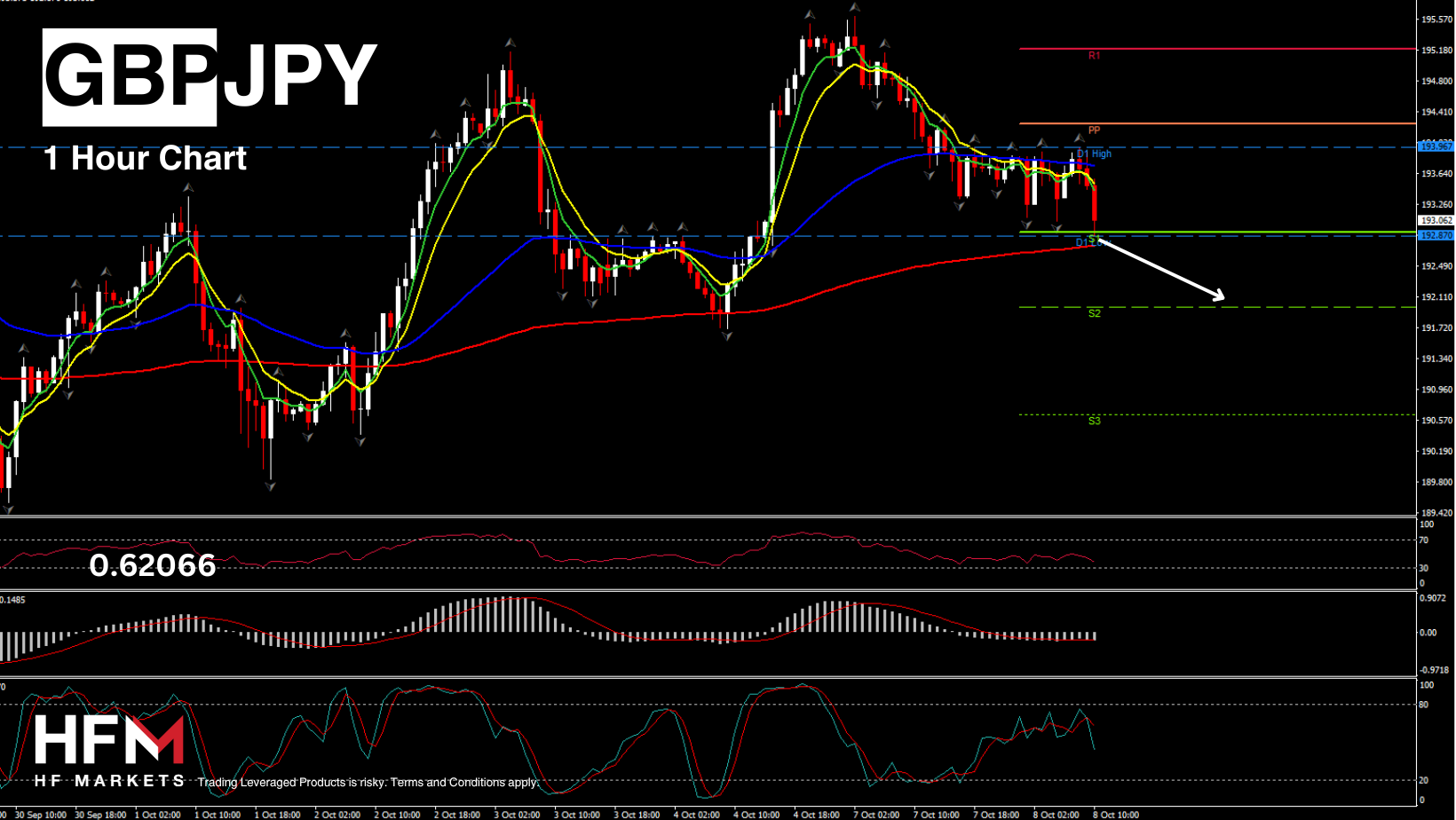

In terms of technical analysis, the price of the Dow Jones continues to find support at the $38,577.09 level. However, the price is testing the level for the fourth time this week. The question is, will the index break below the price or find short-term support. Currently the price trades below the 75-Period EMA, 100-Period SMA and below the 50.00 level on the RSI. However, a positive factor is the VIX index trades lower as do bond yields.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Bitcoin Forex Forum

Forex Community Place

First

First

Thread:

Thread:

Reply With Quote

Reply With Quote